The alternatives landscape is changing. While once reserved for institutional investors, pension funds and high-net-worth individuals, it is now opening its doors through the democratisation of alternative funds. A coming together of worlds so to speak, which are combining and innovating to create a hybrid world of liquid and illiquid funds, which are both now open to individual investors.

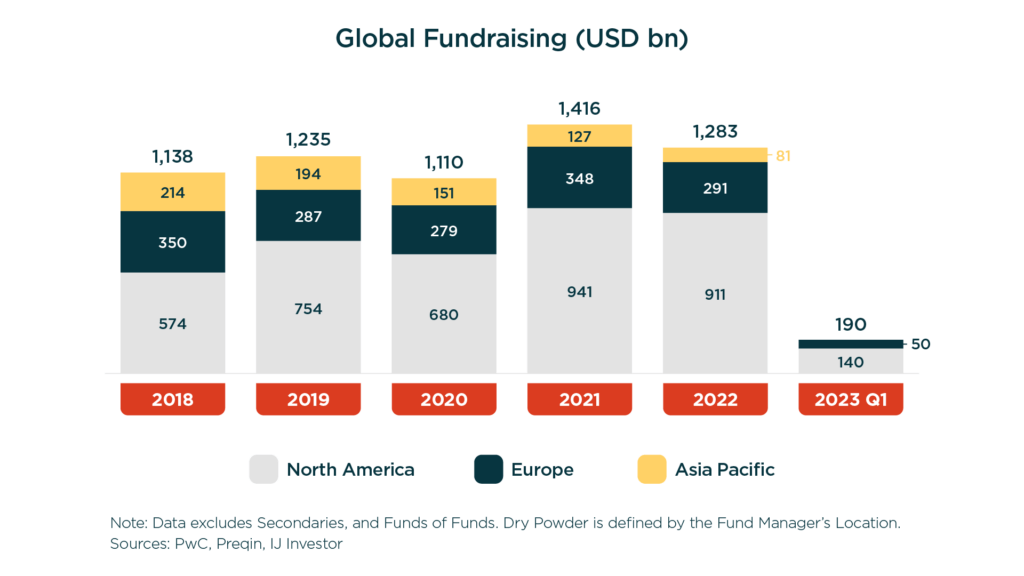

There are a number of trends and drivers in the market that have been behind the emergence of these hybrid funds. Firstly, monetary tightening is resulting in institutional money pulling back from the market. Private asset AUM continues to grow, however traditional LPs are reducing new commitments with global fundraising declining by c. 10% in 2022, followed by further declines so far in 2023 – GPs have been forced to pursue alternative sources of capital to support fundraising.

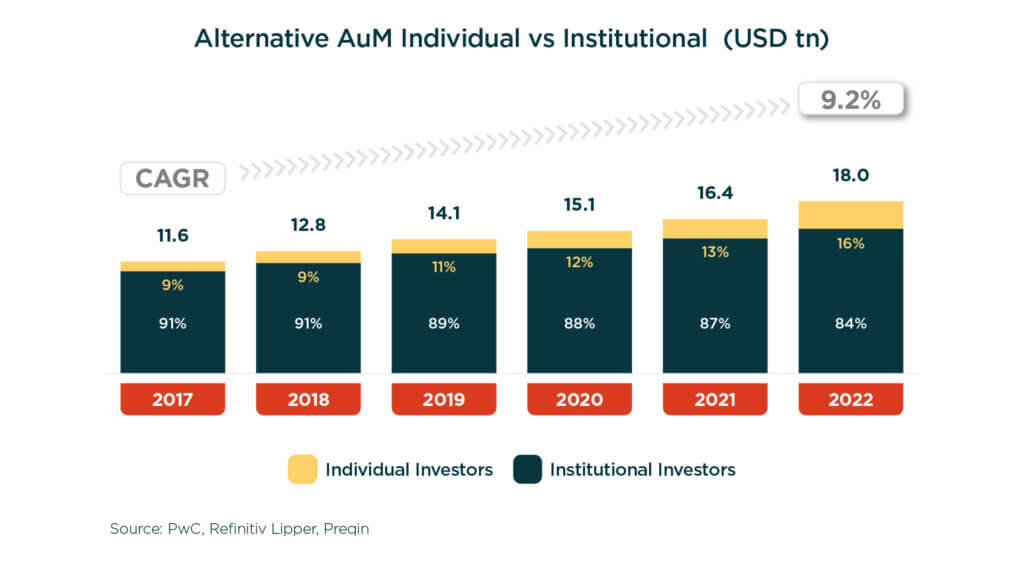

At the same time, a new demographic of investor is seeking to gain access to such markets. While private asset funds have long been used by institutional investors, due to regulatory restrictions, private individuals have been limited in their ability to allocate funds to the asset class. As this portion of the market is becoming more sophisticated and educated, individuals’ appetite for private asset funds is growing as they recognize that gives them more options to build a more diversified portfolio. While allocations by this investor group accounted for 9% of Alternative AUM in 2017, that climbed to 16% in 2022, a 165% increase in AUM.

Hybrid funds have the traditional alternative fund strategies, while also incorporating open-end fund features and accepting individual investors, with the goal of bridging the gap between individual investors and private assets. Within the industry, that’s often described as the ‘democratization’ of alternative funds, with Bain forecasting that individual wealth allocated to alternative investments will increase 12% annually over the next decade while institutional capital will grow by 8% annually over the same period. We have seen how large managers are directing their funds towards retail clients, with Blackstone expanding retail capital from $200 billion to $500 billion, while KKR are looking to raise up to 50 per cent of their new capital from private wealth and Apollo are looking to raise $50 billion in retail capital from 2022-26.

New regulations pulling in the same direction as the market

Regulation is at the forefront of the market’s needs and is allowing the market to deliver these types of products to individual investors at the very time it’s looking to do so.

In the UK, the Financial Conduct Authority has developed the open-ended Long-Term Asset Funds, or LTAFs, while in the US the term ‘accredited investors’ has been defined, enabling sophisticated investors who have a reduced need for protection to invest in alternative products. In Europe, welcomed enhancements to the European Long-Term Investment Fund, or ELTIF, came into effect in January this year, replacing the existing ELTIF regime. We will be exploring ELTIF 2.0 in greater detail in the next two articles in the series.

Now is the time to take advantage

This new regulatory landscape is providing a toolbox for managers, enabling them to develop products and expertise for the retail network. At Alter Domus, we are already working with managers to capitalize on these developments while overcoming the challenges that come with it, which we will be looking at in the fourth and final article.

Read part one of this four-part series here.