After more than 36 years of existence, the London Interbank Offered Rate (LIBOR) was discontinued in July 2023 in favor of alternative references rates, such as SOFR (Secured Overnight Financing Rate). As mentioned in previous Alter Domus reports, we discussed the need to migrate away from LIBOR and provided updates on the transition as the cessation date grew closer.

Now that LIBOR is no longer published, we report on the impact it continues to have, albeit declining, in the U.S private debt market and address any lingering considerations.

Announcement of LIBOR’s future discontinuation in 2017 posed an intimidating feat, like an impending storm, as LIBOR was pegged to almost all contracts accounting for billions of dollars of debt. Six years later, though, market participants made it through the storm quite successfully.

Overall, the LIBOR transition was, as the AARC[1] puts it, “smooth and uneventful.”[2] Much of the success is attributed to the careful planning and coordination between agents, like Alter Domus. borrowers, lenders and financial regulators.

Moreover, as the June 30,2023 deadline approached, there was a predictable uptick in credit agreement amendments and triggering of existing ones. As reported by the LevFin Insights, amendments spiked in June, nearly totaling 300, representing almost 3 times the amount of amendments in May and April[3].

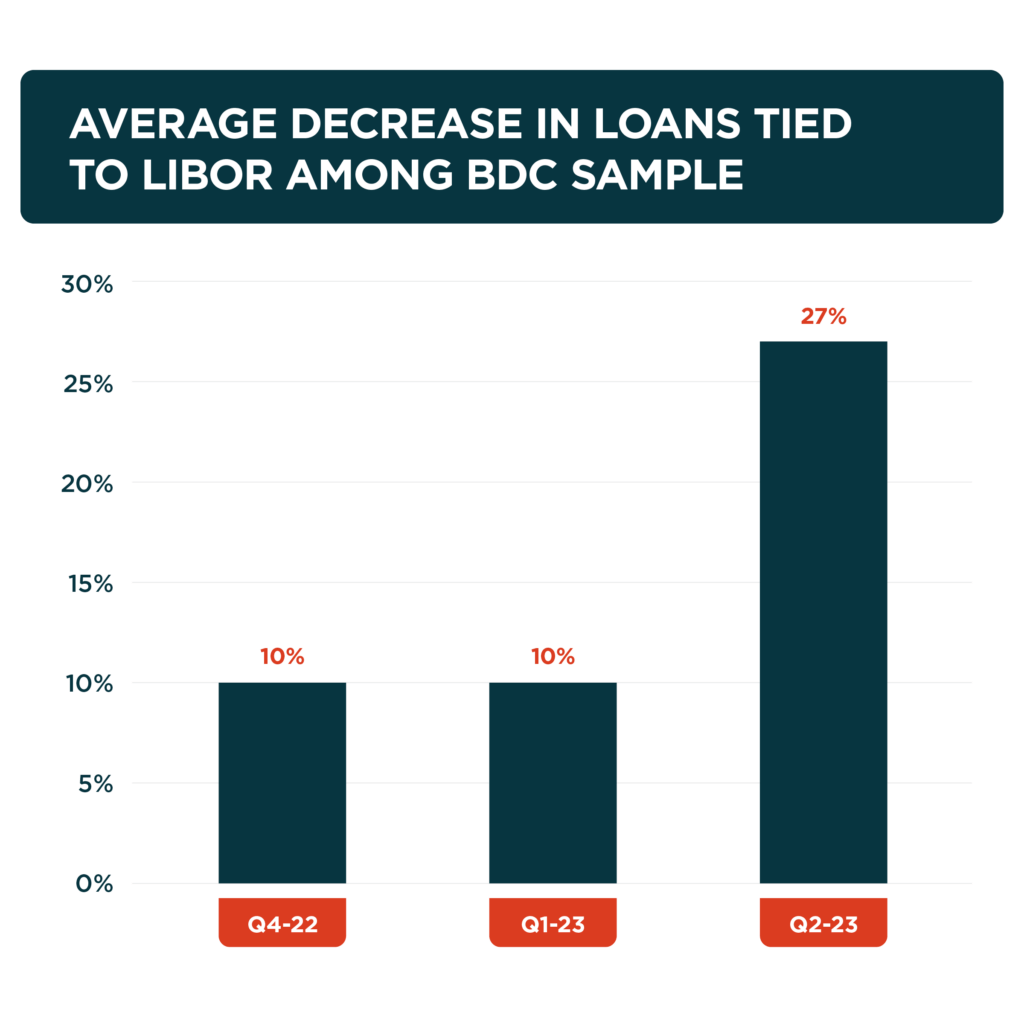

The same can be inferred with respect to the direct lending space, as we turn to publicly available BDC (Business Development Companies) data as a proxy. From a sample of 13 BDC’s registered with the SEC, representing over $33bn in portfolio valuations or about a quarter of the publicly traded BDC market, we observe from the 2023Q2 SEC filings that the average decrease in loans tied to LIBOR jumped to 27% during 2023Q2 from 10% in 2023Q1.

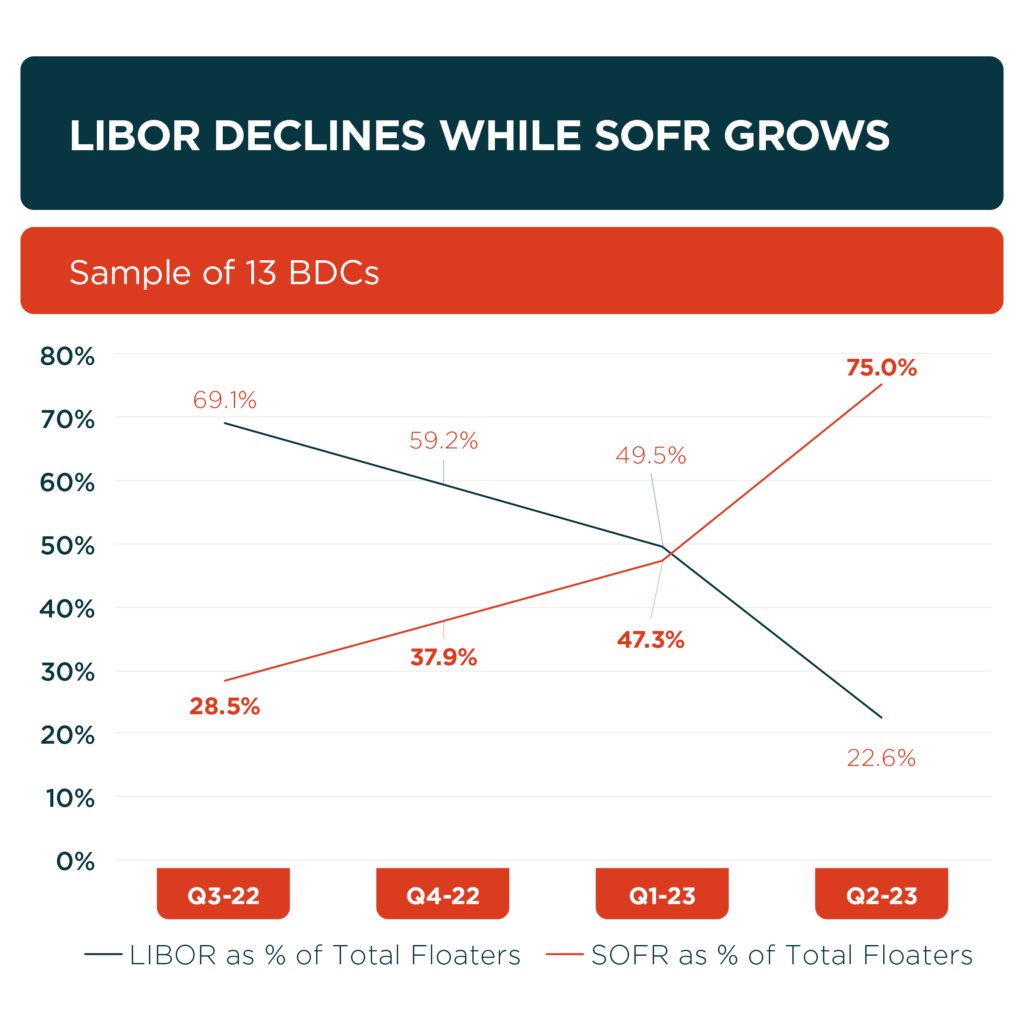

The graph and table that follow clearly illustrate the declining relevance of LIBOR and rising relevance of SOFR in the last four quarters – with SOFR beginning to equal and surpass LIBOR in Q1’23. Over the past 9 months, SOFR-pegged loans have gone from 28.5% of total floating loans to 75% for the loans in the underlying sample portfolios.

LIBOR Declines While SOFR Grows (sample of 13 BDCs)

Count of Floating-Rate Investments – Sample of 13 BDCs over the past 4 quarters

| Base Rate | Q3’22 | Q4’22 | Q1’23 | Q2’23 |

|---|---|---|---|---|

| LIBOR-based floaters | 1,232 | 1,117 | 986 | 454 |

| Non-LIBOR-based floaters | 550 | 769 | 1,005 | 1,555 |

| Total Floaters | 1,782 | 1,886 | 1,991 | 2,009 |

| LIBOR as a % of Total Floaters | 69.1% | 59.2% | 49.5% | 22.6% |

| SOFR-based floaters | 507 | 715 | 942 | 1507 |

| SOFR as a % of Non-LIBOR | 92.2% | 93.0% | 93.7% | 96.9% |

| SOFR as % of Total Floaters | 28.5% | 37.9% | 47.3% | 75.0% |

We’ve currently discussed the recent increased migration efforts that led to a successful migration away from LIBOR, but does that mean all loans refer to an alternative rate? Not quite. Currently, in the same BDC sample as of the end of 2023Q2, 75% of loans reference SOFR.

With regards to the leveraged loans and the CLO market, the results are similar, as 76% of loans reference SOFR (as of August), per LSTA.[4] The reason why these numbers are not 100% is due to contracts that were opened prior to the June 30,2023 deadline that still refer to a LIBOR reference rate.

Since most contracts are 3-months, we should expect to see a considerable amount of loans automatically migrating to SOFR (via the LIBOR act or through the triggering of an amendment). We will continue to track this migration as it nears completion.

Overall, it appears that the transition has gone quite smoothly, thanks to years of thoughtful preparation. Loans that are currently tied to LIBOR will eventually point to an alternative rate once the contracts next renew – post June 30.

The AARC, which was tasked to determine the proper alternative rates to transition to, will slowly[5] wind down its work, emphasizing that the SOFR should be deemed the best option as the alternative rate given its robust tie to the transaction-heavy treasury market.

Going forward, we will keep readers updated on the status of the remaining loans that still reference LIBOR and hope to look past the migration with a greater sense of triumph.

Sample of BDCs in our study:

| Audax Credit BDC Inc. |

|---|

| BlackRock Private Credit Fund |

| BlackRock TCP Capital Corp. |

| Capital Southwest Corp. |

| CION Investment Corp. |

| Fidus Investment Corp. |

| Great Elm Capital Corp. |

| Oaktree Strategic Credit Fund |

| Oaktree Specialty Lending Corp |

| Blue Owl Capital Corp. |

| Oxford Square Capital Corp. |

| PennantPark Floating Rate Capital Ltd. |

| Prospect Capital Corp. |

[1] Alternative Reference Rates Committee

[2] https://www.newyorkfed.org/medialibrary/Microsites/arrc/files/2023/ARRC-Readout-July-31-2023-Meeting

[3] https://www.lsta.org/news-resources/libor-transition-one-two-last-hurrahs/

[4] https://www.lsta.org/news-resources/libor-cessation-t1-month/

[5] https://www.newyorkfed.org/medialibrary/Microsites/arrc/files/2023/ARRC-Readout-July-31-2023-Meeting