Analysis

Evolving Operations: The Rise of Co-Sourcing in Private Markets

Co-sourcing is increasingly being seen as a viable operational model by asset managers. In this article, we break down the fundamentals of co-sourcing, and outline the factors driving its adoption.

Staying in Control

How do private markets firms scale operations while maintaining control? It’s a challenge facing CFOs, COOs, and fund controllers as the industry grows in scale and sophistication.

Over the past decade, private capital has become a mainstream asset class, with managers handling larger, more complex portfolios across diverse jurisdictions. The introduction of new fund structures—like continuation vehicles and co-investments—has expanded the toolkit for general partners (GPs) but also intensified operational demands amid rising regulatory pressures and limited partner (LP) expectations.

Eight Drivers of Co-Sourcing In Private Markets

A 2024 Private Markets Insight Report by Allvue Systems reveals that 84% of private capital firms plan to re-evaluate their operating models within the next 12–18 months, with modular co-sourcing as a key focus. Similarly, 88% of managers at the Fund Operator Summit Europe are exploring outsourcing or co-sourcing in operational areas, particularly in reporting and support functions. Here, we explore the driving forces behind the growing adoption of co-sourcing.

1. Complexity outpaces legacy models

Firms manage more funds, across more jurisdictions, for increasingly diverse investors. Co-sourcing provides the flexibility and transparency needed to navigate this complexity.

2. Control without Overhead

Managers want to own their data, systems, and client relationships—without carrying the full operational load. Co-sourcing allows firms to retain oversight while shifting execution to trusted partners.

3. Scalable without compromise

As strategies multiply and reporting timelines tighten, operational needs fluctuate. Co-sourcing provides institutional-grade support that flexes with demand, without overcommitting to permanent hires.

4. Enhanced governance and risk management

Regulators demand clear accountability on vendor oversight and operational continuity. Co-sourcing provides transparency into workflows, responsibilities, and data flows, strengthening governance.

5. Rising regulatory burden

SEC Form PF updates, AIFMD filings, ESG disclosures, and tax transparency rules require greater frequency and granularity in reporting. Co-sourcing ensures consistency and accuracy across jurisdictions.

6. Growing LP expectations

Investors want richer insights into performance, fees, and portfolio exposures—delivered faster. Co-sourcing gives managers the back-office strength to meet these expectations while retaining control of the client narrative.

7. Data and platform ownership

Unlike traditional outsourcing, co-sourcing ensures managers keep ownership of their platforms and data, while partners integrate into existing systems to maintain continuity and reduce transition risks.

8. Talent scarcity

Specialist skills in fund operations—such as waterfall calculations or jurisdiction-specific compliance—remain hard to source. Between 2020 and 2022, the U.S. lost more than 300,000 accounting professionals. Co-sourcing provides immediate access to expertise without lengthy recruitment cycles.

Co-Sourcing Overview

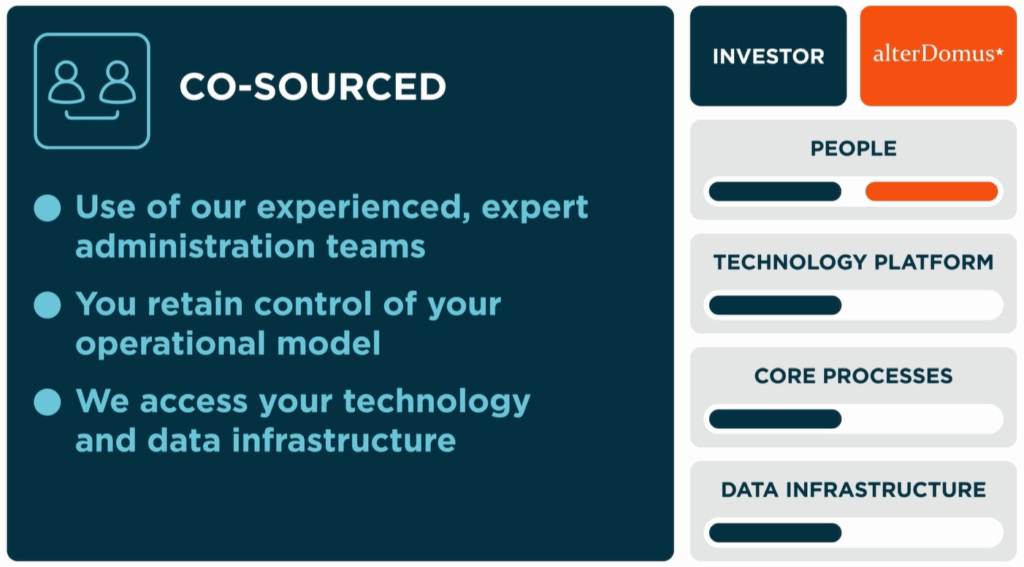

To address these challenges, many fund managers are shifting towards a hybrid co-sourcing approach, allowing them to retain control over their systems and client experience while leveraging specialist partners for precise execution.

Ready to transform your operating model?

Co-sourcing with Alter Domus offers General Partners a tailored approach that combines internal oversight with the executional strength of a specialist partner.

Our consultative model allows you to define the scope of support that best fits your unique operational needs, whether it’s fund accounting, capital activity, or regulatory reporting.

By maintaining system continuity and establishing strong governance, we empower your internal teams to focus on strategy while we handle execution efficiently.

Experience the benefits of enhanced operational resilience, regulatory readiness, and access to deep industry expertise.

Contact us today to explore how co-sourcing can elevate your business.

"*" indicates required fields