Since coming into force at the start of 2024, the revamped version of the European long-term investment fund (ELTIF) structure – ELTIF 2.0 – has been building momentum.

In Luxembourg we are seeing early indications that between 30 and 40 ELTIFs are due to be launched and approved in the coming months, while in Ireland the first ELTIFs have been authorized by the Central Bank of Ireland, following the local adoption of the regime in March.

As outlined in the second and third articles in our four-part series on raising capital in Europe, the revisions to the ELTIF 2.0 regime have opened exciting opportunities for asset managers; unlocking new sources of investor capital and broadening investor bases.

Launching ELTIF 2.0 structures does not come without challenges, but the flexibility and wider pool of assets now eligible for ELTIF 2.0 present advantages that far outweigh them.

Here at Alter Domus we have tracked the evolution of the ELTIF 2.0 structure closely and implemented new infrastructure to support asset managers with solutions for potential challenges that ELTIF 2.0 funds may present.

In this article we explain the key considerations around product design, liquidity management, distribution, reporting and service provider capability for asset managers to consider when launching an ELTIF 2.0, and outline how Alter Domus can help managers to navigate these areas; harnessing the upsides and opportunities that ELTIF 2.0 provides.

What are the main considerations for asset managers?

In the third article in the series, we outlined the investment restrictions of ELTIF 2.0 regulation.

Once asset managers have developed an investment strategy within these parameters there are two further key areas for managers to address.

Product design and liquidity management

ELTIF 2.0 gives managers the option to raise closed-ended or open-ended funds.

The option to raise an open-ended ELTIF has been particularly well-received by market stakeholders, and while it has taken time for the European Commission and European Securities and Markets Authority (ESMA) to align on the regulatory technical standards (RTS) governing open-ended ELTIFs, a consensus has been reached and managers have clarity on the regulatory position. When officially adopted later this year, we expect this will drive a significant increase in fund launches with open-ended features.

For private markets managers who have historically structured their investment vehicles as closed-ended funds, there will be a learning curve when it comes to managing open-ended funds and investors who expect and require liquidity.

Managing liquidity whilst maintaining preferred portfolio composition will be a key area private markets managers will need to focus on when managing open-ended ELTIFs, we take a closer look at the considerations, below:

Redemption Frequency, Notice Period & % of Liquid Assets

The RTS sets out the the percentage of liquid assets available for redemption on a given redemption date can be calculated under one of two methods.

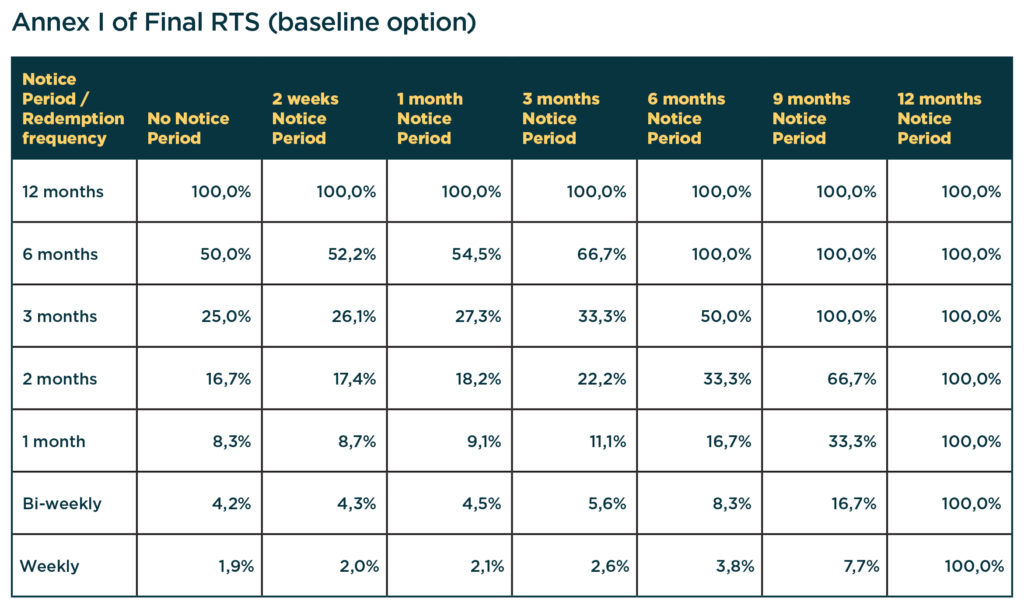

Method 1 – the basis of the redemption frequency and maximum length of the notice period. This implies no mandatory minimum % of liquid assets. (See Annex I below).

Annex I example – an ELTIF that has a quarterly redemption window and -three- month notice period, can on any one redemption day allow redemptions up to 33.3% of the liquid assets in the portfolio. There is no implied gate as it is dependent on the percentage of liquid assets in the portfolio at redemption date.

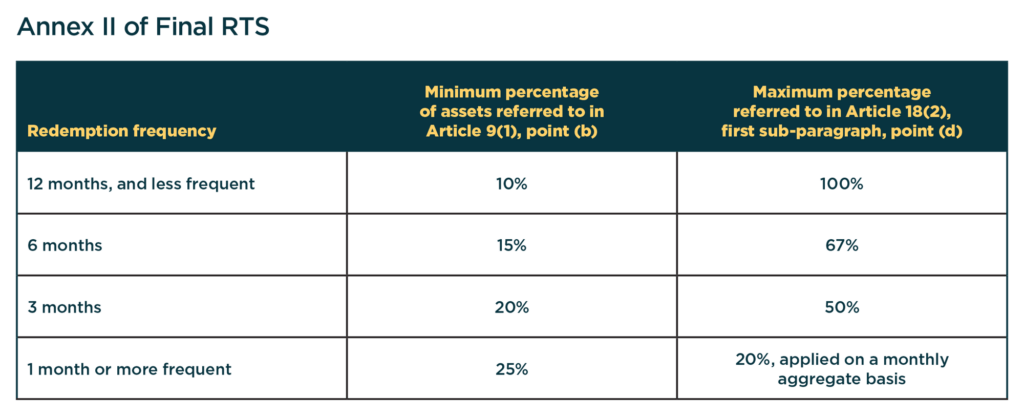

Method 2 – on the basis of the redemption frequency and the minimum percentage of liquid assets held by the ELTIF. (See Annex II below).

Annex II example – an ELTIF that has a quarterly redemption window, must hold a minimum of 20% of NAV in liquid assets. On any one redemption day, maximum redemptions are capped at 50% of liquid assets, which implies a gate of 10%.

It should be also noted that the ELTIF Manager can include the expected cash flow, forecasted on a prudent basis over 12 months within the % of liquid assets.

Redemption frequency and minimum notice periods are an area that asset managers will have to keep a close eye on, as the requirement may still be to align closely with other investment products.

In Luxembourg, for example, it is common for Lux Part II UCI semi-liquid funds to offer notice periods of between 30 to 60 days, while in the UK, the Long Term Asset Fund (LTAF) structure has a minimum notice period of 90 days. In both these examples, there is no requirement to hold a minimum percentage of liquid assets.

Other factors that ELTIF managers of open-ended ELTIFs will need to consider in product design are minimum holding periods and liquidity management tools.

Minimum holding period: asset managers do have the flexibility to determine a minimum holding period, subject to certain criteria set out in the draft RTS, but will need to demonstrate to a local regulator the appropriateness of the minimum holding period.

Liquidity management tools: an ELTIF asset manager may choose to apply liquidity management tools (such as anti-dilution levies, swing pricing or redemption fees).

For asset managers addressing these areas and developing a suitable liquidity management policy, a redemption policy and updating valuation policy will be key to demonstrating their ability to manage the open-ended features in an ELTIF 2.0 product.

Considerations for service providers

For service providers that specialize in alternative assets, the evolution of the hybrid fund model like ELTIF 2.0 will demand a shift in mentality and operations.

For administrators, this will require specific tools that are able to manage funds with open-ended features.

Such tools have not been available in the alternatives world, where functions like transfer agency have been embedded within the accounting infrastructure, as these functions had been primarily associated with the UCITS and retail investor market.

Additionally, there is a need for single systems that can handle portfolio accounting for both illiquid and liquid assets.

For us at Alter Domus, we needed to identify and implement a real hybrid solution and to do this recently announced a partnership with Temenos Multifonds, which gives Alter Domus the capability to combine a dedicated solution for funds with open-ended features with our asset expertise alongside tools to support our clients as they move into the new and evolving area of hybrid funds.

For depositories, the retail regime is geared towards optimal protection for the investors, insofar that only banks can operate as depositary for the retail ELTIF 2.0. This will open opportunities for specialized banks, who will need to blend liquid and illiquid setups together to manage these hybrid funds.

Demonstrating the ability to combine the intricacies of private assets with the liquidity features of open-ended funds, as well as private client subscription volume, will be a key predictor of successful product adoption.

A new beginning

Nine years after the launch of ELTIF 1.0, the democratization of private assets, through the combination of market demand and a product toolkit looks set to take hold in 2024.

We firmly believe that the evolution of the market, and the clarifications to the ELTIF 2.0 framework provided by European Commission, delivers a huge opportunity for managers to launch a new range of funds. Alter Domus has invested heavily in new tools, procedures and teams to manage these new hybrid funds and support managers on their journey.

As we have indicated though, there are challenges which will need to be addressed to ensure the success of these funds.

A change in mindset, both from managers and service providers, to embrace these new opportunities will pave way for new, fast-growing distribution channels that can reaching both private and professional investors.