The leveraged corporate loan market has grown considerably over the past decade. Though a large portion of loan issuance over the years has been to those that are broadly syndicated (“BSL”) – a market that exceeds $1.5tn – growth in the non-syndicated loans issuance market (i.e. private debt) has been equally noteworthy. Estimates indicate total private debt issuance has exceeded $1tn. Both of these markets have been significant contributors to funding the growth of private companies. Both financing methods play crucial roles in supporting business operations among varying company sizes, from large-scale corporations to those in the private sector.

Rudolph Bunja, Head of Portfolio Credit Risk at Alter Domus, draws attention to these two important areas of the market and touches upon some of the key differences between the two funding sources. In this commentary, he provides a high-level comparison of the two based on a variety of characteristics, and shares examples of certain factors for investors to consider during the valuation of alternative investments.

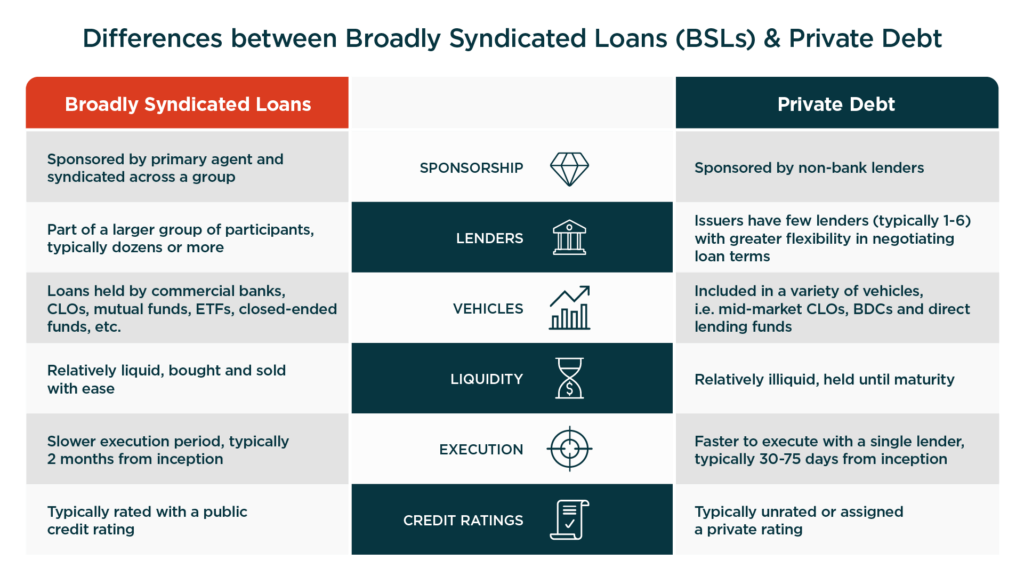

A comparison of private debt and broadly syndicated loan characteristics

BSLs, or broadly syndicated loans, are sponsored by a primary agent and syndicated across a group of commercial banks and specialist loan investors, primarily Collateralized Loan Obligations (“CLOs”). This is different than private debt, which is typically sponsored by non-bank lenders. They are commonly included in a variety of vehicles such as middle-market CLOs, BDCs (more common in the US than in Europe), and funds managed by direct lenders. In contrast, most of the BSL market is held by commercial banks, CLOs, and other types of funds (e.g., mutual, ETFs, closed-end funds). These are important distinctions that affect the two instruments to the point that they can be seen as almost two different, albeit similar, asset classes.

Private debt loans are expected to be held until maturity as they are relatively illiquid while broadly syndicated loans can be bought and sold with greater ease. The trading of syndicated loans enhances liquidity and allows investors easy access to exit their positions when needed. Given the complexity and bespoke nature of these arrangements, loan agency support plays a key role in facilitating administration and communication between borrowers and lenders. Private debt issuers have few lenders, are typically unrated, and often have higher leverage characteristics compared to BSLs. However, private debt is generally expected to have higher comparable yields to a BSL holding all else equal.

It is also noteworthy that private debt lenders tend to have greater flexibility when negotiating loan terms such as covenants and which can lead to a faster time of execution. At the same time, BSLs are part of a larger group of participants, which can extend the process of execution. Private debt lenders, especially in sponsor-backed transactions, will often be able to perform even more thorough due diligence of their borrowers and could be more active in arranging for operational support, business advice, and future funding. This is not surprising given the smaller lender base and the longer-term holding period for private debt lenders compared to BSL lenders.

Considerations

As expected, a major factor influencing an investor’s decision to invest in a loan fund (e.g., CLO, direct lending fund) is an evaluation of the credit expertise of the collateral manager or direct lender, including their overarching strategy. This includes a review of their credit selection process when constructing the portfolio. Equally important is the manager’s diligence in credit surveillance considering there could be substantial downside risk, with limited upside, assuming they are not investing in assets at a significant discount (e.g., distressed debt funds). For the private debt market, given the stability of the lender group, investors should also consider the lender group, especially the lead lender, to assess the motivation and ability of the group to offer support for the borrower – whether it is operational or financial support. This feature may not be as important in BSLs since the lender base will often change given the ability of BSL investors to trade in and out of their holdings.

A single lender (or small group) managing a group of credits across a portfolio of private debt may be more adaptable to varying economic conditions based on their strategy, as they were closely involved during the underwriting process. This adaptability is particularly vital when signs of credit impairment appear or in the event of a workout process upon default, allowing more responsive decision-making.

Private debt is relatively illiquid and expected to be held until maturity. Therefore, investors need to carefully consider the lender’s in-house expertise to be proactive with the borrower in distressed credit situations. That expertise may also include the ability to provide business and operational support to the borrower. Lenders, especially sponsors, will often have in-house expertise to support their portfolio companies around business, technology and other critical functions. Lenders may also have access to a wide network of third-party experts that they can offer to the benefit of their borrowers.

In contrast with a BSL, the lenders would generally be minimally involved in providing business advice/support to borrowers. Trading strategies in the BSL market may also involve leveraging market conditions to optimize returns for institutional investors. Typically, in a distressed situation, a BSL manager can lose leverage when negotiating terms upon a restructuring as there can be competing interests among the underlying lenders/investors within the BSL. For example, CLO mangers may be subject to certain constraints when voluntarily agreeing to a maturity amendment of a distressed loan. However, BSL managers do have greater flexibility to dispose of a loan when signs of credit impairment exist as reliable loan prices are more readily observable and managers may be more likely to dispose of the loan at some point following a potential credit event or default as opposed to going through a period of credit risk volatility or even a workout process.

The ability of lenders to monitor their credit portfolio rests strongly on their ability to access, analyze, and secure financial and other types of relevant data about their borrowers. BSL data is often readily available in many cases and potentially with some standardization, though it’s still challenging to manage all the data. Private debt lenders also have access to significant amounts of data – often more data, though typically with almost no standardization.

With demands for even more data, such as ESG data, the pressure on lenders to ensure a proper data and analytics infrastructure becomes even more important. The ability to access and analyze that data is no easy feat for both BSL and private debt lenders and building these capabilities can provide them with a competitive advantage. In either case, it is an essential part of the surveillance process and lenders should carefully assess their ability to manage the data challenges surrounding private debt.

Conclusion

Leveraged corporate loans, which largely consist of those that are broadly syndicated or private, continue to be an important source of funding in the private corporate markets. These two segments, which have experienced significant growth and offer investors strong financial risk return performance, are supported by robust corporate services that help manage and optimize loan structures.

They can also present distinct challenges, for example, when there is potential credit impairment of the borrower that requires proactive diligence and the ability to closely track and monitor performance. In this regard, managers continue to reinforce and expand their capabilities while private debt investors need to carefully consider the credit expertise of the manager within their respective market as a key factor during their investment evaluation.