Analysis

Evolving Operations: The Rise of Co-Sourcing in Private Markets

Co-sourcing is increasingly being seen as a viable operational model by asset managers. In this article, we break down the fundamentals of co-sourcing, and outline the factors driving its adoption.

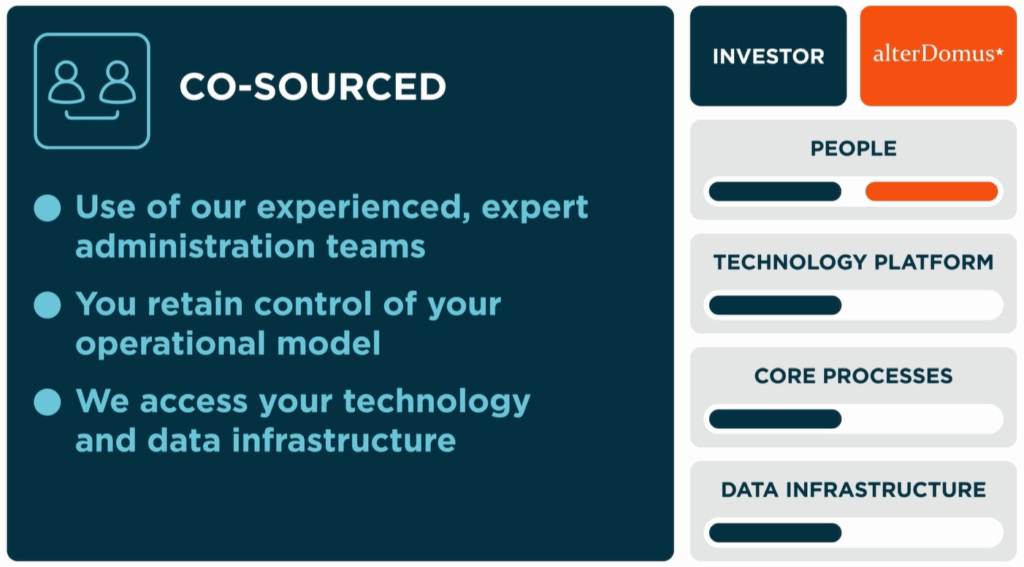

Staying in Control

How do private markets firms scale operations while maintaining control? It’s a challenge facing CFOs, COOs, and fund controllers as the industry grows in scale and sophistication.

Over the past decade, private capital has become a mainstream asset class, with managers handling larger, more complex portfolios across diverse jurisdictions. The introduction of new fund structures—like continuation vehicles and co-investments—has expanded the toolkit for general partners (GPs) but also intensified operational demands amid rising regulatory pressures and limited partner (LP) expectations.

Eight Drivers of Co-Sourcing In Private Markets

A 2024 Private Markets Insight Report by Allvue Systems reveals that 84% of private capital firms plan to re-evaluate their operating models within the next 12–18 months, with modular co-sourcing as a key focus. Similarly, 88% of managers at the Fund Operator Summit Europe are exploring outsourcing or co-sourcing in operational areas, particularly in reporting and support functions. Here, we explore the driving forces behind the growing adoption of co-sourcing.

1. Complexity outpaces legacy models

Firms manage more funds, across more jurisdictions, for increasingly diverse investors. Co-sourcing provides the flexibility and transparency needed to navigate this complexity.

2. Control without Overhead

Managers want to own their data, systems, and client relationships—without carrying the full operational load. Co-sourcing allows firms to retain oversight while shifting execution to trusted partners.

3. Scalable without compromise

As strategies multiply and reporting timelines tighten, operational needs fluctuate. Co-sourcing provides institutional-grade support that flexes with demand, without overcommitting to permanent hires.

4. Enhanced governance and risk management

Regulators demand clear accountability on vendor oversight and operational continuity. Co-sourcing provides transparency into workflows, responsibilities, and data flows, strengthening governance.

5. Rising regulatory burden

SEC Form PF updates, AIFMD filings, ESG disclosures, and tax transparency rules require greater frequency and granularity in reporting. Co-sourcing ensures consistency and accuracy across jurisdictions.

6. Growing LP expectations

Investors want richer insights into performance, fees, and portfolio exposures—delivered faster. Co-sourcing gives managers the back-office strength to meet these expectations while retaining control of the client narrative.

7. Data and platform ownership

Unlike traditional outsourcing, co-sourcing ensures managers keep ownership of their platforms and data, while partners integrate into existing systems to maintain continuity and reduce transition risks.

8. Talent scarcity

Specialist skills in fund operations—such as waterfall calculations or jurisdiction-specific compliance—remain hard to source. Between 2020 and 2022, the U.S. lost more than 300,000 accounting professionals. Co-sourcing provides immediate access to expertise without lengthy recruitment cycles.

Co-Sourcing Overview

To address these challenges, many fund managers are shifting towards a hybrid co-sourcing approach, allowing them to retain control over their systems and client experience while leveraging specialist partners for precise execution.

Ready to transform your operating model?

Co-sourcing with Alter Domus offers General Partners a tailored approach that combines internal oversight with the executional strength of a specialist partner.

Our consultative model allows you to define the scope of support that best fits your unique operational needs, whether it’s fund accounting, capital activity, or regulatory reporting.

By maintaining system continuity and establishing strong governance, we empower your internal teams to focus on strategy while we handle execution efficiently.

Experience the benefits of enhanced operational resilience, regulatory readiness, and access to deep industry expertise.

Contact us today to explore how co-sourcing can elevate your business.

"*" indicates required fields

Analysis

Co-Sourcing with Alter Domus: A Custom Approach for General Partners

Alter Domus understands that every General Partner has unique operational needs, which is why we offer tailored co-sourcing strategies to enhance efficiency and maintain control. Our expertise allows clients to focus on strategic growth while we manage execution and ensure regulatory compliance.

In the dynamic landscape of private markets, every General Partner (GP) has unique operational needs and preferences. At Alter Domus, we understand that a one-size-fits-all model simply doesn’t work. Instead, we adopt a consultative approach, collaborating with each client to define a co-sourcing strategy that aligns with their specific requirements.

Whether it’s supporting a single process like Form PF reporting or managing full fund accounting cycles within the client’s infrastructure, our flexibility ensures that we meet diverse operational contexts.

Here are some examples of how we empower GPs through customized services and expertise:

Typical Capabilities Include:

- Fund Accounting: We prepare books and records using the client’s technology platform, with workflows designed for dual review and sign-off.

- Capital Activity: We calculate and format capital calls, distributions, and notices, while clients retain approval rights and manage LP communications.

- Regulatory Reporting: Our teams collect, map, and format data to comply with evolving requirements.

By partnering with us, internal GP teams can concentrate on oversight and strategy, while our dedicated professionals manage execution within a clearly defined control framework.

Making the Shift: Practical Considerations:

Transitioning to a co-sourcing model doesn’t mean overhauling existing systems or starting from scratch. With years of implementation experience, we guide clients through a structured transition focused on clarity, integration, and flexibility.

Through our extensive work with clients, we’ve identified three key building blocks essential for unlocking the full potential of a co-sourced operating model:

1. Define the right scope: We pinpoint operational areas under pressure, such as:

- Fund closings and reconciliations

- Capital statements and investor notices

- Data preparation for regulatory reporting

- Waterfall modeling and fee calculations

2. Maintain System Continuity: Clients keep their platforms while we securely integrate into their ecosystem, ensuring a single source of truth and avoiding fragmentation.

3. Establish Strong Governance: We align with each client’s compliance and oversight model, ensuring clear roles, documentation, and audit trails. Managers retain ultimate responsibility, while our teams execute defined workflows according to agreed service-level agreements (SLAs).

Figure 1 – The Benefits of Co-Sourcing with Alter Domus

| Benefit | How it Helps |

|---|---|

| Internal Oversight | Control over systems, data, policies, and approval processes remains in-house |

| External Execution | Alter Domus executes defined tasks at scale, with speed, accuracy, and rigor |

| Data Ownership | Clients maintain full ownership of their infrastructure and data environment |

| Regulatory Readiness | Respond to changing rules with agile support and specialist knowledge. |

| Investor Responsiveness | Meet LP reporting demands faster and more consistently. |

| Operational Scalability | Expand or contract support without internal hiring constraints. |

| Access to Talent | Tap into deep experience across private equity, private credit, and real assets |

Co-Sourcing: A Model for Long-Term Resilience

For private markets managers, operational resilience transcends mere business continuity; it’s about forging systems and partnerships that can adapt and thrive in an increasingly complex environment. Co-sourcing provides the perfect balance: the stability of internal oversight combined with the executional strength of a specialist partner.

At Alter Domus, we view co-sourcing as a strategic decision rather than just a service model. It empowers asset managers to focus on what truly matters: creating value for investors, meeting regulatory expectations, and growing with confidence.

If you’re reevaluating your operating model or exploring how co-sourcing could enhance your structure, we’re here to assist. Alter Domus has extensive experience supporting transitions of all sizes and complexities—whether you’re managing a single strategy or adding new strategies.

Ready to transform your operating model?

Our consultative model allows you to define the scope of support that best fits your unique operational needs, whether it’s fund accounting, capital activity, or regulatory reporting.

By maintaining system continuity and establishing strong governance, we empower your internal teams to focus on strategy while we handle execution efficiently.

Experience the benefits of enhanced operational resilience, regulatory readiness, and access to deep industry expertise.

Contact us today to explore how co-sourcing can elevate your business.

"*" indicates required fields

Analysis

Looking to incorporate a Securitisation Vehicle? Here’s what you need to know

Securitisation vehicles are powerful tools that enhance liquidity, optimize risk management, and streamline capital structures. We explore how understanding their complexities can equip you to unlock financial opportunities and stay ahead in today’s evolving markets.

Securitisation has become an indispensable tool for institutions, asset managers, and asset owners. This sophisticated financial instrument offers a powerful trifecta: effective risk management, enhanced liquidity, and streamlined capital structures.

For those contemplating the incorporation of a securitisation vehicle, a comprehensive grasp of this intricate yet potentially lucrative process is crucial. By mastering its complexities, you’ll gain the confidence to navigate challenges adeptly and fully harness the myriad benefits securitisation offers, positioning yourself at the forefront of modern financial strategy.

What is Securitisation and why is important?

Securitisation is the process of pooling various types of financial assets, such as loans, mortgages, or receivables, and converting them into marketable securities. These securities are then sold to investors, allowing the originators to free up capital and manage risk more effectively. The cash flows generated from the underlying assets are used to pay interest and principal to the investors.

During 2017 and 2018, the European Union set up rules for securitisations. The goal was to bring the EU securitisation market back to life while also addressing worries about risky practices that had threatened stability after the global financial crisis of 2008. Since it entered into force in 2019-2020, the framework has strengthened investor protection, transparency, and financial stability.1

The European Commission has recently taken steps to revitalize the EU’s securitisation framework to make it simpler, more effective, and supportive of economic growth. These initiatives are part of the savings and investments union strategy, which focuses on improving the way the EU financial system works to boost investment and economic growth across Europe.

Benefits of Securitisation

Enhanced Liquidity

By converting illiquid assets into tradable securities, institutions and originators can access capital markets and improve their liquidity position. This transformation allows entities to free up resources that can be used for further lending to EU citizens and enterprises.

Risk Management

Securitisation allows for the transfer of risk from the originator to investors, which can help in managing credit risk and regulatory capital requirements. The main goal is to enable banks and other financial institutions to use the loans and debts they grant or hold, pool them together, and turn them into different types of securities that investors can purchase.

Cost Efficiency

Securitisation can lead to lower funding costs compared to traditional financing methods, as it often allows for better pricing based on the risk profile of the underlying assets. Recent EU reforms aim to simplify unnecessarily burdensome requirements and reduce costs to encourage more securitisation activity.

Diversification of Funding Sources

By tapping into the capital markets, institutions can diversify their funding sources and reduce reliance on bank financing. This diversification is particularly important in today’s volatile economic environment.

Regulatory Benefits

In some jurisdictions, securitisation can provide regulatory capital relief, allowing institutions to optimize their balance sheets. The European Commission’s recent proposals have estimated a reduction in capital requirements by one-third for senior securitisation tranches, which should encourage new issuances in member states where activity has been limited.

Key Considerations before incorporating a Securitisation Vehicle

The European securitisation market operates under the EU Securitisation Regulation (EUSR), introduced in January 2019 as part of a comprehensive regulatory response to the Global Financial Crisis.

The Securitisation Regulation amendments aim to reduce operational burdens by simplifying transparency requirements, with plans to cut reporting fields by at least 35%. The revisions introduce more proportionate, principle-based due diligence processes, eliminating redundant verification steps when the selling party is EU-based and supervised.

Notably, the requirement for Simple, Transparent and Standardised (STS) securitisations has been modified to consider pools containing 70% SME loans as homogeneous, facilitating cross-border transactions and enhancing SME financing opportunities.2

Choosing the right jurisdiction

Selecting the appropriate jurisdiction for your securitisation vehicle is a critical strategic decision that impacts regulatory compliance, tax efficiency, and operational flexibility. Several European jurisdictions offer competitive frameworks for securitisation vehicles, each with distinct advantages depending on your specific transaction objectives.

The optimal jurisdiction ultimately depends on multiple factors: the location and type of underlying assets, your investor base, anticipated transaction complexity, and specific business objectives. Regulatory changes, such as the EU Securitisation Regulation, have created a more harmonized framework across Europe, though important jurisdictional nuances remain that can significantly impact transaction efficiency.

Structuring the vehicle

Decide on the structure of the securitisation vehicle. Common structures includes:

- Securitisation Undertaking: A corporate entity specifically designed for securitisation transactions

- Securitisation Fund: Similar to an investment fund, but specifically for securitisation assets

- Fiduciary Structures: Where assets are held by a fiduciary for the benefit of investors

These structures are designed to isolate financial risk and facilitate the issuance of securities. You can choose a bankruptcy-remote structure with a Dutch Stichting or a Jersey Trust, which are most commonly used, or incorporate a vehicle using an entity in your group.

Legal & Tax Implications

You’ve made the strategic decision to incorporate a securitisation vehicle—now it’s time to navigate the complex legal and tax landscape that comes with it. Have you considered how different jurisdictional choices might impact your bottom line?

Legal and tax considerations aren’t just compliance checkboxes. They’re powerful levers that can dramatically enhance your securitisation structure’s efficiency. Engaging specialized advisors early in your planning process to avoid costly restructuring later.

By strategically selecting your jurisdiction and structure based on your specific assets and investor profile, you can create a tax-efficient vehicle that maximizes returns while maintaining full compliance.

Servicing and Management

Establish a reliable servicing and management framework for the transaction. Effective management and administration of the vehicle by an experienced partner is critical to ensure the correct execution of the transaction.

As the legislative changes removed restrictions on leverage and the nature of the securities permitted as collateral, the SV can now enter into a facility with a credit institution. This is required to acquire the full amount of the contemplated investments, providing greater certainty to the market.

Conclusion

Incorporating a securitisation vehicle represents a strategic opportunity for financial institutions and asset managers seeking to optimize their capital structures, enhance liquidity, and manage risk effectively. The European securitisation market, with its evolving regulatory framework, offers sophisticated mechanisms to achieve these objectives when properly structured.

Partnering with an experienced service provider gives you access to specialized knowledge from structuring and incorporation to efficient implementation and execution to vehicle liquidation.

This collaboration enables you to navigate jurisdictional complexities with confidence, ensure regulatory compliance across borders, and optimize your structure for maximum efficiency and investor appeal. Such expertise has become not merely beneficial but essential for institutions seeking to leverage the full potential of securitisation.

Securitisation is complex and you shouldn’t have to manage it alone. At Alter Domus, we simplify the process with end-to-end expertise, from transaction closing through administration and up to liquidation. With us as your partner, you can focus on strategy and investors while we take care of execution.

Contact us today to learn about how you can unlock of the full potential of securitisation with Alter Domus.

Analysis

Broadening horizons: how data centers and renewables are reshaping infrastructure

Data centers and renewable energy have been two of the fastest growing infrastructure subsectors.

In the fourth article in a five-part infrastructure series Alter Domus looks into what has driven the expansion of these two assets classes, how they are reshaping what is defined as infrastructure, and why future growth in data centers and renewables will be closely interlinked.

Analysis

Mind the gap: the vital role of private markets in meeting the infrastructure funding gap

Private markets will have a crucial part to play in financing the roll-out of essential infrastructure over the next 15 years, as the gap between current levels of investment and what is required to keep pace with growing demand widens.

In the second of a five-part infrastructure series, Alter Domus explores the essential role infrastructure funds have to play to plug the infrastructure funding gap.

Global demand for infrastructure is skyrocketing and governments around the world are struggling to keep pace.

The world’s population, estimated at around 8 billion, has more than tripled since 1950 and is forecast to increase by more than 20 percent by 2025, according to the United Nations. This has driven up demand for more provision of electricity, transport, water and sanitation and telecommunications.

In addition to the pressure for additional core infrastructure capacity to come onstream to support a growing population, there is also growing demand for investment in new areas, including digital, renewables and decarbonization. Ageing infrastructure also requires capital for urgent upgrades and maintenance, usage of existing assets increases in line with rising populations.

A widening fund gap

It has become increasingly difficult for governments – who have had to rein in spending after pandemic financing stimulus and in the face of rising borrowing costs – to keep up with the accelerating demand, as required investment outstrips available public resources.

According to The G20 Global Infrastructure Hub initiative, current levels of investment in infrastructure will not be enough to meet long-term demand, with $15 trillion investment gap opening by 2040 if investment doesn’t increase materially.

If governments do not make the necessary investment to fix, upgrade and build new infrastructure, the costs to economies and societies will be immense, with impacts on domestic and cross-border trade, economic competitiveness, consumers and the environment.

Governments will remain ultimately responsible for infrastructure development, but will have to work with private sector capital providers to finance the build of new projects and operate and maintain existing assets.

The investment case for private markets

The urgent requirement for governments to up infrastructure investment align with the commercial objectives of private markets fund managers, who can invest in infrastructure on a sound commercial basis at the same time as serving a wider societal objective.

The solid long-term fundamentals that underpin infrastructure demand, and the stable contracted revenue streams tied to infrastructure assets, have drawn more and more capital into private infrastructure funds during the last 15 years.

Infrastructure assets under management (AUM) have expanded at a compound rate of 16 percent since 2010 and now exceed US$1 trillion, according to Preqin figures. By 2026 AUM could exceed US$1.8 trillion.

The levels of infrastructure AUM relative to the forecast 2040 US$15 trillion infrastructure funding gap suggests that their a is still a long runaway of growth ahead for infrastructure funds, and clear incentive for the public sector to funnel this capital into infrastructure projects.

Bringing in the private sector

Bringing in private capital to finance the construction of new infrastructure can be facilitated through the range procurement channels and public-private-partnerships (PPPs), where the private and public sector share the risk and capital expenditure burden of construction new assets. Private sector operators can also back existing infrastructure assets, investing in the ongoing provision and maintenance of services.

Funding core infrastructure operations and build-out with private sector capital, however, is not a silver bullet that will magic away the widening infrastructure funding gap and eliminates financial risk and delay on infrastructure projects

There have been high profile examples of PPP deals. for example, that have been hit by long delays and large cost overruns, such as the California High-Speed Rail project in the US and the Sydney light rail development in Australia. Direct private ownership of infrastructure assets has not always worked either.

Projects run only by the public sector, however, have also been subject to prolonged timelines and mushrooming budgets, and there is a body of research showing that in the round, PPP projects offer better value for money than vanilla government procurement.

In addition, G20 Global Infrastructure Hub analysis shows that the increase in capital flows into private infrastructure funds has translated into more investment. Private investment in infrastructure does not come without its risk, but with the infrastructure gap widening every year, the requirement to accelerate private investment is becoming ever more pressing.

In it for the long-haul

From an investor and private funds manager perspective, while infrastructure does offer protection against downside risks, there will be points in the cycle when wider macro-economic and geopolitical and even infrastructure trends impact deployment and fundraising opportunities.

Interest rate dislocation during the last 36 months, for example, has taken a toll on infrastructure fundraising, which has declined for the last three years, falling to a decade low in 2024.

Deployment can also prove challenging, through all points in the cycle. Competition for a limited pool of existing assets, with bankable, established cashflows is intensifying and high valuations on entry can make it tough for managers to meet investor return expectations.

The Global Infrastructure Hub, meanwhile, notes that sourcing suitable greenfield projects is also difficult given the risk that comes with backing these projects. The highest share of uninvested infrastructure dry powder is held by managers who are targeting greenfield projects exclusively.

If governments want to draw more private capital into funding infrastructure, preparing a longer pipeline of bankable investment opportunities will be essential.

Even entirely privately funded infrastructure projects involve close coordination with government agencies to cover of planning permissions and permitting. According to the World Bank project preparation can take between 24 and 30 months and absorb between five and 10 percent of total project investment before ground is even broken.

When crowding in private capital governments also have to ensure that risk is allocated sensibly between the private and public sector. Private investment in infrastructure is not sustainable if managers are seen to be taking excessive profits from building and running public assets without taking on any risk, but at the same time private markets players won’t have the balance sheets or capacity to bear all the risk of large projects entirely in isolation. Rigorous planning, structuring and negotiation is necessary to strike this fine balance.

Governments that expedite pre-project planning and permitting work and take a balanced approach to risk sharing, will have a deeper pool of bankable projects for private funds managers to back, and be in the front of the queue to attract more private investment.

Demand for infrastructure, across all geographies and all categories, is not slowing down. private markets managers have the potential to generate excellent returns when serving that demand. Governments should be ready to help them every step of the way.

Infrastructure Solutions

Discover our deep infrastructure asset management expertise, and our full lifecycle offering of global infrastructure solutions.

Analysis

Solid foundations: the infrastructure opportunity

As rising inflation macro-economic uncertainty have sharpened investor focus on building exposure to assets that offer inflation protection and stable, uncorrelated returns, private infrastructure funds have emerged as an obvious area to invest.

In the first of a five-part infrastructure series, Alter Domus outlines why the asset class is an ideal fit for pension funds and sovereign wealth funds with long-term investment horizons.

Analysis

5 real estate takeaways from IMN Winter Forum

A team of our real estate-focused sales and operational leaders attended IMN’s Winter Forum on Real Estate Opportunity & Private Fund Investing in Laguna Beach, California this past week. Held from January 22-24, 2025, at the Montage Laguna Beach, the conference attracts more than 1,200 attendees and holds an agenda of more than 40 sessions with more than 200 speakers participating, including our own Manager Director Michael Dombai.

While there, we spoke with fellow servicing firms, software providers, and real estate managers of all sizes and niches while also listening in to the expert opinions on the top trends affecting the segment.

What’s clear is that real estate finds itself at an important junction with the new year ahead – whether it’s a new U.S. administration, the still-evolving commercial real estate recovery, or the closely watched interest rate cycle. As a result, there was plenty to discuss with our industry peers over the course of the conference – here are some of the most buzzed-about trends.

1. Fundraising is down

As cited in a speaking session from our valued partner Matt Posthuma at Ropes & Gray, PERE has published that fundraising is down 50% from its peak in 2021, and down around 30% from 2023. Of this shrunken fundraising pool, the largest real estate managers are claiming the lion’s share – a trend we are seeing not only in real estate but across the broader alternative asset landscape.

While fundraising may be tempered, returns and investment values show promising signs of health, as the U.S. real estate sector is forecasted to submit better returns than the public equities market.

2. Interest rates continue to bring uncertainty

When it comes to interest rates, few feel confident enough to make a defining statement on what is to come, particularly with the volatile last five years in mind. However, with a recovered market, vocalized rate cuts by the Federal Reserve, and a likely extension to the U.S. Tax Cuts and Job Act, the broadly held hope is that we will settle into stable period of interest rates.

3. Outsized insurance risk is our new normal

Skyrocketing insurance rates were also heavily discussed – a timely topic given the event’s proximity to the L.A. fires that tragically continue to burn through the metropolitan area. Speakers suggest that while these natural disaster events are often referred to as “once-in-a-lifetime events”, they will transition to our new normal. Insurance rates in high-risk areas are unlikely to return to the past levels we’re accustomed to, and that added cost must be factored into future real estate deals and underwriting processes.

4. All eyes are on the new U.S. administration

As a new U.S. administration entered the White House earlier this week, the industry is on the lookout for changes in regulation, tariffs, geopolitical conflicts and more. The consensus is that impending deregulation could have a favorable effect, but other question marks remain. For example, how could impending tariffs affect the costs of building materials, and how might the possibility of mass deportations affect access to building labor and construction timelines?

Even with the uncertainty of a new administration’s impact on the real estate space, foreign managers and investors have a favorable eye to U.S. real estate exposure due to its strong market recovery in a post-COVID world.

5. Several sectors are producing exciting activity

Activity in the data center niche creates the most excitement. Though they require ample energy to operate, some think we will see a renewed rise in nuclear power plants to power these data centers. Open air shopping centers have also performed well and new opportunities in this niche are attracting healthy deal attention.

Luxury housing conversely has a poor outlook as a sector, even amid high building activity since materials and labor costs to build remain high. At the other end of the spectrum, demand for workforce housing may be at an all-time high, but the real estate investment space isn’t feeling optimistic about the possibility of returns for such projects, which tend to require a private/public partnership.

In all, we had a productive few days rubbing shoulders with some of the brightest minds in the real estate investment space. This new year is certain to hold wins, challenges, and changes, and we’re excited and committed to helping our clients navigate what’s set to be a fascinating 2025.

Ready to talk about your real estate servicing needs for 2025? Reach out to our team here.

Key contacts

Stephanie Golden

United States

Managing Director, Sales, North America

Analysis

Global infrastructure outlook & market insights for 2025

The global infrastructure space is well-positioned for a solid year of financing, development, and fundraising activity in 2025 as interest rates subside and macro-economic conditions improve.

Global infrastructure outlook trends in 2025

- The data center and decarbonization mega-trends will animate infrastructure fundraising and deal activity in 2025

- Significant opportunities will emerge in building out utilities and power provision to support the data center boom

- Signs of a soft landing after the rising interest rate cycle bodes well for toll road, airport and port assets

- After a tough year for managers, fundraising sentiment should improve as sliding base rates drive up investor appetite for yield

The infrastructure space is well-positioned for a solid year of deal and fundraising activity in 2025 as interest rates subside and macro-economic conditions improve.

As has been the case for other private markets asset classes, 2024 has been a challenging year for infrastructure with a notable gap in financing and development needs. Annual fundraising is at risk of falling below 2023 levels, according to Infrastructure Investor, while CBRE has recorded declines in year-on-year infrastructure M&A during 2024.

The next 12 months are likely to remain challenging and unpredictable for infrastructure managers and investors – after all, infrastructure fund dry powder has recently hit a record 24% of total global AUM, according to Preqin, indicating managers’ caution to deploy. But falling interest rates will help to put the asset class in a more stable position.

For deep dives into key trends driving the 2025 global infrastructure outlook, read on.

Infrastructure investment trend #1: Fundraising on a firmer footing

Fundraising activity will derive potentially the greatest benefit from lower rates, as investors emerge from the defensive crouch of the last 24-36 months and resume the search of yield as interest rates come down.

Infrastructure will be ideally placed to serve investors as they gradually look for opportunities to take on more risk, as it offers returns at a premium to the risk-free rate while retaining defensive, inflation-resistant qualities, according to asset manager ClearBridge Investments. For investors who are still wary of downside exposure as economies emerge from a period of high inflation and rising interest rates, but have to sustain yields, infrastructure will be an ideal fit.

The 2025 infrastructure vintage also holds the potential to deliver attractive returns for investors.

ClearBridge Investments analysis shows that over the long-term infrastructure asset returns correlate strongly with infrastructure asset earnings growth. Since 2022, however, a recalibration of risk and valuations across all asset classes has seen infrastructure asset valuations drop even though earnings growth has proven resilient. This delta between earnings and valuations will fall back into the long-term pattern, presenting early movers with an opportunity to invest at potentially highly attractive entry multiples.

Infrastructure investment trends #2: Going green and going digital

Fundraising and deal activity in infrastructure will be driven by the two mega-trends that dominated the asset class during the last 24 months – decarbonization and data centers.

Both subsectors are underpinned by robust underlying fundamentals and have experienced little if any impact from recent capital markets dislocation.

Decarbonization and targets to reduce emissions to net zero by 2050 have become compliance and regulatory essentials for all sectors, with regulators mandating higher energy efficiency standards and disclosure on emissions.

The cost of constructing new, green, low emission infrastructure, as well as repurposing existing legacy infrastructure assets will involve substantial resources and investment. According to S&P Global estimates $5 trillion of annual investment in energy transition will be required every year between 2023 and 2050 to meet Paris Agreement emissions reductions goals – triple current levels, highlighting the need for sustainable and economic growth in this sector.

Governments will be unable to shoulder this obligation alone, opening up an investment opportunity of vast scale for infrastructure players.

The fundraising market is already pivoting in this direction, with renewable energy fundraising the largest category for infrastructure project-specific fundraising in 2024, according to Infrastructure Investor. And the deals are following suit – per Preqin’s Infrastructure Global Outlook, renewable energy accounted for 69% of primary deals in 2024 – its highest share since at least 2006.

Decarbonization will not be a one-way street, especially as the costs of energy transition are felt by taxpayers and consumers, pushing decarbonization into the political sphere. Nevertheless, the fact that decarbonization can also address other long-term energy pain points, such as cost of energy and energy security, gives the net zero project the necessary momentum to withstand any political or consumer resistance. The risks posed by climate change are simply too severe for governments to ignore.

In the data center space, meanwhile, similarly robust fundamentals will power sustained investment opportunities.

Demand for data is surging, particularly given the huge amounts of computing power that will be required to support the rapid growth of the AI sector, which private markets platform Partners Group forecasts will grow at a remarkable compound annual growth rate (CAGR) of 42 percent to become a $1.3 trillion market by 2032.

Investors and dealmakers have been racing to provide capital and gain exposure to this dynamic sector, via both equity and debt investment strategies, including public-private partnerships. The scramble for data centers and infrastructure project funding shows little sign of slowing in 2025.

Infrastructure investment trend #3: Classic categories. New opportunities

But while data centers and decarbonization will grab the headlines (and with good reason) 2025 also promises to be a good year for more established infrastructure categories in various countries. Emerging markets provide regions with distinctive infrastructure development challenges, requiring unique financing solutions.

Indeed, as data centers grow so will the core utilities required to service them, most notably power generation. According to McKinsey, the power generation capacity required to support electricity-hungry data centers will have to more than double by 2030. Grid connection capacity will have to be ramped up in similar increments.

Outside of utilities, other sub-segments such as airports, toll roads and ports are also set for a positive 2025, as the inflationary pressures that have weighed on consumer spending start to ease, and travel activity and demand for goods increases.

According to the International Air Transport Association (IATA) global air passenger numbers are forecast to exceed 5 billion in 2025 for the first time, while global container volumes passing through ports are expected to climb by as much as 7 percent in 2025, according to shipping and logistics group Maersk. Toll road traffic is also expected to increase, particularly in centers with growing populations, with usage on most routes now back at or above pre-pandemic levels.

New verticals may be expanding the options and growth opportunities for infrastructure stakeholders, but “old-fashioned” infrastructure assets look set to remain as attractive and valuable for investors as ever. This global performance will depend on effective management, the industry’s responsiveness to technology trends, and the impact of climate resilience initiatives.

The full scope of private capital outlooks

To read about the trends driving all private capital asset classes through 2025, check out the other articles in our Outlooks series.

Private equity outlook 2025

Private debt outlook 2025

Real estate outlook 2025

Key contacts

Anita Lyse

Luxembourg

Global Sector Head, Real Assets

Michael Gregori

United States

Real Estate Operational Leader, North America

Analysis

Real estate: outlook for 2025

Real estate is in a much stronger position than it was 12 months ago, but while the asset class is set to rally in 2025, the road to recovery will be uneven and complex.

Key trends in 2025’s real estate outlook

As we move into 2025, the real estate market is showing cautious signs of recovery, shaped by stabilizing prices, shifting demand, and evolving property use. Lower interest rates are expected to boost buyer confidence and ease refinancing pressures, while high-demand segments like data centers and housing continue to draw investor attention. Despite lingering risks, the year ahead offers new opportunities in both traditional and emerging parts of the housing market.

- Lower interest rates will ease the pressure on real estate investors in 2025, but the rebound in real estate deal activity will be uneven

- The sector continues to grapple with secular shifts in the market following pandemic. Opportunities will arise but risk lingers

- Data centers, logistics and the living sector present the most compelling near-term investments, but there is value to be found in other verticals

- Real estate players still have to manage a large wall of debt maturities. This will be a challenge, even as interest rates recede

Real estate is in a much stronger position than it was 12 months ago, but while the asset class is set to rally in 2025, the road to recovery will be uneven and complex.

The good news for the sector is that as near-term interest rates have cooled and stabilized, so have real estate valuations, with asset manager abrdn noting that the pricing corrections that weighed on the sector through the rising interest rate cycle appear to have run their course.

As valuations stabilize, returns are set to improve, with abrdn forecasting annualized global all-property total returns of close to 7 percent for the next three and five-year periods.

For deep dives into key trends driving the 2025 real estate outlook, read on.

Navigating real estate’s recovery in 2025

Navigating the real estate recovery, however, will not be straightforward, even as the macro-economic fundamentals improve.

The sector is still in the midst of a period of reconfiguration following pandemic lockdowns, which has driven large, secular shifts in usage patterns.

Remote working and AI, for example, have had a profound impact on office real estate assets, which continue to encounter headwinds even as large corporates lean on employees to return to the office. Retail is another real estate sub-sector that has been challenged following the pandemic, and then the squeeze on consumer spending as inflations and interest rates climbed. In the two-years following the first pandemic lockdowns, retail vacancy rates climbed to new record levels in some jurisdictions as rents saw drops of more than 10 percent.

Other real estate verticals, however, have thrived. Private markets investment platform Partners Group notes that living and logistics assets have benefitted from long-term secular growth drivers and constrained supply, while the data center space has gone from strength to strength.

In the US alone, the colocation data center market has doubled in size during the last four years, defying the rising rate cycle to continue meeting surging demand for data and digital infrastructure to power AI and digitalization.

The rub for real estate investors as they move into 2025 is that real estate remains bifurcated and complicated market. There will be a recovery in pricing and deal activity, but there are still banana skins that investors will have to avoid.

Why balance sheet management remains a priority for real estate investors

In addition to trying to read the real estate rune sticks, investor bandwidth will also continue to be absorbed by existing portfolios, for which large amounts of refinancing are imminent in the next four years.

According to Trepp data analyzed by asset manager Franklin Templeton around US$1.2 trillion of commercial real estate debt will mature in 2024 and 2025, with a further US$1.7 trillion falling due between 2026 and 2028.

Falling interest rates and lower debt costs will ease refinancing pressure to a degree, as will stabilizing pricing, which will support more favorable loan-to-value ratios.

However, even though interest rates have eased in 2024 and are expected to continue moving in favor of borrowers in 2025, base rates remain materially higher than they have been for years and will test capital structures put in place prior to the rising interest rate cycle.

Even as the wider real estate market shows green shots, there will simultaneously be pockets of distress in the housing market in 2025 as borrowers battle to service debt costs while base rates remain elevated relative to the prior cycle.

2025 Real estate outlook: balancing risk with strategic opportunity

Against a background of looming maturities and market bifurcations, investors are likely to continue leaning into the most robust and fastest growing real estate segments, with the red-hot data center space leading the charge.

There will, however, be a window of opportunity for savvy investors with solid operational track records as well as sector and regional know-how to lean into less popular real estate segments and invest in high quality assets attractive valuations.

Retail real estate, for example, which has been struggling and out-of-fashion for years, appears to be turning a corner as global retail sales recover.

JLL notes that in key jurisdictions such as the US, vacancy rates in high-quality retail locations are approaching record lows, with tenants jumping at opportunities to lease new space as it becomes available. Not all locations will see an uplift, but prime space is well placed to generate attractive returns.

The office segment, which looks challenging overall, also presents opportunity for investors and developers that can identify sites in the right location and price risk effectively. According to JLL, office vacancy rates are forecast to peak in 2025 with availability for high demand locations falling. The narrative around offices may still be broadly negative, but early movers who pick the right assets will see the potential in 2025 vintage deals.

Real estate risk will continue to linger in 2025 – but so will new opportunity.

The bottom line for real estate investors in 2025

The real estate market in 2025 presents a mixed but maturing picture: headwinds remain, but the worst of the repricing cycle may be over. Investors who can navigate ongoing bifurcation, sector-specific shifts, and refinancing hurdles will find compelling openings—particularly in underappreciated segments like prime retail and select office assets. As rates stabilize and macro pressures ease, disciplined managers with a clear operational edge will be best positioned to capitalize on real estate’s next cycle of growth.

The full scope of private capital outlooks

To read about the trends driving all private capital asset classes through 2025, check out the other articles in our Outlooks series.

Private equity outlook 2025

Private debt outlook 2025

Infrastructure outlook 2025

Key contacts

Anita Lyse

Luxembourg

Global Sector Head, Real Assets

Michael Gregori

United States

Real Estate Operational Leader, North America

News

Alter Domus launches office in Manila

Alter Domus cements connections across the Philippines and Asia with a new office in Manila.

Luxembourg and Manila, Philippines, December 12, 2024 – Alter Domus, a leading provider of tech-enabled fund administration, private debt, and corporate services for the alternative investment industry, today announced the opening of its new office located in Bonifacio Global City (BGC), Taguig, the Philippines. This strategic new location in Manila’s growing business hub underscores Alter Domus’s dedication to better serving its clients, improving access to its world-class fund administration services and facilitating collaboration with private markets firms.

The Manila office occupies a full floor of the state-of-the-art workplace located in the Ecoprime building in BGC. Over 100 employees are currently based in Manila, and Alter Domus aims to nearly double its workforce in the city by 2025. The firm is actively recruiting finance and accounting professionals to support this expansion. The office marks Alter Domus’ 39th global location and follows the launch of Alter Domus India earlier in 2024, expanding the organization’s footprint in the Asia Pacific region to 12 offices across seven jurisdictions.

I am thrilled to announce the opening of our vibrant Manila office and celebrate this milestone with our Alter Domus Philippines team. Establishing our presence in BGC enables us to better connect with our clients, strengthen our private markets services and technology and further expand our global reach.

Sandra Legrand, Regional Executive for Europe & Asia Pacific, Alter Domus

About Alter Domus

Alter Domus is a leading provider of tech-enabled fund administration, private debt, and corporate services for the alternative investment industry with more than 5,500 employees across 39 offices globally. Solely dedicated to alternatives, Alter Domus offers fund administration, corporate services, depositary services, capital administration, transfer pricing, domiciliation, management company services, loan administration, agency services, trade settlement and CLO manager services.

Media contact: [email protected]