Exploring options and best practices

The London Interbank Offered Rate (LIBOR), a controversial cornerstone of the financial system, will be discontinued on June 30,2023. In a previous article published in December 2022, we discussed the need to migrate away from LIBOR and the migration status for the U.S private debt market[1].

As LIBOR will be discontinued in less than 30 days, we will provide updates on the current migration status and answer key questions: what happens if no explicit migration plan exists before LIBOR is discontinued and what are the current industry trends regarding credit adjustment spreads[2]?

Current Status of migration for U.S. Private Debt Market

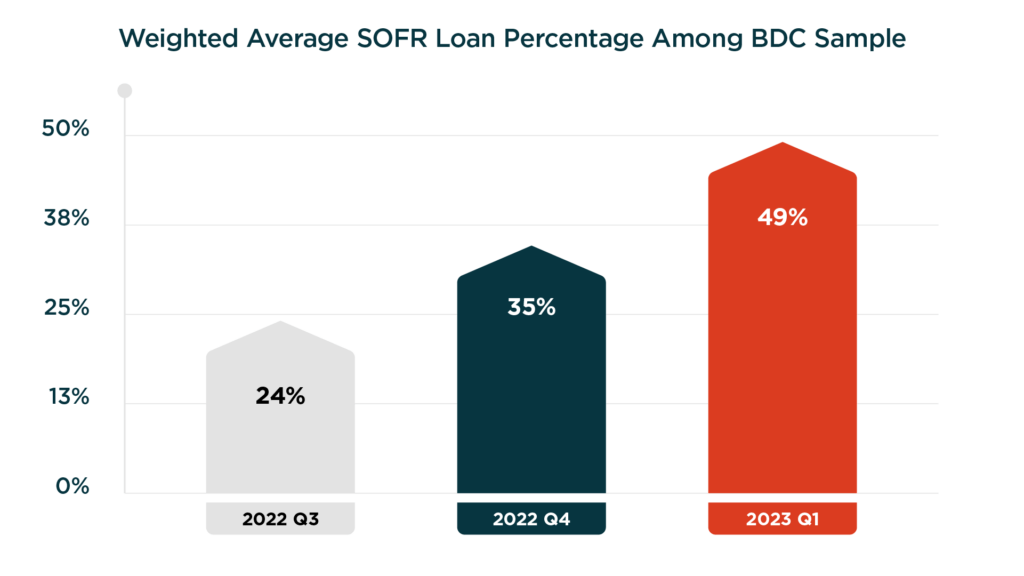

According to the LSTA, in reference to the JPM index as of April 2023, roughly 40% of private loans are currently on SOFR[3]. With respect to the direct lending space, we turn to publicly available BDC (Business Development Companies) data as a proxy. From a sample of 12 BDC’s registered with the SEC, we observe from the 2023Q1 SEC filings that on average 49% of loans are pegged to SOFR.

For the same sample, 2022Q3 and 2022Q4 SEC filings report SOFR loan percentages of 23% and 35%, respectively, showing an increased effort to transition away from LIBOR as the cessation date approaches. While industry trends suggest a concerted effort to convert loans to SOFR, we would likely to expect these figures to be close to 100% as we have to count days and not months until LIBOR is discontinued.

However, data from Covenant Review reveals that over 90% of syndicated loans have language in their contracts or amendments that determine the alternative rates at the time of LIBOR cessation[4]. Moreover, as discussed in the previous paper, industry trends point in the larger private debt space point to a larger effort to add amendments to contracts to trigger immediatley after LIBOR cessation date rather than transition earlier. Therefore, although the numbers are not nearly close to 100% as we would expect, there are already contractual agreements in place for a vast majority of loans to migrate away from LIBOR once it is discontinued.

But what about the contracts that are not in the “vast majority” that do not have an alternative rate in place come June 30,2023? What will those loans be tied to if not LIBOR? The Federal Reserve Board, in December 2022, provided its final set of guidelines for such contracts[5].

Fallback options for contacts without alternative rate transition plans prior to June 30, 2023

Final rule regarding the implementation of LIBOR ACT

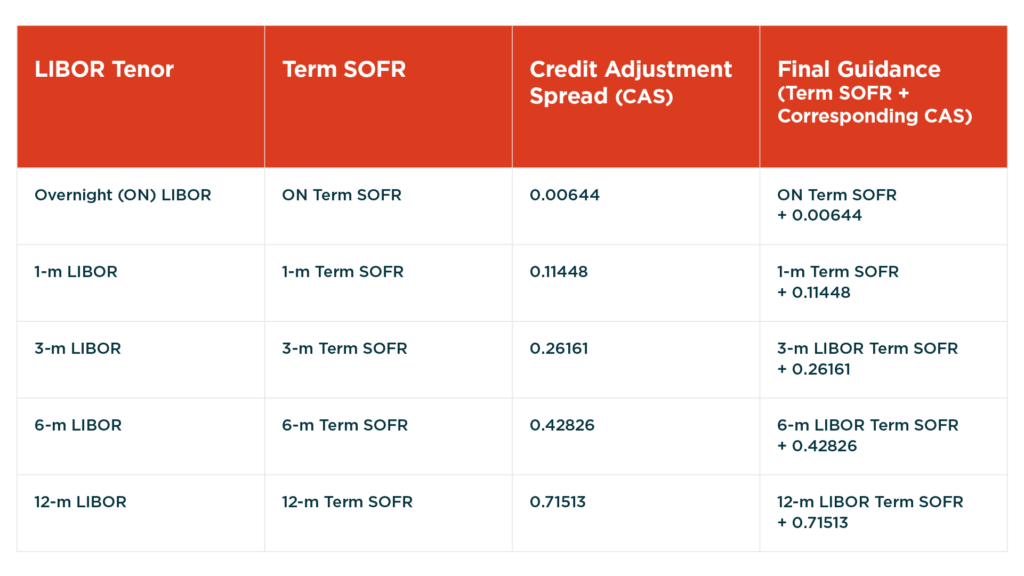

Widely expected, the Federal Reserve Board in December 2022 published its final guidance to implement the LIBOR act[6]. This guidance is to explicitly provide a benchmark replacement for contracts governed by U.S law that refer to either the overnight, 1-month,3-month, 6-month and 12-month LIBOR tenors and do not have a clearly defined benchmark to transition to after June 30,2023.

In general, the guidance determines if there is a “determining person” in the contract. If so, that person should determine the replacement contract by the LIBOR cessation date. If the person does not, or if there is no “determining person” in the contract, the contract must transition to the corresponding Term SOFR plus the prescribed credit adjustment spread based on ISDA/AARC fallback protocols[7][8].

As Term SOFR is typically lower than LIBOR (as it does not involve credit risk), the credit adjustment spread is added to the current spread/margin to reflect a number closer to LIBOR. For clarity, if a loan has locked in a 6-month LIBOR rate on June 15, 2023, it will still be valid until the contract ends on December 15, 2023. After the contract ends on December 15, however, the loan must be tied to an alternative rate. The table below summarizes the final guidance for the current published LIBOR tenors:

In short, if there is no transition plan, the guidance will provide one. The guidance provides a particular credit adjustment spread depending on the tenor (1-Month, 2-Month, etc.), but how were those spreads determined and how are market participants adapting to them?

Credit Adjustment Spreads: ISDA/AARC Recommendations and Trends

Because private debt loan amounts generally range between 10s or 100s of millions of dollars, it is no surprise that both borrower and lenders are highly sensitive to change in spreads and thus haggle to achieve a mutual agreed upon credit adjustment spread[9]. For example, in a loan of $100,000,000, an increase in 20 basis points to the spread results in an increase of roughly $50,000 in interest payments every quarter. Given a tense negotiating environment, are borrowers and lenders trying to negotiate their own credit adjustment spreads or adopt the ISDA/AARC recommendations? Recent evidence points to the latter.

According to the LSTA, 65% of tracked amendment fallbacks used the recommended credit adjustment spreads in April 2023, up from roughly 57% in March 2023[10]. Although there is no clear trend when looking at January and February, it is likely that the strong percentage will persist in May as the transition deadline approaches and the room for negotiation narrows.

Because the recommended spreads are 5-year median differences (March 2016-March 2021), the values should in theory be stable and subject to less litigation in the near future[11].

Conclusion

As the LIBOR cessation date nears, loan migration away from LIBOR picked up considerably in 2023. Thanks to the final guidelines published by the Federal Reserve Board in December 2022, there is clear guidance to ensure a (relatively) smooth transition away from LIBOR.

It is up to market participants to act proactively to ensure the proposed credit adjustment spreads are economically viable and confirm the final transition plans for each contract. As LIBOR is currently pegged to trillions of dollars, it is paramount for market participants to adequately forecast the financial impacts resulting from LIBOR migration.

Footnotes:

[1]For purposes of this paper, ‘private debt’ refers to broadly syndicated loans and private direct lending markets. See existing Alter Domus report for further details.

[2]The credit adjustment spread added to the current spread/margin on a loan to compensate the lender for switching to an alternative rate, which is typically lower than LIBOR.

[3]https://www.lsta.org/news-resources/libor-transition-45-days/

[4]https://www.lsta.org/news-resources/usd-synthetic-libor-exactly-as-expected/

[5]https://www.federalreserve.gov…

[6]https://www.congress.gov/bill/…

[7]https://www.govinfo.gov/conten…

[8]The credit adjustment spread added to the current spread/margin on a loan to compensate the lender for switching to an alternative rate, which is typically lower than LIBOR.

[9]https://www.bloomberg.com/prof…

[10]https://www.lsta.org/news-reso…

[11]https://www.newyorkfed.org/med..