Analysis

Private credit markets offer meaningful benefits that can outweigh related risks

Key features of the private credit markets can mitigate risk while offering investors and borrowers a valuable alternative.

Overview

Amongst the alternative investment universe, private credit[i], specifically loans to corporate borrowers made by non-bank lenders, has garnered significant media attention – seemingly in the headlines on a daily occurrence.

The growth of the private credit markets has introduced new participants to this asset class while raising capital for new funds, acting as an efficient intermediary between prospective borrowers seeking more efficient funding and investors seeking more favorable risk/return characteristics.

However, the attention the private credit market has attracted has been varied. Many recognize the benefits that the private credit market provides for fueling economic growth while offering borrowers alternatives to greater diversified sources of funding.

On the other hand, some have raised concerns referring to its immense growth as an asset ‘bubble’ and/or potentially introducing systemic risk to the financial markets. They have pointed to, as examples, the opaqueness of the private credit markets and limited regulatory oversight.

Still, there are aspects of the private credit markets that are transparent and regulated, and there are features of this market that mitigate some of the concerns often cited by market observers.

Furthermore, the notion that ‘bubbles’ are countered with regulation or that ‘bubbles’ follow just ‘opaque markets’ is somewhat inconsistent with what has been historically observed from some of the most transparent and regulated markets in the world (e.g., the various ‘bubbles’ that have occurred in public credit and equity markets and of course some of the stress associated with regulated banks and other regulated institutions such as money market mutual funds).

In this paper we offer some perspective on the private credit market drawing attention to, as examples, certain key elements that market participants could take into consideration during their general risk assessment of the industry. These topics as well as others, including the nature of the individual credits and the lenders’ expertise, are all worthy of their own individual attention.

Private credit as a valuable alternative

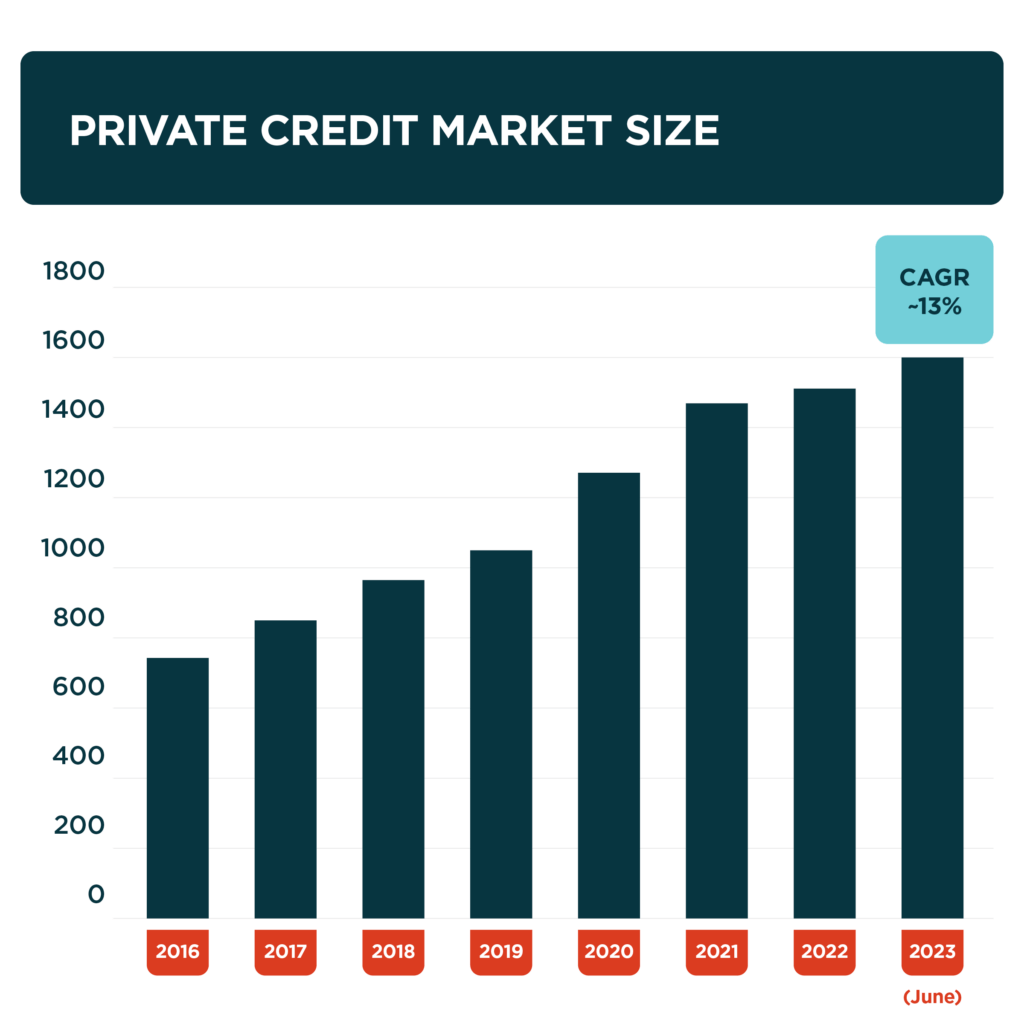

Private credit markets have been growing for well over a decade post the Great Recession. That growth has been further highlighted since the US bank crisis in early 2023. The failure of several prominent regional banks that required FDIC intervention has been one of the catalysts that has most recently led to greater regulatory scrutiny across the banking sector.

As a result, banks have tightened their credit standards leading to relatively curbed lending activity. Regulatory pressures will continue to place pressure on banks and their loan portfolios. Recent stress on some regional banks in early 2024 has reinforced this perspective.

Corporate borrowers have in turn increased their reliance on the private credit markets as an alternative source of funding, and non-bank lenders have continued to fill in the void left by banks – a “de-banking” phenomenon, as one market participant put it. What was once an area of the market confined to leveraged loans to small and mid-size corporate borrowers has increasingly financed larger sizes of loan issuances as well as those considered to be investment grade.

We believe that the market evolution has fostered a steadier environment characterized by longer-term oriented investors with fewer liquidity constraints than banks, thus better aligning supply and demand. A good example of which is when the market is faced with too many borrowers looking to rollover (or refinance) their loans (i.e., ‘maturity walls’) and with not enough liquidity available.

The private credit markets satisfy significant investor appetite for its risk/return characteristics as they offer comparably equity-like returns with significant credit spreads versus other fixed income investments.

This generous return profile is especially so since most loans are floating rate where its base rate (e.g., SOFR) has followed the Federal Reserve’s fund rate increases. The enhanced returns aim to not only appropriately compensate the lender (and investors) for the credit risk of the loan (i.e., reflecting degree of leverage, seniority, etc.), but also for the illiquidity of the loan.

Furthermore, investment returns may include incremental premia for the borrower’s prepayment optionality as well as fees associated with the loan facilities. Since the investor base is typically long-term focused, they can realize these additional premiums.

Transparency – Are these markets really “opaque”?

Market participants could access significant amounts of data on the performance of private credit portfolios. These data could be used as reasonable proxies to assess or ‘check’ lender performance in those instances where detailed data may be limited or not readily observable. Here are some key examples:

- Banks and credit unions post quarterly data on the performance of their loan portfolios (e.g., commercial & industrial – ‘C&I’, real estate, consumer). This allows market observers to conduct their own assessment of credit performance (losses and allowances) for almost 10,000 institutions on a quarterly basis with significant historical information. Estimates of the private credit markets, excluding banks, are in the area of $1.7trillion. The three largest US banks alone have about $1.4trillion in C&I loans, a good proxy for private credit performance, whereas all the banks in the US have close to three times this amount.

- Business Development Companies (BDCs) that are regulated report their financial information generally on a quarterly basis, consistent with SEC reporting requirements. These reports include detailed information across their portfolio holdings, with estimated valuations and income earned on these portfolios. The total BDC market is approaching $300bln where roughly half of the market is publicly traded.

- Leverage loan funds (e.g., open-ended funds, closed-ended funds, ETFs) also report detailed information on a quarterly basis regarding their portfolio holdings, with valuations and income earned on their investments and are consistent with reporting requirements that are guided by SEC rules and regulations.

Reduced Pressure for ‘Fire’ Sale

Bank lending is often financed with deposits, a source of funding that could be volatile depending on human behavior. Several banks in early 2023 experienced a ‘run’ on their deposits which imposed significant pressure on their funding needs while many of their assets were ‘locked’ into longer-term loans.

The private credit markets, on the other hand, are typically funded with more stable and longer-term funding. For example, private credit investment vehicles can have access to a fixed liability profile (e.g., direct lending fund, CLOs, BDCs, closed-end funds) or one that is highly predictable (e.g., life insurance, pension) along with semi-permanent capital.

The better match between funding sources and underlying loans provides a significant cushion to private credit investors and acts as a ballast against a liquidity crunch. Importantly, this longer-term match allows investors to potentially reap the excess returns associated with illiquidity and other premia that are attached to private debt investments.

Active Portfolio Management – ‘Skin-in-the-game’

Banks may have millions of loans across various segments (e.g., Commercial Real Estate – ‘CRE’, C&I, residential real estate, consumer, etc.) whereas private credit lenders will tend to have tens or hundreds (in a few cases maybe more but that is not common) of loan issuers, primarily C&I-related.

Private credit managers will typically invest in fewer companies but will invest significantly in knowing those companies and related industries very well. This active management and expertise allows private credit managers to be more focused and proactive in preserving value for their investors.

As we have noted earlier, private credit managers tend to have a longer-term investment horizon and a general tendency to invest in companies where they have an in-depth understanding of the borrowers and related industries. Furthermore, in times of distress, private credit managers will often have less pressure to offload investments since these managers are in the business of lending and working through any stress in underlying credits. In many instances, the managers may have significant relationships with the private equity sponsor.

Banks, on the other hand, often have competing interests including regulatory pressures to ‘clean their balance sheet’, which often means a tendency to sell and offload stressed credits at inopportune times with lower prices. Ironically, the sales are sometimes made to private credit investors who have more stable funding to reap the long-term value of these stressed credits. Another somewhat similar example can occur in the active BSL secondary market where there are often many parties participating in a BSL entering at varying price points and with possibly different investment strategies (e.g., distressed, special situation).

It is worth noting that some active private credit investors are subject to regulation (e.g., insurance companies and pension funds to some extent). However, the regulatory pressure for these investors to sell investments in times of stress may not be as pronounced as it is with banks, which are often funded with short-term deposits.

Private Credit offers relatively high returns, but with associated risks. Mitigants to risk include:

- Asset-liability matching – longer-term investor base with fewer liquidity constraints.

- Sophisticated investors with significant interest in risk/return and diversification characteristics.

- Ample data to assess market performance.

- Experienced, focused, and active managers – understand companies and industries well.

- Excess spreads and fees to compensate for risks.

A Diversified Market

Unlike large liquid markets such as BSL, mortgage-backed securities, agency mortgages, and equity markets, the private credit market is characterized by small companies issuing debt to a limited (and often small) number of creditors.

Thus, issuer concentration risk is to some degree mitigated in the private credit markets. We have also shown in previous research that there exists some diversification across industries (and possibly investment strategies) in the private credit market, mitigating some type of ‘systemic’ event.

When these features are combined with the close watchful eye of seasoned asset managers and more stable funding sources, as discussed above, the risk can be further reduced.

However, there are at least two areas of potential systemic risk worth noting – correlation with the broader (potentially global) economy as a whole and any risk related to looser underwriting processes paired with poor risk management applications by the asset managers.

Both risks apply regardless of the asset class in question – whether it is private credit, actively traded high-yield bonds or the most liquid agency mortgage-backed securities. There is no substitute for prudent underwriting processes and disciplined risk management.

Conclusion

The private credit market, senior secured loans in particular, is a significant element within the alternative investment universe, displayed by its immense growth in recent years. This market has contributed to the overall economy providing corporate borrowers an alternative to banks with more diversified source of funding.

This is especially important in times when it is most needed and is a sign of a dynamic market where supply/demand imbalances are filled with market solutions that may be more efficient by better aligning risk/return characteristics.

As the private credit market has grown, it has attracted significant attention from the media and other market participants across the capital markets. Though many rightfully give credit to the economic benefits the private credit market provides to both borrowers and investors, the rapid growth of this market has also raised concerns from some that are wary of the size and growth of this asset class.

Risk-return tradeoffs are a constant in all financial markets, and it is no different with the private credit markets. The overall benefits that the private credit markets provide may significantly be more than enough to offset any potential risks that may reside.

The private credit markets, which offer relatively high returns, already feature various mitigants to some of the identified risks. For example, certain levels of transparency, various regulatory oversight, asset-management focus and expertise, and more effective asset-liability matching. It is also worth noting that a number of these identified risks also exist in the public capital markets to varying degrees.

[i] Note: that we make a distinction here between the private credit market and the Broadly Syndicated Loan (BSL) market (see our previous research here on key differences between them).