The Reality for Endowment Operations Team

Managing investment operations in an endowment or foundation is a delicate balancing act. Teams are often small, yet they oversee increasingly complex portfolios that now include alternatives alongside public markets, leading to a surge in data, valuation methods, and reporting requirements.

The pressure is relentless. Investment offices and committees demand daily insights into exposures, liquidity, and a multitude of associated information, while boards and donors expect transparency. Auditors require precise reconciliations, all of which must be delivered timely despite the various formats of data received from multiple custodians and investment managers.

For investment operations teams, the challenge lies in managing enterprise-scale complexity often without the required bandwidth. It’s essential to focus on what operations teams need to succeed.

What Ops Leaders Need

Alignment between Accounting Book of Record (ABOR) and Investment Book of Record (IBOR)

No more misalignment between the “official” accounting book and the “working” investment book. The two must reconcile seamlessly, so finance and investment teams are speaking the same language.

Daily, Decision-Ready Data

Ops teams need more than quarterly closes or batch-driven reports. They need accurate daily visibility into exposures, liquidity, cash flows, and commitments — so the investment office can act with confidence in real time.

Forward-looking Transparency

Accounting records are essential, but investment operations must also anticipate what’s ahead: capital calls, distributions, unfunded commitments, and liquidity pinch points. This forward view is what enables true risk management.

Customizable Reporting

Boards, donors, auditors, and regulators all want information in different formats, often on short notice. Ops leaders need reporting that adapts to the audience, not rigid templates that force endless manual work.

A Partner that Understands Alternatives

Endowments and foundations manage complex, multi-asset portfolios where alternatives are only one piece of the equation. True partnership means understanding how private market investments fit within the broader ecosystem of public equities, fixed income, and real assets—and ensuring they’re all captured in a single, coherent reporting framework.

At Alter Domus, our strength lies not just in our alternative expertise but in how we integrate that knowledge across the full spectrum of holdings. We help investment teams achieve true total-portfolio visibility—connecting data from private funds, co-investments, and partnerships to the liquid exposures managed elsewhere.

The result is unified, institutional-grade reporting and governance that reflects the full reality of your portfolio. That integrated approach extends to how we collaborate with your existing partners.

Seamless Collaboration with Custodian Banks

We work closely with custodian banks to ensure that data and reporting flow smoothly across both public and private assets. Our systems and workflows are designed to complement custody platforms—enhancing, not duplicating, their capabilities.

For investment teams, this means maintaining established banking relationships while gaining a more complete and connected picture of portfolio performance. The result is a cooperative model that brings together the strengths of both worlds: the custodians’ scale and security with Alter Domus’ deep understanding of private markets.

The Challenge with Non-specialist Solutions

Many of the partners that serve endowments and foundations operate a model that was designed for traditional markets, excelling in equities and bonds but struggling with alternatives. Data silos hinder operations teams from achieving a unified portfolio view, and standardized reporting falls short of delivering the daily insights investment offices need.

Non-specialist solutions often overlook the complexities of private equity, private credit, hedge funds, and real assets. Capital calls, unfunded commitments, and bespoke valuations don’t fit into public market workflows, forcing teams to manually reconcile gaps and adapt templates for boards and auditors. For small endowment teams, these challenges lead to increased workload, risk, and confusion—contrary to the goals of ABOR and IBOR.

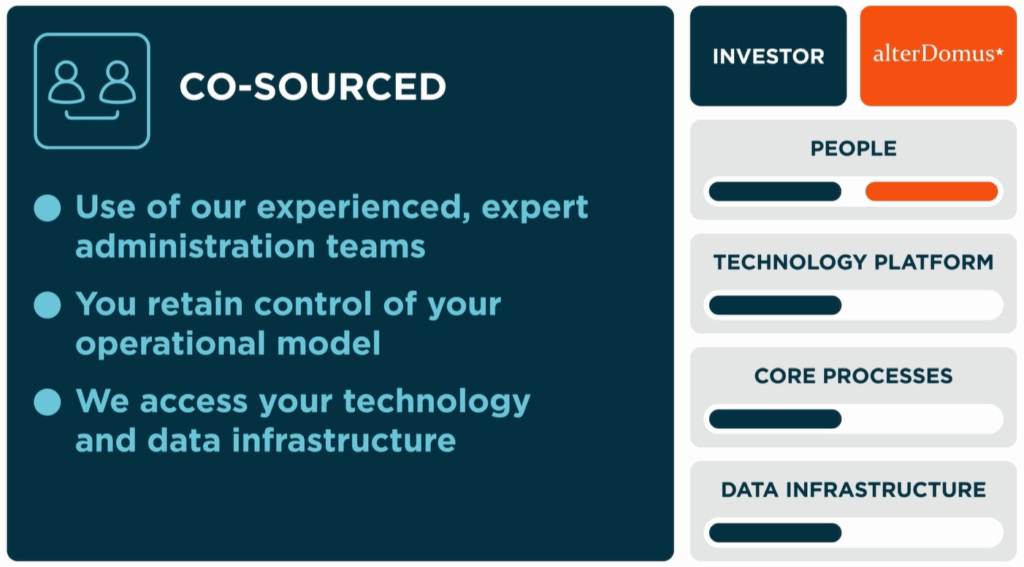

Aligning for Clarity and Control

For directors of investment operations, the challenge isn’t just more data — it’s delivering accuracy, timeliness, and transparency with small teams under mounting pressure.

That requires a model where ABOR and IBOR are aligned, reconciled, alternative-aware, and tailored to your governance needs.