The favorable risk-return characteristics of private debt are attributed to a variety of factors, including compensation to sophisticated investors for accepting limited liquidity and increased complexity relative to the liquid public markets. A contributing factor to the liquidity premium in the private debt market is the cost and related risk of trade settlement.

Trade settlement in the private debt market is a complex process and is often subject to the unique characteristics of the traded facility. At times, trades could take months to settle, exposing buyers and sellers alike to significant risks around volatility, losses and cash flow management. However, there are certain factors that could assist private debt investors to better assess and manage the risks associated with trade settlement.

Loan Trade Settlement – Not a Transitory Consideration

Trading in private loans continues to grow. In just the first half of 2022, $459B has been traded on the LSTA secondary market alone, increasing 12% over the same period in 2021. And as more investors turn to private debt as a viable asset class, we expect trading to continue to grow in tandem.

At Alter Domus, our Loan Trade Settlement group continues to see significant growth in trading volumes, well in excess of the LSTA volumes, as we continue to maximize efficiency, flexibility, and reliability for our clients. With the anticipated continuing growth of the private debt markets, we expect trading volumes to maintain their current upward trajectories, further highlighting the importance for investors to better understand and manage the risks associated with loan trade settlement.

Why Should I Care?

Trade settlement exposes buyers and sellers to several risks. Trades could take a relatively long period of time to settle. These longer time periods pose challenges to buyers and sellers to forecast and manage their cash flows – an important consideration for fund managers looking to satisfy, for example, (i) investor redemptions (seller), (ii) commitments to purchase other loans (seller), or (iii) investment objectives (seller and buyer). Delayed settlement could also pose significant incremental administrative challenges and costs to trade counterparties. In a nutshell, delayed and unpredictable trade settlement imposes costs and operational challenges and risks to the front, middle and back offices of sophisticated alternative debt investors.

As already noted, one of the most notable traits of loan trade settlement is the wide variation in times to settle. While public equity and bond traders can confidently expect that the trades initiated on a given day will close in a narrow and predictable time span, private loan traders have no such luxury.

Consider a secondary, non-distressed loan on the LSTA market, the most common loan type traded. A well-behaving trade might close in a little under 20 business days. But things don’t always go so smoothly. Sometimes the process is initiated, but then stalls immediately. Sometimes the process is near completion, only to have the agent point out that the key parts of the signoff are still pending, such as KYC or Borrowers’ Consent. Sometimes these challenges occur as the quarter is nearing its conclusion and the Agent puts all transfers on hold for several days due to scheduled principal or interest activity. At this point, the still open trade is now at 45 days, and may not close for another week or more as the factors contributing to the delay are resolved. As such, even in the secondary LSTA market, loan settlements in the 60-90 days range are not rare.

During a prolonged settlement period, risks could emerge – for example, market conditions could shift, interest rates could change beyond expectations, or the borrower’s risk profile could change.

Similarly, loan managers face additional challenges regarding cashflow management. Anytime a given loan trade settles, cash reserves are affected. Loans committed to be purchased or fund investor redemptions require cash to complete the transaction. Loans sold will lead to an inflow of cash that could be used to meet those commitments. As alternative debt managers continue to gain better insights into the timing of loan settlement, they could further improve their overall fund operations.

Given these potential challenges, it is no surprise that traders would want to factor time to settlement risk into their decision-making process. The good news is that there are several factors that could assist traders to better quantify and manage their trade settlement process. Importantly, while in this paper we share generic observations about the loan trade settlement process, each alternative debt investor will often face unique risks given their portfolio strategy. At Alter Domus, our Loan Trade Settlement team considers these factors and works closely with our clients to provide greater transparency into their unique risks.

What are the Indicators of Loan Settlement Risk?

Loan Facility and Market Characteristics

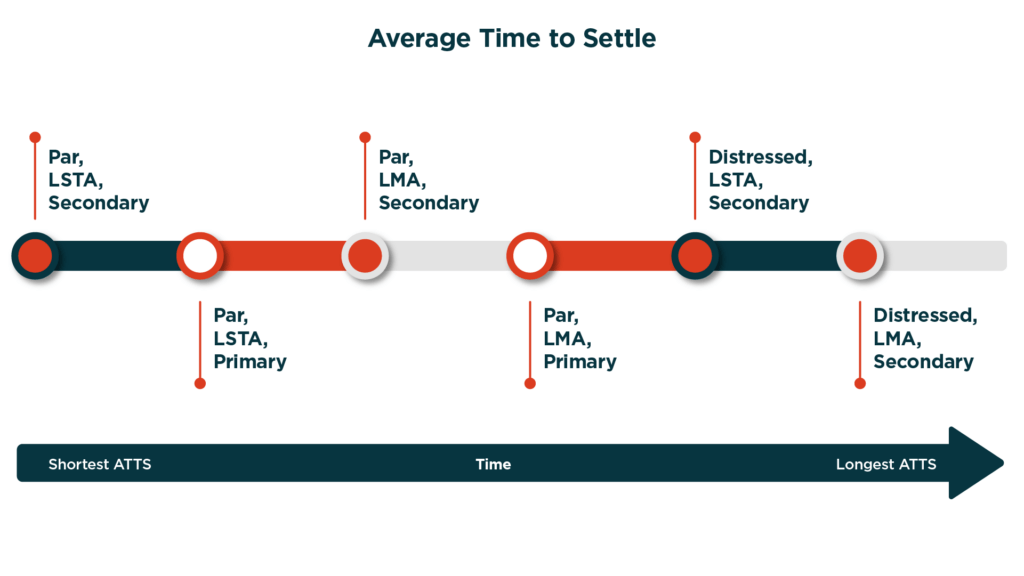

The most visible factors impacting loan trade settlement are; (i) the trading market (LMA vs. LSTA), (ii) the borrower’s financial condition (‘Par’ loans for financially healthy borrowers and ‘Distressed’ loans for financially stressed borrowers), and (iii) whether the trade is a primary versus secondary market trade. Par LSTA loans are the fastest loan type to close, typically closing in under 25 business days. Par LMA loans take somewhat longer, coming in just under 60 days across both markets. In both the LSTA and LMA Markets, Secondary Par Loans close faster than Primary loans. On the other hand, Distressed loans across both LMA and LSTA are the longest to settle, with distressed LMA loans being the longer of the two.

Cyclicality

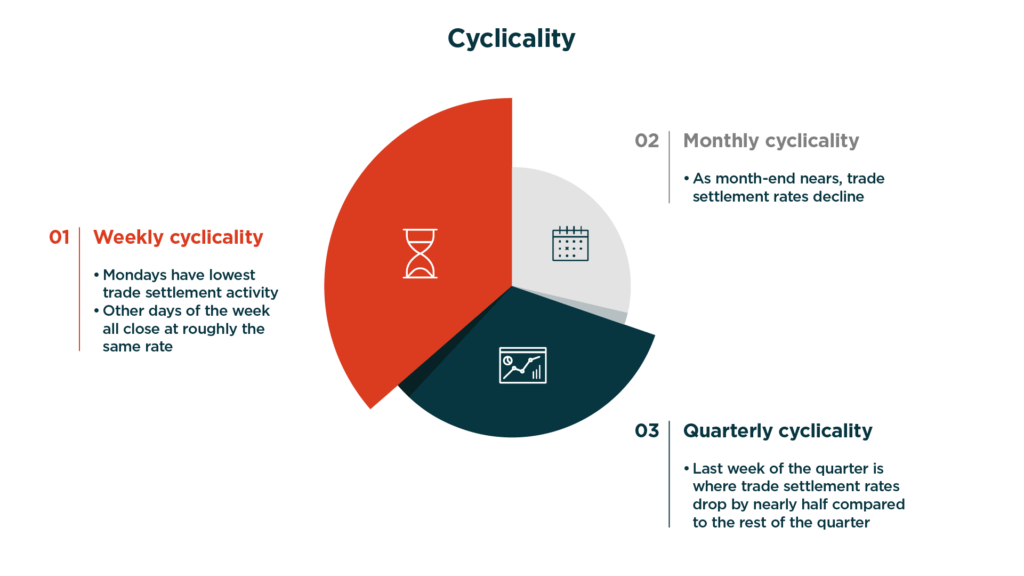

Weekly, monthly, and quarterly cyclical elements come into play for determining loan settlement. At the weekly level, all else equal, Mondays often seem to have the lowest trade settlement activity, while the other days of the week close at roughly the same rate.

While at the weekly level the start of the week is where settlement slows the most, the monthly and quarterly patterns are the opposite. As month-end nears, settlement rates decline quite a bit. This pattern appears to be particularly strong, during the last week of the quarter.

Trade Activity for the Loan

The Loan Identifier can indirectly become a quite useful variable to better understand trade settlement risk. By tracking repeat loan trades using the loan identifiers, we have noticed that loans that have traded repeatedly tend to settle much faster than less frequently traded loans. Intuitively, this is not surprising. As a loan facility’s trading activity increases, the administrative process to settle trades improves as kinks in the settlement process are addressed and corrected through repeated activity.

Counterparties, Agents and Others in the Settlement Process Ecosystem

Intuitively, the counterparties and agents involved in a trade would affect how smoothly a given trade settlement process might go. Traders might have an awareness that certain counterparties or agents have been very effective in the past, or vice versa. The data supports such intuition. Counterparties and agents have historic patterns regarding their trade settlement effectiveness.

Conclusion

The factors that affect loan trade settlement times are very relevant for private loan traders. Implications include cash flow management challenges, potential losses, and costs related to delayed trades. These associated challenges are not transitory. The market continues to grow as investors expand their allocations to this appealing asset class.

We’ve identified several factors that could help traders better manage this risk. But we do caution that aggregated market data from industry sources can only tell part of the story. Each client will have their own unique trading profile, and only by exploring the nuanced specific data could traders more precisely quantify their unique risks. Alter Domus will continue to support the loan trade settlement marketplace in our ongoing mission to provide insights to our clients that helps them manage and quantify their trade settlement risk.