How robust is the LP-led secondaries market right now?

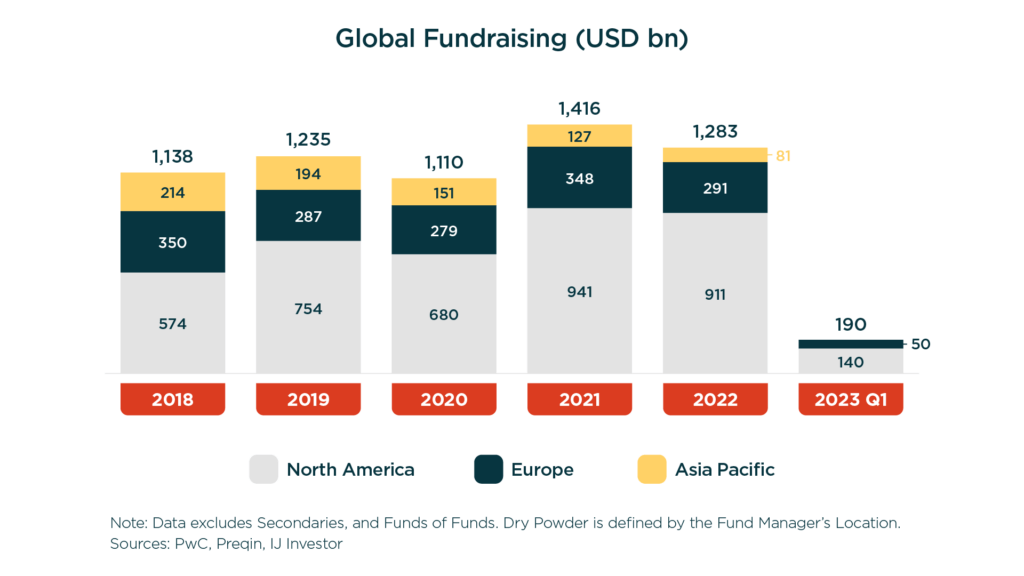

The secondaries market is more robust than we have ever seen it. Capital raises are up – there was a 30 percent jump in secondaries fundraising in the first half of this year, versus 2022. On a relative basis, the jump is even more pronounced, seeing as the overall fundraising market for private equity is pretty flat.

Secondaries had always been a single-digit percentage of the overall marketplace, but now we are seeing it move into the low double digits. Furthermore, LPs are now leading the majority of secondaries deals, which is quite different to the situation we have seen in the past few years.

This is a logical result from the market dynamics that are playing out. In a prolonged low fundraising marketplace, we are seeing concentrations build within LP portfolios due to fewer new funds being launched. Distributions have also slowed in the last 12-18 months, so there is a significant change in the return perspective – we are going from more of an IRR-led model, to a distributed to paid-in capital or a return on capital model.

Generally, this is a space LPs want to be in, while ensuring they have proper asset allocation across secondaries and are not overly exposed. In addition, they want to be relevant players in the marketplace.

Can the secondaries market retain momentum as the broader market rebounds?

This year we’ve seen major market players raising capital for massive, multi-billion-dollar secondaries-specific funds, with many longer-term forecasts indicating that the market will continue to grow and become a bigger piece of the private equity landscape. The volume of actual secondaries transactions may be influenced by what happens with the inflationary environment and interest rates, which have caused headwinds for private equity over the last 18 months.

But there are two other factors to consider here, the first being that a secondaries play isn’t the blunt tool of its earlier years, when it was just used to generate short-term liquidity. This is a market and a strategy that have really come to maturation, and LPs are increasingly using what’s now a very nuanced instrument to actively help manage the composition of their portfolios.

Secondly, the increase in secondaries volumes and activity is attracting a lot of talent in the marketplace today – there’s been huge industry investment in standing up dedicated, specialist secondaries teams. From an Alter Domus fund administration perspective, some of the best individuals in our teams are moving into this space to continue to take on demand and support onboarding requirements for secondaries, which involve more reporting, and more detail than ever before.

What this all indicates is there’s now a very defined ecosystem around the secondaries market, and we are unlikely to see all that talent and creativity suddenly shift away from it – secondaries will likely continue to play a vital role in LPs’ strategic investment plans.

How do you see this ecosystem around secondaries evolving?

There is more demand on reporting and more demand on LP transfer process efficiency. In the past, the somewhat bespoke nature of secondaries allowed for much longer timelines for investor onboarding. Today, those timelines are truncated to the point where processes are advanced quickly to meet the timelines for the new marketplace velocity.

One aspect of that, as we look at the ecosystem’s evolution, is that there are new participants coming into the marketplace around data and analytics. There is a body of data now and more standardization. This ecosystem is allowing data and analytics, tracking, forecasting and modeling to become much more advanced. Investors can come in and have confidence to position their portfolios in an allocation structure that is more nuanced, or more advanced, than in a marketplace without data and analytics capabilities.

Turning to private markets more broadly, what are the main regulatory changes that LPs and GPs should be aware of in the next year?

The biggest change in Europe is the new European Long-Term Investment Funds Regulation (ELTIF 2.0), which comes into force in January 2024. This is going to expand the permissible investments that can be brought into a portfolio. There will be a lot less prescription in the regulation, which means there is more scope for creativity in how a portfolio is constructed. It will be interesting to see how that plays out.

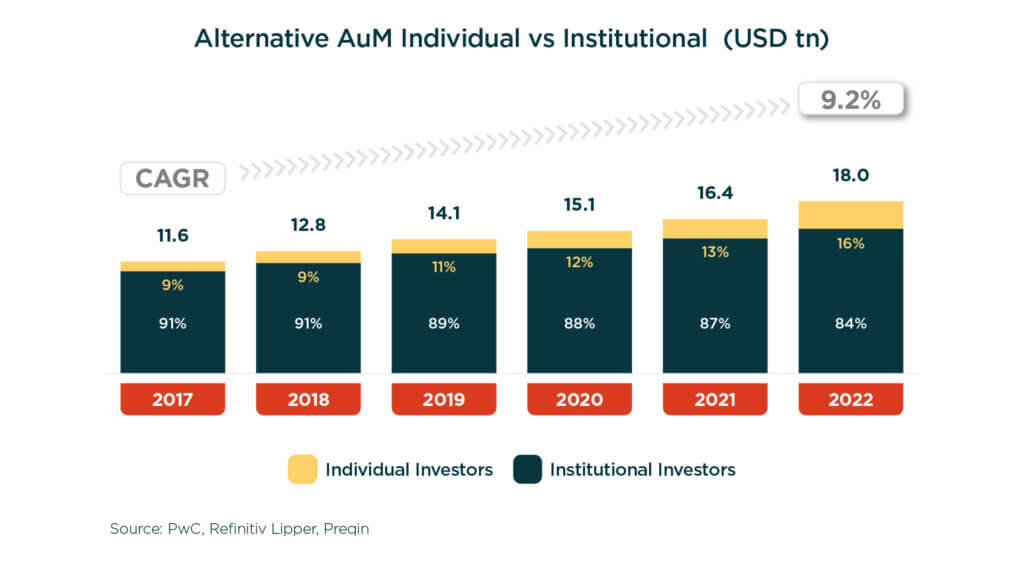

The big headline that we are focused on is the democratization of closed-end vehicles. A lot of private market assets historically have not been open to retail investors, and ELTIF 2.0 will address that. Almost overnight, we will see retail investors have an entry point into private markets.

The US market, meanwhile, has historically been less regulated. There are more opportunities for high-net-worth individuals and retail investors to invest in private market funds. But the US Securities and Exchange Commission recently decided to strengthen regulation of private fund advisers, largely because it wants to protect retail investors. It is going to require a lot more disclosure, reporting and real-time assessment of the investors coming into the portfolio and the portfolio’s ability to provide sufficient liquidity and information to that investor.

There are various opinions on these rules, and they are being challenged quite vigorously in the courts. From our perspective, we are excited by the opportunity to open up private markets to a large channel of new investors. We are tracking the situation closely and are prepared to be on the forefront to ensure those investors come into an information-rich environment.

What are the challenges to supporting clients across both Europe and the US, given the complexities of the regulatory environments?

Very few firms have the size and the scale to support a complex, complete understanding of both markets. The regulatory environments and the reporting requirements are both complex, and the complexity is doubled if you need to pivot between the two. Most of our clients are naturally more familiar with their home region and look for support from service providers like us when they operate in other jurisdictions.

We have always had the ethos of being where our clients need us to be. The key thing is to find the right talent in different markets who have knowledge of the local regulations and expertise in operating in the private markets.

This article was originally published in PEI’s Perspectives Report.