Secondaries

Extensive market experience and advanced technology come together to support your secondaries ambitions

Partner with Alter Domus to make every secondary count

Secondaries are increasingly proving to be vital financial vehicles for both asset managers and asset owners, especially during times of economic uncertainty.

So whether you’re an LP seeking to generate liquidity, or a GP looking setting up continuation funds and reduce the administrative burden, Alter Domus are ready to help our clients make every secondary count.

We’ve combined deeply experienced and dedicated secondaries teams with the latest 3rd generation fund administration technology to help our clients capitalize on their opportunity and deal with any complexity or volume.

Our vertically integrated model enables us provide support and bespoke solutions for the entire value chain and across our extensive range of services, from depositary to AIFM and accounting. Contact us here to discuss your secondaries strategies with our team.

Capitalizing on the secondaries opportunity

Secondary transactions rebounded in 2023 to the second highest on record. With 2024 set to continue this trend, it’s vital that GPs and LPs select the right administrator for their funds. Watch the video to see what differentiates Alter Domus as a partner for your secondaries strategies.

5 trends shaping private markets secondaries in 2024

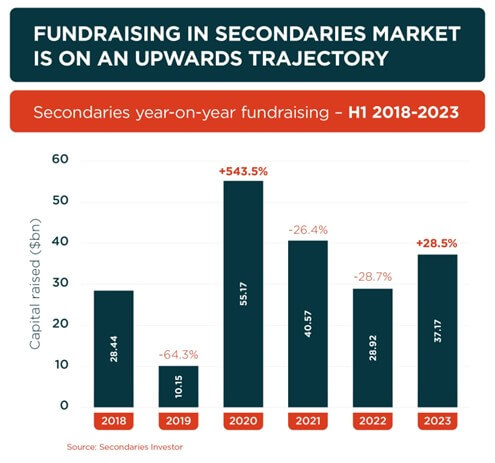

The data shows that amid the macro-economic headwinds that buffeted private markets in 2023, the secondaries space managed to deliver year-on-year growth across most key metrics. And, after a bumper year of fundraising, 2024 looks set for secondaries growth. In our latest article we highlight 5 key themes for the year ahead.

For private equity, necessity is the mother of invention

In this interview from Private Equity International’s Debt Finance issue, Tim Toska, Group Sector Head of Private Equity, outlines how ingenuity is helping LPs overcome liquidity issues in a sluggish market. This includes using GP-led secondaries to release liquidity from long-held assets and turning to NAV financing.

Keeping the lifeblood of capital flowing: the undervalued role of the secondaries market

Amid the rise of alternative assets over the last two decades, the number of investment opportunities available to both limited partners and general partners has grown. One such vehicle – the secondaries market – is attracting increasing amounts of attention and fundraising.

Mid-market GP-led secondaries heat up

Tim Toska, Global Sector Head of Private Equity at Alter Domus, and Brian Mooney, Managing Director and Co-Head of GP-led Secondaries at Portfolio Advisors discuss how GP-led deals are emerging as a strong exit option, the impact of supply/demand dynamics on pricing, the importance of transparency and preparation for sponsors, and the role of technology and data analytics in the process.

Goldman Sachs $15bn to buy stakes in private equity funds

The Financial Times reported that Goldman Sachs will be investing large parts of a new $15bn fund in the PE secondaries market piqued our interest. Secondaries really do appear to be on an upward trajectory right now.

Our Secondaries Solutions

Fueling growth and reducing risk through integrated, tech-driven administration support.

Customized support from sector specialists, and proprietary systems, that allow you to increase your market advantage.

Get in touch with our team

Contact us today to learn more about our secondaries solutions.

"*" indicates required fields