Time, as they say, moves on relentlessly, and for financial institutions the clock is well and truly ticking down on the transition away from the LIBOR. Indeed, borrowers and lenders are acutely aware that in just months the long-utilized rate will cease to exist.

The need to successfully shift to an alternative rate such as the Secured Overnight Financing Rate (SOFR) is vital. LIBOR is the basis on trillions of dollars of loans and is tied to a multitude of products, such as adjustable-rate mortgages, student loans and corporate loans. Careful transitioning is the key to minimizing large-scale financial impacts, especially in the private debt market[1].

Now, as the deadline looms, it’s essential that we examine the two fundamental questions: what’s the current status of LIBOR transition in the U.S private debt space, and how well prepared are institutions for an orderly transition to the aforementioned new rates?

The impetus for change: LIBOR and the financial crisis

As the dust finally began to settle on the financial crisis, public scrutiny in mid-2012 turned sharply to focus on LIBOR, which had been the standard reference rate for most adjustable-rate products for decades. The market was awash with allegations that during the financial turmoil, banks were misreporting borrowing rates in order to convey financial stability.

Since LIBOR was calculated from self-reported bank submissions, banks could in theory change the submissions and influence the published LIBOR value. In the wake of the allegations, financial regulators around the world urged financial institutions to move away from LIBOR. In 2014, the Alternative Reference Rates Committee (AARC) was created by the Federal Reserve Board and the New York Fed to support the transition away from LIBOR.

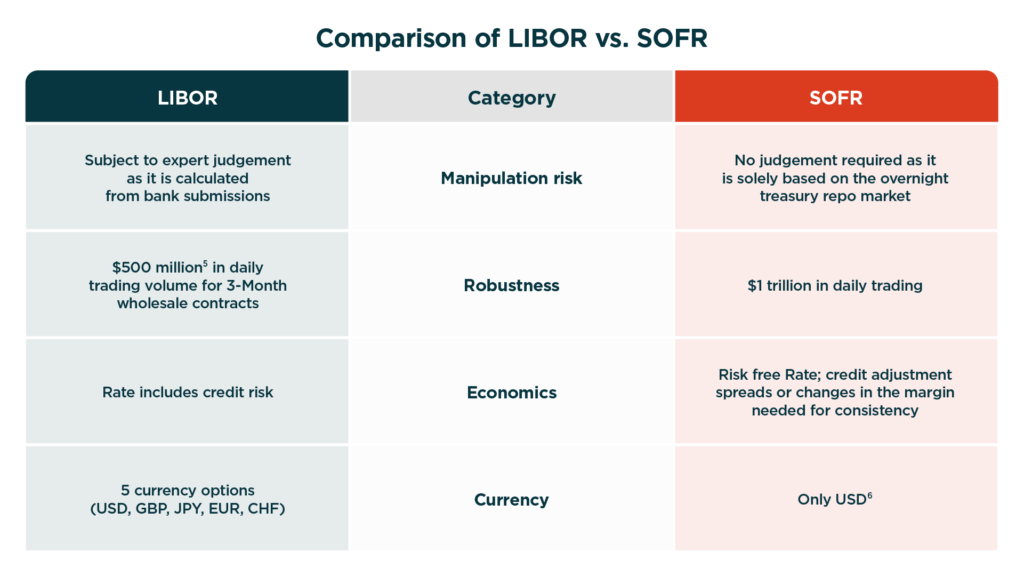

In 2017, the AARC then recommended the SOFR, a measure of the cost of borrowing overnight collateralized by Treasury securities[2], as the preferred alternative rate. This is primarily because SOFR is thought to be less susceptible to manipulation and is based on a vast volume of daily transactions (nearly $1 trillion), as opposed to LIBOR (estimated $500 million).

The early struggle to adopt SOFR

While it was helpful to determine an alternative rate, market participants struggled to quickly adopt SOFR, for various reasons. First, SOFR is a risk-free rate since it is backed by the U.S treasury. The LIBOR rate, however, incorporates credit risk (between banks) in the rates, and therefore tends to be higher. If lenders are to adopt SOFR, they need to add this incremental credit risk. To address this issue, the AARC also provided guidance on an additional “credit adjustment spread” to add to the SOFR rate when transitioning away from LIBOR[3].

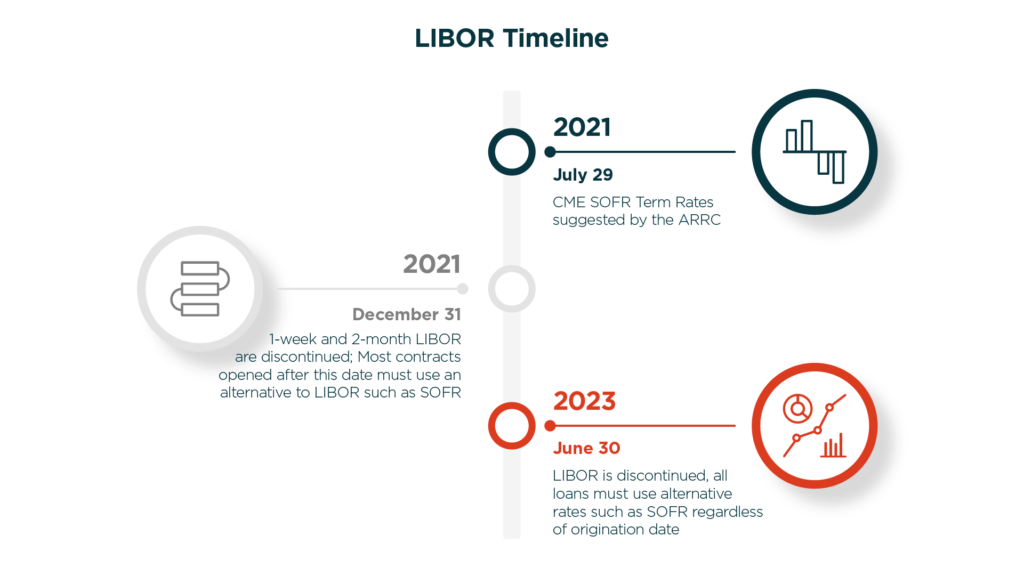

Moreover, SOFR is an overnight rate, whereas LIBOR contains various terms/tenors (overnight, 1-week, 1 month, 2 month, 3 month, 6 months and 12 months). To address this gap, the AARC suggested the CME Term SOFR in July 2021, which modifies SOFR to have the same terms/tenors as LIBOR[4].

Timeline of transition

Now that lenders/borrowers are equipped with alternative rates that are most consistent with LIBOR, what are the key dates they should have in mind regarding the transition? The 1-week and 2-month LIBOR rates were discontinued in Dec 31, 2021, and loan originations after that date should for the most part be pegged to an alternative rate[7]. The most important deadline is June 30, 2023, which is when all LIBOR rates would irrevocably be discontinued, and every LIBOR rate loan should be moved to an alternative rate.

The state of play: Where do US private debt markets stand?

Bank loan originations tied to SOFR in 20222: On track

New bank loan originations in 2022, which post Dec 31, 2021, should not be pegged to LIBOR, went according to expectations. Based on data from Refinitiv, a large majority of syndicated US loans originated in 2022 were priced to Term SOFR. For the non-regulated direct lending market, however, the share of new originations priced to Term SOFR was closer to 50%[8].

The transition to SOFR was generally smoother than what lenders were expecting, largely in part to AARC’s recommendation of the CME Term SOFR back in July 2021[9], which helped generate a term structure akin to LIBOR.

Transitioning remaining loans to SOFR: long road ahead but room for optimism

So what about the remainder of loans, originated prior to 2022, that still need to transition away from LIBOR? According to the LSTA[10], using data from LevFin Insights, the CS Loan Index, Refinitiv LPC and CLO surveillance reports, roughly 15% of broadly syndicated loans are currently on SOFR. What about the direct lending space? As a proxy, we turned to publicly available BDC data.

From a sample of 12 BDC’s (Business Development Companies) registered with the SEC, all but three BDCs had between 12% to 30% of their books currently pegged to SOFR. In this sample, the average transition rate was 15%, exactly what is estimated for the broadly syndicated loan market.

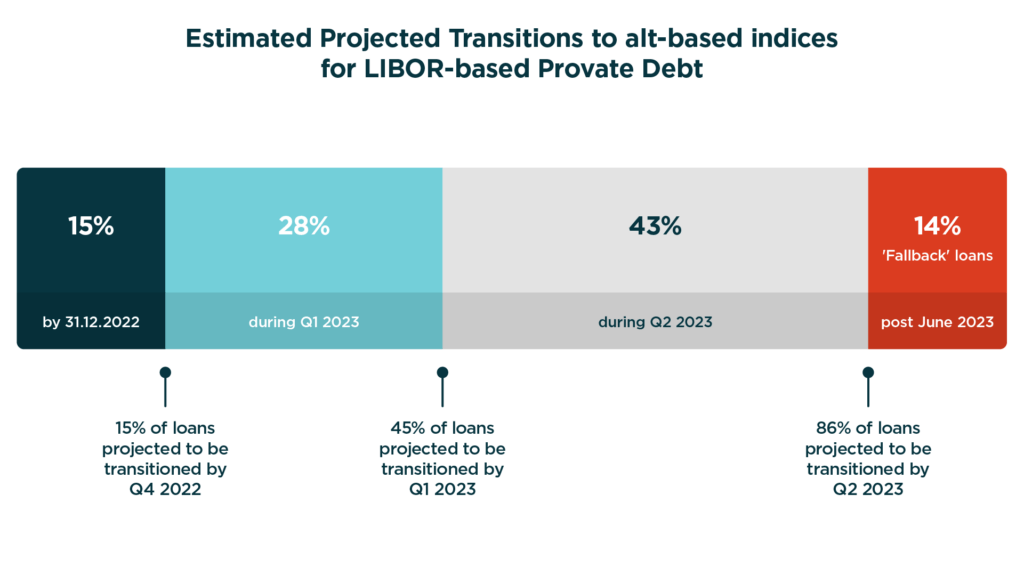

The general 15% LIBOR transition rate may seem small, considering how near LIBOR cessation is, but to further understand that number we can turn to the Loan Remediation Survey[11][12], recently administered by the ARRC.

The survey ran from August 9 to through September 7, 2022 and is comprised of 73 submissions; lenders and borrowers comprise of roughly 70% and 30% of the responses, respectively. Across all respondents, 89% had a loan remediation plan, which suggests that, even though there doesn’t appear to be much activity, there is significant planning that is yet to manifest. Across all agents or bilateral lenders, 94% have identified all LIBOR loan exposures, 75% have contacted borrowers regarding their remediation plans and 75% have begun to actively transition loans away from LIBOR.

How do lenders and borrowers intent to transition the remaining loans?

It is encouraging to see that there is considerable planning and action taking place to transition away from LIBOR, but what methods are most adopted? 64% agents or bilateral lenders began to remediate contracts by adding “hardwired” fallback language. From the borrowers that were contacted, however, only 13% were receptive to amending “hardwired” fallbacks and 4% wanted to rely on existing fallbacks at cessation.

The most popular response, by 46% of borrowers, was to refinance directly to the replacement rate. In this environment of high inflation and economic uncertainty, getting favorable terms in a refinance may be challenging and could cause a backlog without a backup plan, like an amendment.

What timeline do lenders and borrowers have in mind?

With regards to timing, 86% of agents/lenders expect most of their loans to transition away from LIBOR by the end of 2023Q2, or the last available quarter where LIBOR will be published. At 43%, half the agents/lenders expect to transition in 2023Q1 or earlier, leaving a potential backlog come 2023Q2. The remaining 14% of agents/lenders expect most loans to be transitioned after 2023Q2, which may seem concerning.

However, from those 14%, 70% of lenders report that a vast majority of their loans have hardwired fallback language, which means that loans would automatically revert to an alternative rate at LIBOR cessation.

Alter Domus’ role in the LIBOR transition

As a leading agent in the private debt markets, Alter Domus has proactively reached out to our clients to make sure they were preparing for the transition of their portfolios. Using our recommendations and reporting tools, our clients are prepared for the end of LIBOR in 2023.

The Reasons for Market Optimism

Although the percentage of loans currently transitioned away from LIBOR in the private debt space, 15%, seems rather small, there is reason to be optimistic. Thanks to the Loan Remediation Survey, there is data to support considerable LIBOR remediation plans by 89% of market participants. While the loans might not be transitioned currently, most loans have either AARC hardwired fallbacks (where transition is triggered automatically after LIBOR cessation) or amendment fallbacks, which would mean an amendment would have to be raised.

If action is taken early enough, the private debt market can avoid a costly and risky backlog of amendments. With the end of LIBOR coming within the next six months, we will continue to provide timely updates as warranted, in line with evolving private debt trends.

Footnotes:

[1] For purposes of this paper, ‘private debt’ refers to broadly syndicated loans and private direct lending markets. See existing Alter Domus report

for further details.

[2] https://www.newyorkfed.org/mar…

[3] https://www.newyorkfed.org/med…

[4] Details of how the Term SOFR is calculated is out of scope for this article

[5] https://www.newyorkfed.org/arr…

[6] Other alternative rates like SOFR exist in other currencies, such as SONIA in the UK and SONAR in Switzerland.

[7] Some exceptions/gray areas apply, like add-ons of existing deals or originations that were underwritten in 2021. https://www.lsta.org/app/uploa…

[8] https://www.loanconnector.com/…

[9] https://www.newyorkfed.org/med..

[10] https://www.lsta.org/news-reso…

[11] https://www.newyorkfed.org/med…

[12] https://www.newyorkfed.org/med…