After a challenging two years punctuated by rising interest rates and post-lockdown dislocation, there is cautious optimism among real estate investors and operators that markets are stabilizing.

As green shoots start to emerge, Alter Domus assesses and compares the key drivers of growth and investment opportunities across the US, European and Asia Pacific markets.

United States

Even though interest rates in the US have not come down at the pace anticipated at the end of 2023, US real estate markets have enjoyed a sense of renewed confidence in 2024 as investors have built comfort on asset pricing and sought to resume capital deployment after stepping back from new deals in 2022 and 2023.

Office

Despite an improvement in overall sentiment across US real estate, the office sub-sector has remained challenging, with investors and operators not only having to adjust to a higher interest rate environment, but also the secular shift in office space demand following pandemic era lockdowns.

According to CBRE, tepid economic growth and the entrenchment of hybrid and homeworking have put the brakes on demand for office space and driven up vacancy rates. CBRE forecasts show vacancy rates climbing to almost 20% in 2024, with a survey of US office occupiers highlighting plans to reduce office space through the course of 2024.

Slowing demand has already filtered into new build activity, with Cushman and Wakefield figures showing that construction pipelines have fallen below 50 million square feet (MSF) – the lowest levels since 2013.

The US office real estate slowdown, however, is not universal, with certain locations and categories proving resilient and continuing to grow.

CBRE, for example, has observed steady growth in the Las Vegas market, where a business-friendly tax regime has attracted new companies and driven up office-using employment. Miami is another hot market, with asking rents showing year-on-year growth of around 6%, with the Nashville market also enjoying steady demand for office space.

Logistics

Demand for US logistics real estate has trended lower during the last 12 months, with Prologis analysis estimating demand at 195 million square feet at the end of 2023 – below the 490 million square feet of new space that became available as projects launched in 2022 reached completion.

Vacancy rates have also edged higher, but there is an expectation that vacancies will peak below long-term averages this year.

The continuing growth of global e-commerce sales, and ongoing efforts to “near-shore” supply chains in the face of rising geopolitical tensions, will support long-term rent growth, which although down from the levels observed at the peak of the market in 2022, has settled above pre-pandemic levels in North America, according to JLL.

Ongoing demand for sites that meet best practice ESG standards, and can support increasingly specialized warehouse picking and packing technology, are also set to spur ongoing investment.

Retail

The long-term secular shift to online shopping has continued to weigh on US retail space, with Colliers recording an increase of 10 basis points in US retail real estate vacancy rates in Q1 2024.

There is a growing sense, however, that the retail real estate space may have bottomed out, with supply-demand dynamics shifting back in favor of landlords, particularly for space in prime locations and high-end shopping malls.

According to JLL leasing rates have reached 35.1% in 2024, an improvement on rates for the prior 12 months. Demand for small spaces of less than 2,500 square feet has proven particularly robust, with casual dining and fast-food chains snapping up these smaller spaces.

Regionally, JLL has also noted strong growth in markets across the Sun Belt, where rising populations and strengthening buying power have supported steady demand for retail space.

Residential

US house prices have proven remarkably resilient through the rising interest rate cycle, and even though mortgage costs have increased, the National Association of Realtors anticipates that house prices will still edge higher by around 2.6% in 2024.

Apartment occupancy rates are also expected to remain robust and well-above the 90% threshold according to the CBRE.

Investors and developers, however, are taking the time to ensure that investment in additional residential real estate construction is targeted in the right areas, with demand bifurcating between different regions.

CBRE, for example, notes that rental growth and occupancy rates for multifamily real estate is expected to be strong in the Midwest, Northeast and urban centers of New York, Washington D.C. and Chicago, whereas the Mountain and Sun Belt regions, where supply-demand imbalances are less acute, will see softer demand and rent growth.

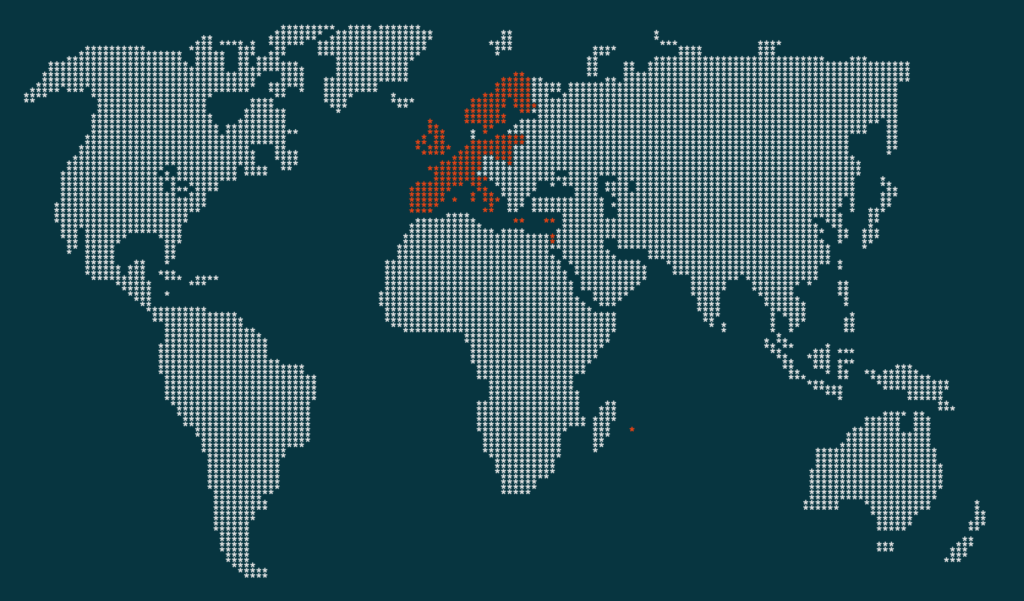

Europe

After a year of inflationary and interest rate headwinds, as well as weak economic growth, European real estate markets have stabilized in 2024. Even though the European Central Bank (ECB) did cut rates for the first time in almost five years in June, macroeconomic uncertainty continues to linger and drive a delta between buyer and seller valuation expectations, according to asset manager abrdn. But with the value of real estate assets relative to government bonds improving, a pathway back into the market is opening up for investors.

Office

As has been the case in other regions the combination of a higher rate environment and increased homeworking post-COVID have proven challenging for office real estate in Europe.

According to abrdn, take up of European office space was down by almost 20% year-on-year in 2023, and some 16% off the long-term average.

The downswing in European real estate office space has not been universal, however, with demand for prime office in key locations continuing to show growth.

Prime office yields have rallied strongly from the lows of 3.2% seen at the trough of the market in the middle of June 2022, improving to 4.6% by the end of Q1 2024, according to BNP Paribas figures.

Logistics

The last 12 months have been a period of reset and recalibration for the European logistics sector after a red-hot period of activity immediately following the pandemic.

Weak economies across the region coupled with the topping out of online shopping growth have resulted in lower new build supply coming to market, as developers readjust to softer demand.

Rents, however, are still growing and according to CBRE are set to expand by 4% in 2024, which is well below the double-digit rent growth observed at the top of the market, but more in line normal run rates. Regional trends are also emerging, with CBRE anticipating that Italy, Germany and Spain will see the biggest jumps in rental growth in 2024.

Certain segments on the market are also performing better than others, with modern units that meet high ESG standards attracting more attractive rents than older sites in need of refurbishment. CBRE anticipates that widening gaps in rents will lead to a two-tier market.

Retail

The long-term secular headwinds challenging European retail real estate have shown little sign of abating, with abrdn recording an increase in shopping center vacancy rates to 12.7% by the end of 2023.

With the market at a low ebb, however, there are opportunities emerging to invest at attractive entry valuations. Retail real estate attracted just under a fifth of total real estate investment in Europe in 2023 – a meaningful increase that points to the potential value still on offer in the segment for investors.

Indeed, JLL notes that prime shopping center and retail park sites in Europe have continued to deliver attractive yields through the investment cycle, and outperformed other categories such as office and industrial assets. With corrections in rental rates having already worked through the market, there is also room for rental growth in the coming months and years.

Residential

Population growth in urban centers has provided a solid foundation for residential real estate in Europe’s capitals, with the CBRE forecasting a 3% rise the number of households in major European cities during the next five years.

These solid underlying fundamentals have made residential real estate one of the most resilient industry segments through the rising interest rate cycle, and while new rent regulations do pose risks for investors, vacancy rates in Europe’s top thirty cities have been low, and some cities have seen double-digit rent growth, according to abrdn. Limited new supply across Europe has supported rental growth and industry cashflows.

As has been the case on logistics, however, sustainability is a looming challenging for residential landlords and investors, who may have to make significant investments to upgrade existing housing stocks to meet higher emissions and environmental standards.

According to CBRE, the European Commission’s Energy Performance Buildings Directive (EPBD) demands that all homes across the EU will have to meet energy performance certificate ratings (EPC) of class E by 2030 and class D by 2033. At present, a quarter of European housing stock is below class E, with a further 49% below class D.

In addition to absorbing extra cots to upgrade properties, investors will also have to be alert to the risk of assets that are lagging on ESG being cast adrift as demand for ESG compliant properties grows.

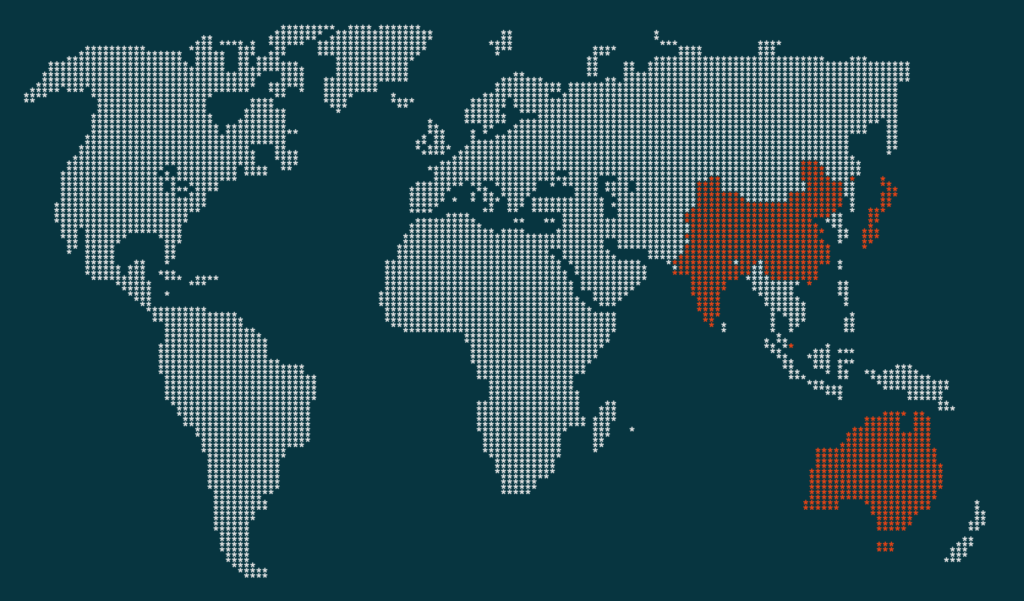

Asia-Pacific

Asia-Pacific’s (APAC) real estate industry has felt the chill of rising interest rates in the US and Europe, and has also had to manage the fallout from a liquidity crisis in the core Chinese real estate sector, which has seen once blue-chip developers fall into default and liquidation, with severe knock affects for investors and the wider economy.

Office

Macro-economic headwinds have taken a heavy toll on APAC’s office market, with average prime rates falling to 3.2% year-on-year in Q1 2024. According to Knight & Frank this represents the seventh consecutive quarter of declining rates. China’s tier-1 cities have been in the frontline of for the downswing, but few APAC jurisdictions have been insulated, with Singapore, Melbourne, Sydney and Tokyo all suffering rental rate declines, according to abrdn.

Prime office sites in Seoul have bucked the trend, with sustained demand keeping a lid on vacancy rates, while in Australia investors are still deploying capital in selected prime office assets. Overall, however, the market is set to remain challenging, with Knight & Frank forecasting that vacancies will continue to edge higher as new supply continues to flood the market.

Logistics

Logistics real estate has been an indirect beneficiary of the tough conditions facing the office segment, with international investors shifting allocations away from office and into logistics.

According to CBRE, logistics leasing in China has held up well, with international e-commerce businesses, third-party logistics (3PL) providers and manufacturers all supporting demand. 3PLs and e-commerce companies have also sustained demand in Korean market, although an oversupply of space has kept vacancy rates elevated. Occupiers are, however, pivoting towards shorter leases in the face of macro-economic risk.

The broadly stable backdrop has supported healthy demand for logistics space across APAC overall, with Savills reporting year-on-year increases of more than 20% in logistics and industrial real estate absorption rates (the amount of space leased less the amount of space vacated).

Retail

Retail has been another bright spot in APAC real estate markets, with abrdn reporting year-on-year rental growth of close to 6% at the back end of 2023.

Momentum from the lifting of lockdowns and the reopening of tourism has supported the retail segment, and the outlook for leasing pipelines is positive, with a CBRE industry survey showing that two-thirds of retail brokers are reporting increases in leasing enquiries and site viewings.

The market is, however, splitting into two tiers. In Hong Kong, for example, demand for prime locations and tier 1 high streets has been strong, according to CBRE, whereas sites that fall outside these locations are encountering high vacancy rates.

Residential

Growth in urban populations is set to carry APAC residential markets through near-term headwinds, with long-term housing demand in cities boosted by forecasts that 19 cities in APAC will have populations of 10 million or more by 2030, according to Knight Frank analysis.

The favorable long-term demographics buoying residential real estate have shielded valuations from wider market dislocation, with Knight Frank reporting dips in pricing of less than 1%.

These solid fundamentals present an attractive mix of investment opportunities for, according to abrdn, ranging from hotel-to-rental apartment conversions in China to multifamily opportunities in Japan’s largest cities.