Analysis

Evolving Operations: The Rise of Co-Sourcing in Private Markets

Co-sourcing is increasingly being seen as a viable operational model by asset managers. In this article, we break down the fundamentals of co-sourcing, and outline the factors driving its adoption.

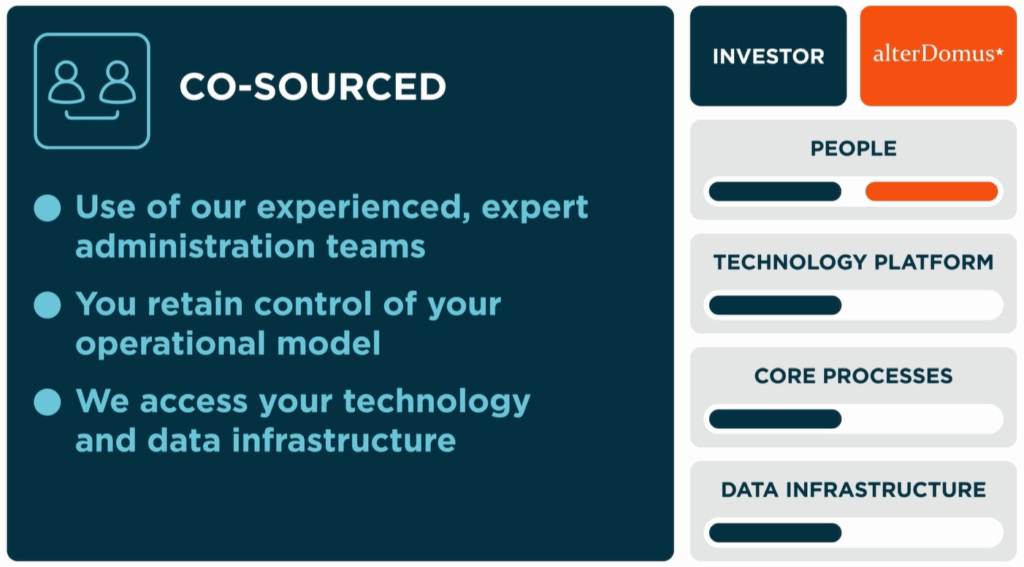

Staying in Control

How do private markets firms scale operations while maintaining control? It’s a challenge facing CFOs, COOs, and fund controllers as the industry grows in scale and sophistication.

Over the past decade, private capital has become a mainstream asset class, with managers handling larger, more complex portfolios across diverse jurisdictions. The introduction of new fund structures—like continuation vehicles and co-investments—has expanded the toolkit for general partners (GPs) but also intensified operational demands amid rising regulatory pressures and limited partner (LP) expectations.

Eight Drivers of Co-Sourcing In Private Markets

A 2024 Private Markets Insight Report by Allvue Systems reveals that 84% of private capital firms plan to re-evaluate their operating models within the next 12–18 months, with modular co-sourcing as a key focus. Similarly, 88% of managers at the Fund Operator Summit Europe are exploring outsourcing or co-sourcing in operational areas, particularly in reporting and support functions. Here, we explore the driving forces behind the growing adoption of co-sourcing.

1. Complexity outpaces legacy models

Firms manage more funds, across more jurisdictions, for increasingly diverse investors. Co-sourcing provides the flexibility and transparency needed to navigate this complexity.

2. Control without Overhead

Managers want to own their data, systems, and client relationships—without carrying the full operational load. Co-sourcing allows firms to retain oversight while shifting execution to trusted partners.

3. Scalable without compromise

As strategies multiply and reporting timelines tighten, operational needs fluctuate. Co-sourcing provides institutional-grade support that flexes with demand, without overcommitting to permanent hires.

4. Enhanced governance and risk management

Regulators demand clear accountability on vendor oversight and operational continuity. Co-sourcing provides transparency into workflows, responsibilities, and data flows, strengthening governance.

5. Rising regulatory burden

SEC Form PF updates, AIFMD filings, ESG disclosures, and tax transparency rules require greater frequency and granularity in reporting. Co-sourcing ensures consistency and accuracy across jurisdictions.

6. Growing LP expectations

Investors want richer insights into performance, fees, and portfolio exposures—delivered faster. Co-sourcing gives managers the back-office strength to meet these expectations while retaining control of the client narrative.

7. Data and platform ownership

Unlike traditional outsourcing, co-sourcing ensures managers keep ownership of their platforms and data, while partners integrate into existing systems to maintain continuity and reduce transition risks.

8. Talent scarcity

Specialist skills in fund operations—such as waterfall calculations or jurisdiction-specific compliance—remain hard to source. Between 2020 and 2022, the U.S. lost more than 300,000 accounting professionals. Co-sourcing provides immediate access to expertise without lengthy recruitment cycles.

Co-Sourcing Overview

To address these challenges, many fund managers are shifting towards a hybrid co-sourcing approach, allowing them to retain control over their systems and client experience while leveraging specialist partners for precise execution.

Ready to transform your operating model?

Co-sourcing with Alter Domus offers General Partners a tailored approach that combines internal oversight with the executional strength of a specialist partner.

Our consultative model allows you to define the scope of support that best fits your unique operational needs, whether it’s fund accounting, capital activity, or regulatory reporting.

By maintaining system continuity and establishing strong governance, we empower your internal teams to focus on strategy while we handle execution efficiently.

Experience the benefits of enhanced operational resilience, regulatory readiness, and access to deep industry expertise.

Contact us today to explore how co-sourcing can elevate your business.

"*" indicates required fields

Analysis

Co-Sourcing with Alter Domus: A Custom Approach for General Partners

Alter Domus understands that every General Partner has unique operational needs, which is why we offer tailored co-sourcing strategies to enhance efficiency and maintain control. Our expertise allows clients to focus on strategic growth while we manage execution and ensure regulatory compliance.

In the dynamic landscape of private markets, every General Partner (GP) has unique operational needs and preferences. At Alter Domus, we understand that a one-size-fits-all model simply doesn’t work. Instead, we adopt a consultative approach, collaborating with each client to define a co-sourcing strategy that aligns with their specific requirements.

Whether it’s supporting a single process like Form PF reporting or managing full fund accounting cycles within the client’s infrastructure, our flexibility ensures that we meet diverse operational contexts.

Here are some examples of how we empower GPs through customized services and expertise:

Typical Capabilities Include:

- Fund Accounting: We prepare books and records using the client’s technology platform, with workflows designed for dual review and sign-off.

- Capital Activity: We calculate and format capital calls, distributions, and notices, while clients retain approval rights and manage LP communications.

- Regulatory Reporting: Our teams collect, map, and format data to comply with evolving requirements.

By partnering with us, internal GP teams can concentrate on oversight and strategy, while our dedicated professionals manage execution within a clearly defined control framework.

Making the Shift: Practical Considerations:

Transitioning to a co-sourcing model doesn’t mean overhauling existing systems or starting from scratch. With years of implementation experience, we guide clients through a structured transition focused on clarity, integration, and flexibility.

Through our extensive work with clients, we’ve identified three key building blocks essential for unlocking the full potential of a co-sourced operating model:

1. Define the right scope: We pinpoint operational areas under pressure, such as:

- Fund closings and reconciliations

- Capital statements and investor notices

- Data preparation for regulatory reporting

- Waterfall modeling and fee calculations

2. Maintain System Continuity: Clients keep their platforms while we securely integrate into their ecosystem, ensuring a single source of truth and avoiding fragmentation.

3. Establish Strong Governance: We align with each client’s compliance and oversight model, ensuring clear roles, documentation, and audit trails. Managers retain ultimate responsibility, while our teams execute defined workflows according to agreed service-level agreements (SLAs).

Figure 1 – The Benefits of Co-Sourcing with Alter Domus

| Benefit | How it Helps |

|---|---|

| Internal Oversight | Control over systems, data, policies, and approval processes remains in-house |

| External Execution | Alter Domus executes defined tasks at scale, with speed, accuracy, and rigor |

| Data Ownership | Clients maintain full ownership of their infrastructure and data environment |

| Regulatory Readiness | Respond to changing rules with agile support and specialist knowledge. |

| Investor Responsiveness | Meet LP reporting demands faster and more consistently. |

| Operational Scalability | Expand or contract support without internal hiring constraints. |

| Access to Talent | Tap into deep experience across private equity, private credit, and real assets |

Co-Sourcing: A Model for Long-Term Resilience

For private markets managers, operational resilience transcends mere business continuity; it’s about forging systems and partnerships that can adapt and thrive in an increasingly complex environment. Co-sourcing provides the perfect balance: the stability of internal oversight combined with the executional strength of a specialist partner.

At Alter Domus, we view co-sourcing as a strategic decision rather than just a service model. It empowers asset managers to focus on what truly matters: creating value for investors, meeting regulatory expectations, and growing with confidence.

If you’re reevaluating your operating model or exploring how co-sourcing could enhance your structure, we’re here to assist. Alter Domus has extensive experience supporting transitions of all sizes and complexities—whether you’re managing a single strategy or adding new strategies.

Ready to transform your operating model?

Our consultative model allows you to define the scope of support that best fits your unique operational needs, whether it’s fund accounting, capital activity, or regulatory reporting.

By maintaining system continuity and establishing strong governance, we empower your internal teams to focus on strategy while we handle execution efficiently.

Experience the benefits of enhanced operational resilience, regulatory readiness, and access to deep industry expertise.

Contact us today to explore how co-sourcing can elevate your business.

"*" indicates required fields

Analysis

Looking to incorporate a Securitisation Vehicle? Here’s what you need to know

Securitisation vehicles are powerful tools that enhance liquidity, optimize risk management, and streamline capital structures. We explore how understanding their complexities can equip you to unlock financial opportunities and stay ahead in today’s evolving markets.

Securitisation has become an indispensable tool for institutions, asset managers, and asset owners. This sophisticated financial instrument offers a powerful trifecta: effective risk management, enhanced liquidity, and streamlined capital structures.

For those contemplating the incorporation of a securitisation vehicle, a comprehensive grasp of this intricate yet potentially lucrative process is crucial. By mastering its complexities, you’ll gain the confidence to navigate challenges adeptly and fully harness the myriad benefits securitisation offers, positioning yourself at the forefront of modern financial strategy.

What is Securitisation and why is important?

Securitisation is the process of pooling various types of financial assets, such as loans, mortgages, or receivables, and converting them into marketable securities. These securities are then sold to investors, allowing the originators to free up capital and manage risk more effectively. The cash flows generated from the underlying assets are used to pay interest and principal to the investors.

During 2017 and 2018, the European Union set up rules for securitisations. The goal was to bring the EU securitisation market back to life while also addressing worries about risky practices that had threatened stability after the global financial crisis of 2008. Since it entered into force in 2019-2020, the framework has strengthened investor protection, transparency, and financial stability.1

The European Commission has recently taken steps to revitalize the EU’s securitisation framework to make it simpler, more effective, and supportive of economic growth. These initiatives are part of the savings and investments union strategy, which focuses on improving the way the EU financial system works to boost investment and economic growth across Europe.

Benefits of Securitisation

Enhanced Liquidity

By converting illiquid assets into tradable securities, institutions and originators can access capital markets and improve their liquidity position. This transformation allows entities to free up resources that can be used for further lending to EU citizens and enterprises.

Risk Management

Securitisation allows for the transfer of risk from the originator to investors, which can help in managing credit risk and regulatory capital requirements. The main goal is to enable banks and other financial institutions to use the loans and debts they grant or hold, pool them together, and turn them into different types of securities that investors can purchase.

Cost Efficiency

Securitisation can lead to lower funding costs compared to traditional financing methods, as it often allows for better pricing based on the risk profile of the underlying assets. Recent EU reforms aim to simplify unnecessarily burdensome requirements and reduce costs to encourage more securitisation activity.

Diversification of Funding Sources

By tapping into the capital markets, institutions can diversify their funding sources and reduce reliance on bank financing. This diversification is particularly important in today’s volatile economic environment.

Regulatory Benefits

In some jurisdictions, securitisation can provide regulatory capital relief, allowing institutions to optimize their balance sheets. The European Commission’s recent proposals have estimated a reduction in capital requirements by one-third for senior securitisation tranches, which should encourage new issuances in member states where activity has been limited.

Key Considerations before incorporating a Securitisation Vehicle

The European securitisation market operates under the EU Securitisation Regulation (EUSR), introduced in January 2019 as part of a comprehensive regulatory response to the Global Financial Crisis.

The Securitisation Regulation amendments aim to reduce operational burdens by simplifying transparency requirements, with plans to cut reporting fields by at least 35%. The revisions introduce more proportionate, principle-based due diligence processes, eliminating redundant verification steps when the selling party is EU-based and supervised.

Notably, the requirement for Simple, Transparent and Standardised (STS) securitisations has been modified to consider pools containing 70% SME loans as homogeneous, facilitating cross-border transactions and enhancing SME financing opportunities.2

Choosing the right jurisdiction

Selecting the appropriate jurisdiction for your securitisation vehicle is a critical strategic decision that impacts regulatory compliance, tax efficiency, and operational flexibility. Several European jurisdictions offer competitive frameworks for securitisation vehicles, each with distinct advantages depending on your specific transaction objectives.

The optimal jurisdiction ultimately depends on multiple factors: the location and type of underlying assets, your investor base, anticipated transaction complexity, and specific business objectives. Regulatory changes, such as the EU Securitisation Regulation, have created a more harmonized framework across Europe, though important jurisdictional nuances remain that can significantly impact transaction efficiency.

Structuring the vehicle

Decide on the structure of the securitisation vehicle. Common structures includes:

- Securitisation Undertaking: A corporate entity specifically designed for securitisation transactions

- Securitisation Fund: Similar to an investment fund, but specifically for securitisation assets

- Fiduciary Structures: Where assets are held by a fiduciary for the benefit of investors

These structures are designed to isolate financial risk and facilitate the issuance of securities. You can choose a bankruptcy-remote structure with a Dutch Stichting or a Jersey Trust, which are most commonly used, or incorporate a vehicle using an entity in your group.

Legal & Tax Implications

You’ve made the strategic decision to incorporate a securitisation vehicle—now it’s time to navigate the complex legal and tax landscape that comes with it. Have you considered how different jurisdictional choices might impact your bottom line?

Legal and tax considerations aren’t just compliance checkboxes. They’re powerful levers that can dramatically enhance your securitisation structure’s efficiency. Engaging specialized advisors early in your planning process to avoid costly restructuring later.

By strategically selecting your jurisdiction and structure based on your specific assets and investor profile, you can create a tax-efficient vehicle that maximizes returns while maintaining full compliance.

Servicing and Management

Establish a reliable servicing and management framework for the transaction. Effective management and administration of the vehicle by an experienced partner is critical to ensure the correct execution of the transaction.

As the legislative changes removed restrictions on leverage and the nature of the securities permitted as collateral, the SV can now enter into a facility with a credit institution. This is required to acquire the full amount of the contemplated investments, providing greater certainty to the market.

Conclusion

Incorporating a securitisation vehicle represents a strategic opportunity for financial institutions and asset managers seeking to optimize their capital structures, enhance liquidity, and manage risk effectively. The European securitisation market, with its evolving regulatory framework, offers sophisticated mechanisms to achieve these objectives when properly structured.

Partnering with an experienced service provider gives you access to specialized knowledge from structuring and incorporation to efficient implementation and execution to vehicle liquidation.

This collaboration enables you to navigate jurisdictional complexities with confidence, ensure regulatory compliance across borders, and optimize your structure for maximum efficiency and investor appeal. Such expertise has become not merely beneficial but essential for institutions seeking to leverage the full potential of securitisation.

Securitisation is complex and you shouldn’t have to manage it alone. At Alter Domus, we simplify the process with end-to-end expertise, from transaction closing through administration and up to liquidation. With us as your partner, you can focus on strategy and investors while we take care of execution.

Contact us today to learn about how you can unlock of the full potential of securitisation with Alter Domus.

Analysis

A comparative analysis of CLO ETF returns

Rudolph Bunja

Head of Portfolio Credit Risk

Nick Harris

Junior Data Analyst

Exchange-traded funds (ETFs) composed of collateralized loan obligations (CLOs) have grown significantly in recent years. The underlying CLOs consist primarily of senior secured broadly syndicated loans (BSLs). Although retail investors have had access to BSL funds for over 30 years through open-ended leverage loan mutual funds and for over a dozen years through ETFs, the first publicly traded CLO ETF was launched only in 2020. Prior to this development, CLO investments were predominantly made by institutional investors. This is particularly noteworthy given that historically anywhere from a half to up to two-thirds or more of the US BSL market are held by CLOs[1].

This paper examines the performance of a sample of publicly traded CLO ETFs based on historical returns. The sample encompasses various CLO ETFs that target a range of tranche seniorities, reflecting different levels of credit risk as indicated by their ratings. Additionally, the performance of BSL ETFs, from which we selected a sample, is considered to provide a reference point, given that a CLO tranche is fundamentally a derivative of its underlying BSL portfolio.

Our analysis of the historical daily returns and correlations of the ETFs indicates that over a longer period (such as two years), the risk/return characteristics amongst the ETFs are generally consistent with the underlying risk profile of the relevant ETF – i.e. similar performance levels for similar risks – and moderate correlations. However, an examination of daily CLO ETF returns and correlations over a short volatile period can exhibit a noticeable divergence in absolute and relative performance. These findings indicate that the ‘intuitive’ view that CLOs and BSLs are highly correlated may not be evident until there is significant market volatility. And even in that case, differences in performance indicate that other factors may be at play.

Our analysis found that CLO correlations may be further explained at times by vintage and underlying asset manager exposure rather than just broader BSL market dynamics. We offer additional insights and key factors that can impact the performance between CLO portfolios.

Historical Returns – Data

Our sample of CLO ETFs spans the range of tranche seniorities and the credit ratings scale – from CLO ETFs that focus primarily on senior tranches (rated primarily Aaa) to those that focus on investment grade mezzanine tranches (rated from Aa to Baa). And even to those that include some speculative grade tranches (Ba). Our study also considers BSL ETFs to acknowledge that CLOs are derivatives of the BSL market.

In this context, the relationship between CLOs and the underlying BSL market could provide additional insight into the performance of CLOs. We also included some other market related ETFs to gain additional insight as to the performance of the BSL and CLO markets relative to the broader capital markets. Thus, the selected ETFs can be grouped into three categories: BSL, CLO and other broader markets.

BSL Category

We selected four BSL ETFs that are managed by well-established asset managers and have benchmarks to broad BSL indices.

Table 1: List of BSL ETFs

CLO Category (BSL-Derived)

We selected a variety of CLO ETFs that invest in CLO tranches across the CLO capital structure, and with investments in CLOs across a range of vintage periods and asset managers.

Table 2: List of CLO ETFs

Understanding the underlying ratings distributions gives further insight into the level of exposures a CLO ETF has within a typical CLO capital structure. The CLO portfolios within our sample cover a range of credit risk exposures – from a fund with essentially 100% Aaa to other funds with a broader representation of investment-grade ratings as well as funds with concentrations of Baa/Ba credit risk[2].

Other Broader Markets Category

We also included ETFs that can provide additional perspective on the relative performance of the BSL and CLO markets to the broader capital markets.

In this context, we selected a small cap equity ETF (IWM) since many BSL borrowers would fall in the small cap category; a high yield bond ETF (HYG) since these issuers have a similar credit risk profile (though with different recovery rate and interest rate risks) as compared to BSLs; and a short-term Treasury fund ETF (VGSH) to provide some benchmark of shorter-term risk-free interest rates.

Looking at Financial Performance

We focused on the risk-return and correlation characteristics across the ETFs. We looked for insights into how the ETFs performance behaved with one another within the same category (‘intra-category’), and across categories (‘inter-category’) over different time periods. We observed that both intra-category and inter-category performance and correlation metrics depended heavily on which period we selected. We found that during the most recent market volatility (April 2025), patterns emerged that were not so evident during calmer periods.

In some cases, the correlations we observed between the BSL and CLO ETFs were not as consistent as expected. Understanding that CLOs are derivatives of the BSL market, we initially expected to see a relatively higher degree of correlation across all market environments, but the correlations across all market environments varied. This observation suggests that not all CLOs track the same broad ‘BSL market’.

We also found that CLO performance could be influenced by unique factors related to range of vintage periods of when the underlying CLOs were issued and the overall exposures to common CLO asset managers.

These findings show that these variations across CLO portfolios can offer an opportunity for CLO investors to diversify their BSL and BSL-derivative portfolios to better optimize their specific risk-return objectives. In other words, not all BSL and CLO ETFs are alike.

Historical Performance – ‘Normal Times’

We chose two distinct historical return periods to begin our comparative analysis. One that we could classify as a ‘normal’ period and the other as a ‘volatile’ one. We chose the month of April 2025 as the volatile period. This period reflected significant market volatility due to the rapidly changing global trade outlook and economic uncertainties associated with the related US tariff announcements.

We selected the two-year period from April 2023 through March 2025 as a proxy of ‘normal market conditions’ and can be considered somewhat as a benchmark. Exhibits 1 and 2 show the historical return statistics and correlations of daily returns for each of the ETFs, respectively. Note that two of the ETFs in our sample were not in existence for the full two year-period analyzed. Thus, summary stats are not available, and correlation stats apply only for the respective period that each of these two ETFs was in existence.

We note that the return and risk characteristics across the ETFs are generally as expected within each investment category and subcategory. For example, among the BSL ETFs we note that there is no material distinction among the standard deviations and coefficients of variation. Among the CLO ETFs, the riskier CLO ETFs with lower rated tranches show higher volatility and coefficients of variation as compared to those CLO ETFs with higher rated tranches. The high yield bond ETF was the most volatile among the credit-sensitive ETFs. As expected, the small cap stock ETF was the most volatile while the short-term Treasury ETF was the least.

Exhibit 3 summarizes the cross-category correlations of historical daily returns. These are based on simple averages of correlations amongst the ETFs within their respective categories. The text box on the right provides guidelines for assessing the correlation results presented in this paper.

During ‘normal times’ NONE of the observed correlations were assessed to be Strong or Very Strong. All the correlations were assessed to be in the Moderate and Weak/Very Weak categories. Only 4 of the 22 observed correlations were assessed as Moderate while the remaining 18 were Weak / Very Weak. Three of the four that were Moderate, were related to the BSL category – BSLs to: BSLs, HY Bonds, and small cap stocks, respectively.

These observations suggest that during normal times, the correlations were not particularly significant for the CLO ETFs. Furthermore, CLO performance did not appear to be materially correlated to other credit risk assets, including the BSL market. Even within the CLO category, correlations were relatively marginal across the CLO capital structure, which suggests that movements in CLO tranche risk premiums seem to be more idiosyncratic during stable markets. These results are not surprising given that the CLO tranches are supported with credit enhancement – unlike CLO equity tranches, which we would expect to be more sensitive.

Exhibit 1: ETFs historical return statistics (April 2023 – March 2025)

Exhibit 2: ETFs Historical Daily Return Correlation Matrix (April 2023 – March 2025)

Exhibit 3: ETF Categories Historical Daily Return Correlation Matrix (April 2023 – March 2025)

Historical Performance – ‘Volatile Markets’

As previously explained, we defined the ‘volatile’ period to be the month of April 2025, a period of significant market volatility. Exhibits 4 through 6 show the various historical return statistics for the ETFs during this period.

One can immediately notice the significant jolt in the related risk statistics for all ETFs and the correlations among them. Below are some noteworthy observations based on the comparison of risk statistics between the two periods.

- CLO ETFs experienced the largest increase in risk measures, measured both by volatility (4x to 11x increase) and the range of daily returns (1.5x to 4x higher).

- BSL ETFs experienced roughly a 4x increase in volatility and about a doubling of the range of daily returns.

- Traditional ‘risk’ asset categories of high yield corporate bonds and small cap stocks did not show as much of a relative increase as the BSLs and CLOs – a relatively modest 2x increase in volatility and a 50% increase in range of daily returns. These asset classes, albeit riskier as they are typically subordinated relative to BSL, are more liquid and established markets. For the short-term Treasury ETF, the risk performance in April 2025 was relatively indistinguishable than during the ‘normal’ period.

With respect to correlations, our observations show a sharp increase. Whereas during ‘normal’ times, correlations are not meaningfully significant, this changed during ‘stressed’ markets – half of the observed correlations are now assessed to be Strong and Very Strong (11 of the 22 observations) whereas 3 of the 22 are now Weak/Very Weak.

While correlations increased substantially, there were still some areas of divergence in performance that are worth noting. For example, the CLO ETFs such as the higher rated investment grade CLO ETFs show moderate correlations to all other asset classes. This implies that CLO ETFs may offer some diversification benefits (especially as you move up the capital structure associated with greater credit enhancement) even in stressed markets. However, the CLO ETFs with lower-rated tranches did show very strong correlations to the ’risk’ assets, but that is to be expected given their tranches’ higher degree of credit risk exposure associated with lower levels of credit enhancement.

Exhibit 4: ETFs historical return statistics (April 2025)

Exhibit 5: Historical Daily Return Correlation Matrix (April 2025)

Exhibit 6: ETF Categories Historical Daily Return Correlation Matrix (April 2025)

Other Observations

A detailed attribution analysis of the underlying CLO ETF performances is outside the scope of this paper. However, we performed some high-level reviews of the CLO portfolios to look for potential factors that could affect the performance of the CLO ETFs and help explain some of the correlation behavior CLOs experienced, especially during the ‘volatile’ period as CLOs appeared to exhibit lower intra and inter correlations than the other asset classes.

Additional factors beyond market considerations appear to emerge when we look closer at the CLO portfolios. In addition to diverse capital structure exposures, we observed that the CLO ETFs had relatively diverse CLO vintage exposures. While exposures to common asset managers across the CLO ETFs could be significant, we noticed that the exposures were often across various CLO vintages of common managers.

Investing across CLOs with unique asset managers can provide diversification benefits despite targeting the BSL market. Different managers may have varying investment styles, strategies, size (or AUM), as well as industry/sector and credit expertise.

Notwithstanding the fact that a CLO portfolio may consist of several CLOs managed by the same entity, there can be advantages from diversifying across vintages. CLOs can be executed under different market conditions and potentially with variations in reinvestment criteria, even given identical CLO portfolio managers. Furthermore, CLOs from different vintages may be at various stages in their lifecycle, such as the reinvestment or amortization period, which also affects the level of a CLO’s reinvestment activity, as well as being past their non-call period, which can indicate the degree of potential refinancing activities.

Conclusion

ETFs composed of CLOs, with underlying BSLs, have experienced significant growth in recent years. While retail investors had access to funds of BSLs for over 30 years, the first publicly traded CLO ETF was introduced in 2020. This is noteworthy since a large part of the BSL market is held by CLOs and thus offers a broader group of investors to participate in the BSL-derived market across various risk/return profiles.

This paper analyzed the performance of CLO ETFs based on a sample of historical returns. The sample included different ETFs that target a range of CLO tranche seniorities, representing varying levels of credit risk. The performance of some BSL ETFs was also reviewed since the performance of a CLO tranche is essentially derived from its underlying BSL portfolio.

Our analysis of the historical daily returns and correlations of the ETFs show that over a longer ‘normal’ period, co-movements in performance are moderate and the risk/return characteristics across the ETFs are generally consistent with their underlying risk profile. However, CLO ETF returns and correlations can exhibit a noticeable divergence in performance and increase in volatility over a shorter period of extreme uncertainty. An example of which was during the recent period of market fluctuations caused by the US tariff announcements.

We also found that CLO correlations can be explained further by key factors such as the distribution of exposures to: (1) seniorities of the CLO tranches, (2) the vintage periods of when the CLOs were issued, and (3) asset manager overlap within a CLO ETF portfolio.

The bottom line is that CLO ETFs appear to offer investment diversification benefits and that not all CLO ETFs are the same, even given similar credit risk. While performance may appear to converge during stressful times, key differences in performance is also evident.

[1] Guggenheim Investments research dated December 7, 2023 – ‘Understanding Collateralized Loan Obligations’ (https://www.guggenheiminvestments.com/perspectives/portfolio-strategy/understanding-collateralized-loan-obligations-clo) and FT Opinion On Wall Street dated June 7, 2025 – ‘The trend strengthening the hand of big credit houses’ (https://www.ft.com/content/b5693e95-3a89-4df0-a1f8-ad3e70338458).

[2] Although some of the CLO ETFs may report CLO tranches that are “not-rated”, this is not technically correct in all cases since some ETFs generally report ratings only from the two largest and widely recognized NRSROs. Nonetheless, “non-rated” tranches may still be less liquid and more volatile given the absence of a rating from one of the two largest NRSROs, but likely to offer higher yields.

Analysis

The growth of the private debt market: Trends, opportunities, and challenges

Explore the growth of the private debt market, including key opportunities & challenges.

Analysis

Private debt financing vs bank lenders: How the market is evolving

Explore how private debt financing is evolving and competing with traditional bank lenders.

Analysis

Private credit vs. public credit: Understanding the key differences and benefits

Understand the difference between private and public credit, including the benefits of each option.

Analysis

Private debt funds: An in-depth guide

Learn how private debt funds work and the role of debt asset management.

Analysis

The AD Score – An objective framework for optimal portfolio allocation

Optimal portfolio allocation in fixed income is a vital part of any investment decision, and it remains an important topic of discussion. This concept applies across all fixed income assets, including investment-grade debt, high-yield bonds, leveraged loans, structured credit, and private debt. To guide investors in their fixed income portfolio allocation decisions, Alter Domus has developed the AD Score – an objective framework that asset managers can use to optimize fixed income portfolio allocations.

Portfolio optimization is a cornerstone of modern asset management, aiming to balance risk/return, promote portfolio diversification, and improve overall portfolio efficiency.

Fixed income managers actively seek to optimize their portfolio allocations such that the portfolio is expected to generate the maximum return with the least amount of risk. In this context, managers may apply an internal scoring methodology to grade assets as part of their investment decisions. These scoring methods in many cases rely on a weighted approach based on certain factors, many of which may be subjective. In addition, managers may rely significantly on a single guiding metric, such as yield, but still need to further control for other factors, such as credit risk, to be comparable.

Investment decisions are further complicated by various constraints. Constraints may be market driven, such as the availability of investments or market prices. Investor-mandated factors such as average credit quality, percentage limitations and duration may also come into play, as do regulatory factors, such as SEC, NAIC, Federal Reserve, Basel III rules.

These constraints can apply across all areas in fixed income, whether the asset is an investment grade credit, a high-yield bond, a broadly syndicated loan, private debt or structured credit. Constraints could also extend to other ‘cash flow intensive’ investments, such as commercial real estate and infrastructure.

Given the myriad factors that investors must consider, it comes as no surprise that portfolio optimization in fixed income is a sophisticated process with complex methods and techniques.

In this paper we present a framework designed to address these complex portfolio allocation challenges. This framework offers a single universal metric, the Alter Domus Score (‘ADS’), which can arm managers with a solution for efficiently measuring an optimal portfolio allocation that is objective and comparable across any fixed income investment.

The ADS, which is an asset-based measure, is also robust and controls for information relevant to any fixed income investment – including those tied to asset based loans – ranging from cashflow characteristics and credit worthiness to market price, pre-payment, and illiquidity costs.

We will detail the elements of the ADS, including the underlying framework, and illustrate the relationship between the ADS and changes to certain key asset-based characteristics.

Why Trade Optimization?

Trade optimization addresses a fundamental economic problem: maximizing the efficient and productive use of limited resources, specifically investable capital. Fixed income managers must, therefore, choose from among various investment opportunities to maximize the overall portfolio return given each investment’s attributes, which include cashflows, credit risk, and market price.

In most cases, managers are also faced with a variety of constraints, such as credit quality, maturity, and diversification limits, to name but a few, which adds more complexity to their decision-making process.

Essentially, managers aim to navigate these variables to deliver the best value for their investments.

The ADS presents a framework that relies on a single metric and objectively accounts for economic factors that are key to any fixed income investment. This framework is particularly valuable for managers bound by constraints, helping them to make the best investment allocations when weighing tradeoffs. The ADS serves as a complement and support to existing methods used by investment managers.

The ADS: an objective and universal measure for trade optimization

The ADS is an objective measure that is rooted in fixed income theory.

Essentially, it represents the discounted and risk-adjusted cashflows for any expected stream of cash flows, including fixed income instruments, such as bonds, loans, and asset-backed securities (ABS).

The ADS is easily comparable across all securities since it is a measure based on a single dollar (or any currency) value at risk. This feature allows any prospective universe of fixed income investments to be rank ordered on a pro-forma basis to determine an optimal portfolio allocation that is subject to constraints.

The score means that a fixed income investor can compare a bond to a loan or an ABS security – or even a real estate investment – when selecting the optimal portfolio allocation investment decision.

The score is agnostic as to the type of underlying investment and relies on the individual cashflow characteristics of the asset, factoring in the time value of the expected cash flow and uncertainties due primarily to the credit risk of the borrower and potential prepayments.

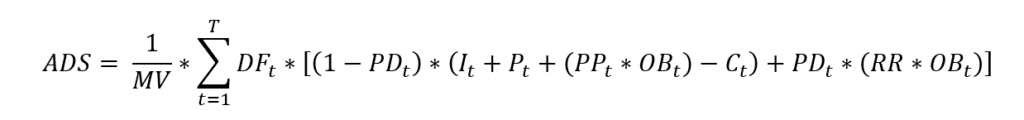

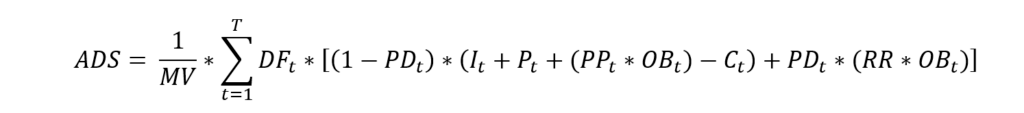

Digging into the detail: the formula behind the ADS

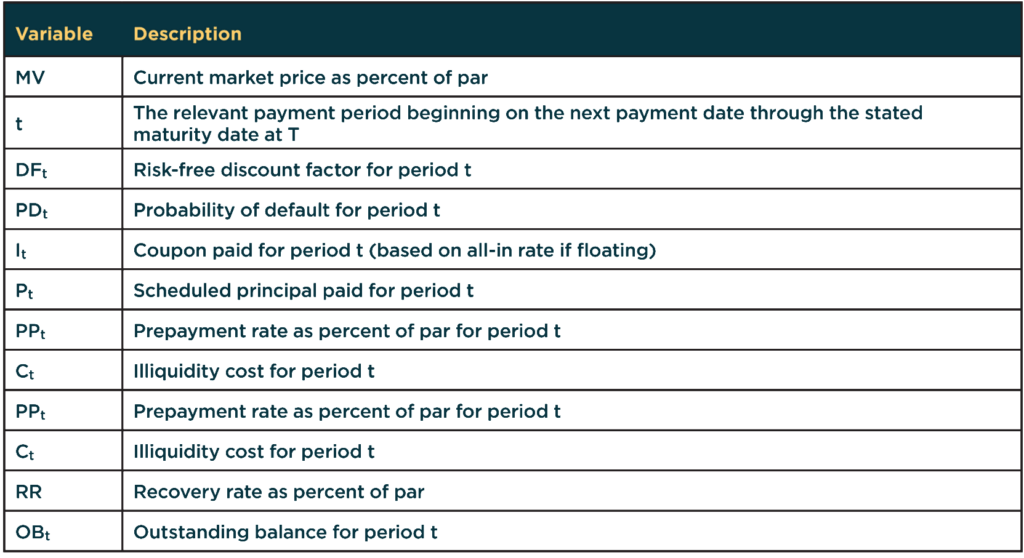

The ADS is calculated based on the following formula (see Appendix for detailed description of inputs).

To make effective comparisons across assets, the outstanding principal balance of the asset is first normalized to an indexed value of 1, which results in the market value (MV) to be a percentage of the indexed value. Therefore, we can break down the key inputs into two groups – one group is based on asset-specific attributes and the other reflects cashflow uncertainties.

To present it simply, the numerator represents the present value of the risk-adjusted weighted cashflows over the duration of the asset, the Cashflows Risk-Adjusted Value (C-RAV) while the denominator is the MV[1].

Some key factors to consider are that the risk related inputs can be based on the manager’s judgement or can be used to gather insight as to what the market value implies.

The ADS can also be used to generate trade ideas for making asset substitutions, when, for example, seeking a better relative-value opportunity, and thus can increase the likelihood that a portfolio will be better off or more optimal.

Applying the ADS in different scenarios

It is noteworthy to begin highlighting three possible scenarios of the ADS for any given security.

- ADS > 1 (i.e., C-RAV > MV),

- ADS < 1 (i.e., C-RAV < MV), and

- ADS = 1 (i.e., C-RAV = MV).

Example 1: In cases where the ADS score is greater than 1, the time-value adjusted and risk-adjusted cashflows based on the manager’s expectations is greater than what the market price is reflecting. The asset is therefore ‘undervalued’, as indicated by the asset’s risk/return profile.

These are assets that offer the manager favorable investment characteristics, as the value of the risk-adjusted cash flows is greater than the price to acquire those cash flows.

Example 2: In cases where the ADS is less than 1, the time-value adjusted and risk-adjusted cashflows based on the manager’s expectations is less than what the market price is reflecting. The asset is thus ‘overvalued’, as indicated by the asset’s risk/return profile.

The manager will seek to sell these assets since the proceeds from those sales would exceed the manager’s fundamental assessment of what those cash flows are worth.

Example 3: In cases where the ADS score is equal to 1, the time-value adjusted and risk-adjusted cashflows based on the manager’s expectations is equal to what the market price is reflecting. So, the asset is ‘fairly valued’, as indicated by the asset’s risk/return profile. These assets have market values consistent with the manager’s fundamental assessment, and the manager would therefore be indifferent to holding, buying, or selling these assets.

When working through these scenarios, it becomes clear that a manager can begin to utilize the ADS as a metric for comparing and effectively rank-ordering decisions across different types of fixed income assets.

The ADS can also be used as a tool to inform the manager as to what the risk-based inputs the market is implying. With these inputs on hand, the manager can better assess whether an asset’s market price is rich or cheap.

Manager judgement, of course, is an important element to calculating the ADS.

The ADS could be pre-populated with apparently objective inputs and additional manager overlay could significantly improve the quality of the ADS and its utility as a tool to support portfolio optimization.

Assessment of prepayment rates and credit risk inputs are informed by asset manager expertise and play a big role in calculating the ADS.

Dissecting the AD-Score

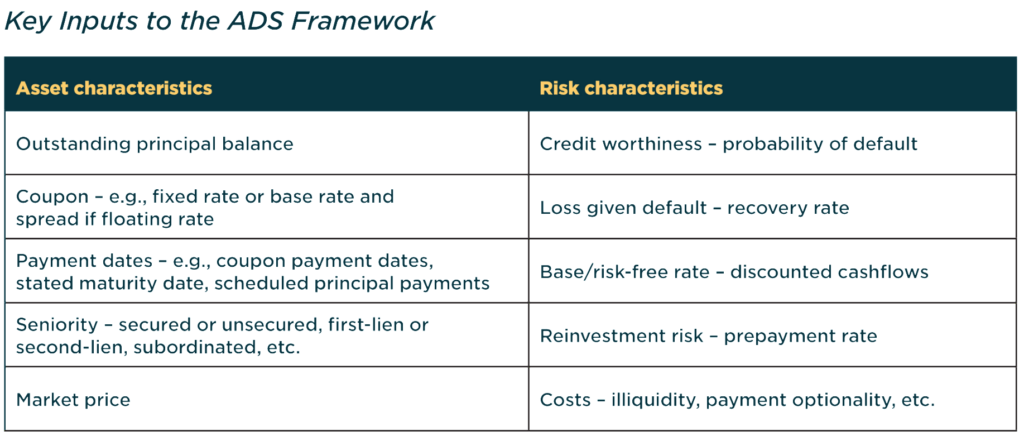

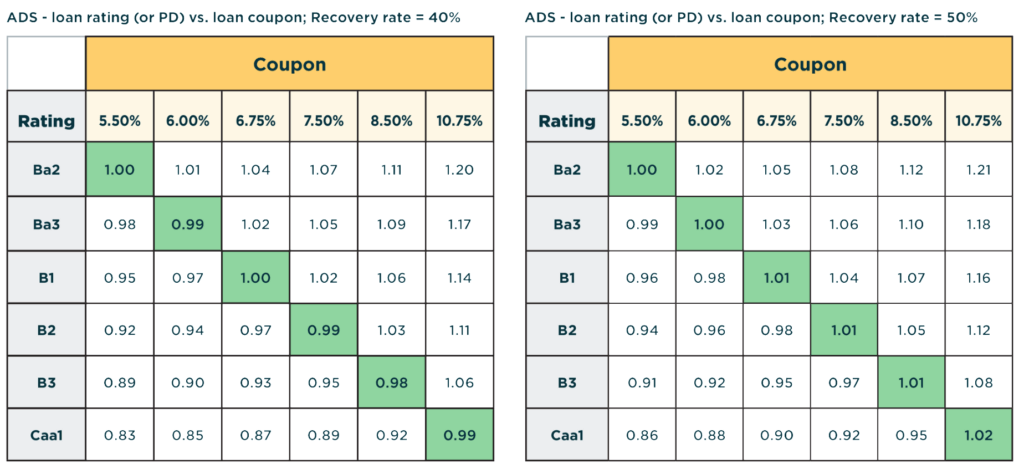

The tables below illustrate the relationship between the ADS and changes to certain key inputs holding all else equal. We have intentionally kept the analysis simple so that we could better illustrate the mechanics behind the score.

A more thorough analysis, inclusive of actual cash flow payment dates (we assume annual for our simple analysis), spot risk-free rates (we assume a flat risk-free curve), more dynamic prepayment rates, and other more precise inputs are considered as part of the ADS.

For simplicity we also assume the assets are floating rate senior secured loans, but set at a fixed rate, and have a narrow band of possible recovery rates. The probabilities of default (PDs) are based on the Moody’s idealized default rate table.

The Tables that follow illustrate how the ADS score may shift under different scenarios:

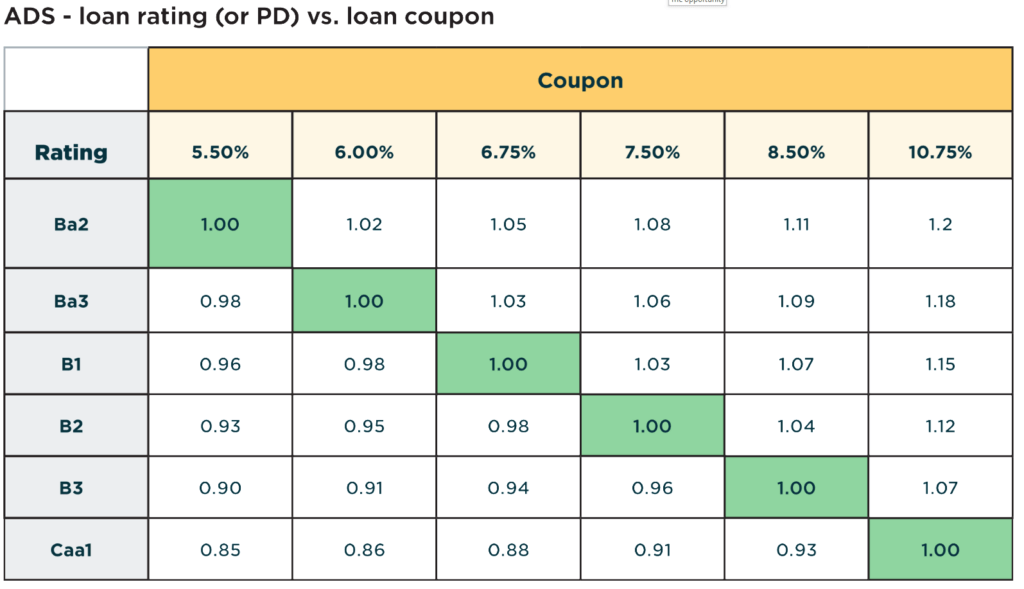

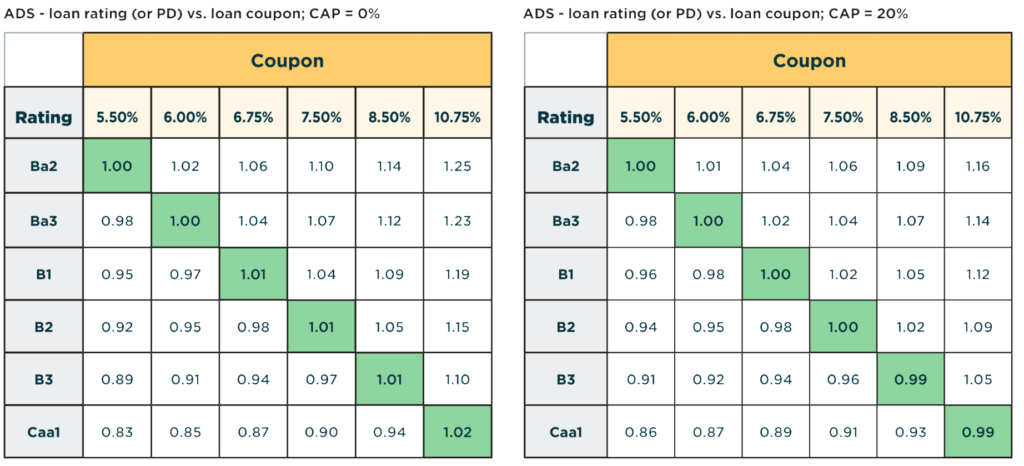

Table 1: Impact of Coupon Rates and Credit Risk Ratings to the ADS

The first part of the analysis (see Table 1) shows the calculated ADS for a group of six stylized loans. The loan coupons range between 5.50%-10.75% (4.50% risk-free rate and risk premiums between 1.00%-6.25%) and have current ratings in the Ba2-Caa1 range. The loans have six-year stated maturities (with 10% constant prepayment rate – CAP) and assumed recovery rates of 45%. Note that for further simplicity we assume the current market values are 100% (or equal to par), and that the stated coupons are such that the current ADS is 1.00 (or ‘fairly valued’ at par).

Table 1 also shows a range of possible ADS scores based on changes to credit risk ratings and coupons. It can also be viewed as changes in the manager’s opinion of credit risk (or PD) associated with the loan. Furthermore, the ADS values can reflect the manager’s opinion on its own fundamental assessment of the loan cashflows (or C-RAV), holding all else constant.

In other words, these ADS values can reflect the manager’s opinion on what the fair value (or price) should be as a percent of par and can be used to compare to what the market price is offering.

Initial noteworthy observations show that investors require compensation via higher coupons that are commensurate with lower rated loans, holding all else equal, such as a larger risk premium for riskier loans.

This can be reflected in the highlighted cells across the loans where the market price clears at par (also reflected with an ADS of 1.00). Notice that for each loan, a change to rating (or PD) impacts the ADS through C-RAV.

For example, if the stylized loan rated B2 were to be upgraded (or downgraded) by +/- 1 subcategory, the ADS value would change from 1.00 to 1.03 (and 0.96) respectively, assuming the market value of the loan remains pegged to 100%.

Table 2: Impact of Prepayment Rates to the ADS

Table 2 displays ADS values after reducing and increasing the CAP rate from 10% to 0% and 20%, respectively.

This scenario, of increasing prepayment rates, effectively reduces the asset’s weighted average life expectation, thereby reducing overall coupon cashflows, while also reducing the exposed amount to default, or in other words, prepayments are not subject to loss.

We first notice that those loans with lower ratings (and higher coupons) appear to be the most sensitive to CAP. A lower CAP rate scenario seems to generate more than enough coupon cashflows to compensate for the longer period of exposure to default, such as relatively higher C-RAV and ADS.

In contrast, the higher CAP rate scenario appears to reduce the coupon cashflows enough to lower the ADS (and C-RAV).

Keep in mind that this is an isolated scenario analysis meant for comparison. The outcome can be sensitive to other variable inputs, such as the default timing profile.

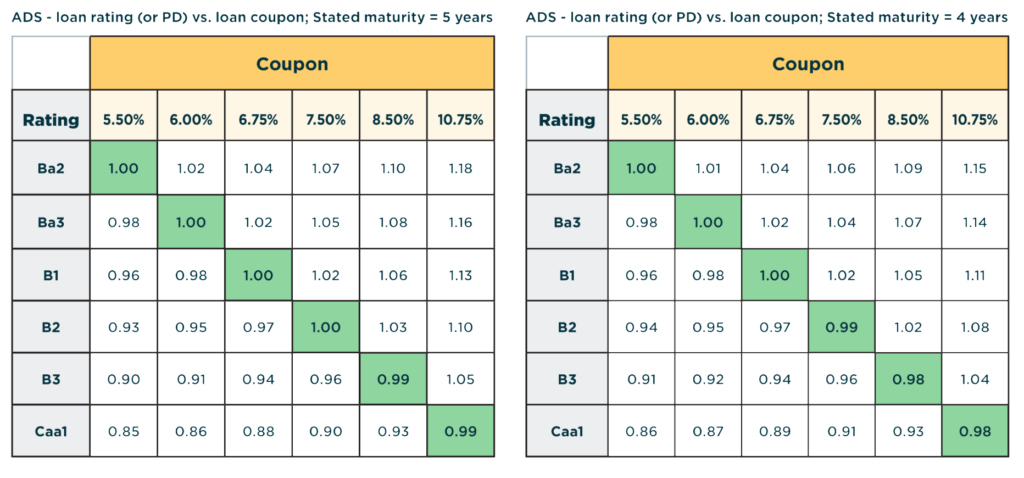

Table 3: Impact of Maturity to the ADS

Table 3 displays ADS values after reducing the stated maturity of the loans from 6 years to 5 and 4 years, respectively.

The stated maturity scenario analysis above shows that it has a similar effect to increasing the CAP rate (see Table 2) thereby drawing a similar conclusion.

Table 4: Impact of Recovery Rate to the ADS

Table 4 displays the sensitivity of ADS values at various recovery rates – from 40% to 50%.

This scenario analysis impacts the ADS through the loss given default (LGD) expectation of the asset. The table results are clear and intuitive in demonstrating that as recovery rates increase (or, as LGD decreases), the ADS naturally increases.

The extent of the increase appears to be in the range of 1-3 points of incremental ADS as recovery rates increase by 10% (from 40% to 50%). The larger ADS impacts are reserved for the lower-rated, or riskier, assets since the benefit of the higher recovery rates is most pronounced when the probability of default is relatively high.

A tool to navigate the complexities of fixed income portfolio allocation

Fixed income portfolio managers seek to optimize their portfolios to achieve the maximum return with the least amount of risk. However, they face numerous challenges, including market-constraints, investor/lender mandates, and potential regulation.

As managers strive to optimize their portfolios, they often utilize a scoring approach for generating trade ideas. In this paper we presented a framework that can support decision-making for these types of complex portfolio allocation challenges and complement frameworks that may already be in place.

The framework provides a universal score, the ADS, that is easily comparable across all cash-generating assets. The ADS is also simple, robust and controls for critical information, whether it is objective or subjective, relevant to any fixed income investment.

For AD clients, including clients of Solvas and Enterprise Credit & Risk Analytics, the ADS is offered as an additional measure to support our clients with their trade optimization, portfolio allocation, and risk analytics.

Please contact [email protected] for further information on how to access the ADS.

Appendix: Calculation of the Alter Domus Score

The first step to compute the Alter Domus Score (ADS) for any fixed income instrument is to normalize the initial face amount to a value of 1 in the relevant currency. The ADS is then calculated as follows:

Where:

[1] The MV can be adjusted in cases where the manager is subject to certain trading criteria. For example, CLOs commonly carry any loan that was purchased below a certain threshold (or ‘deep-discount’) at the purchase price, which results in a haircut to par in the OC tests. The ADS would effectively be capped (potentially at 1) in this instance.

Key contacts

Eric Tannenbaum

United States

Head of Sales for Data & Analytics

Analysis

Private debt outlook & key market trends for 2025

Private debt is in line for a bumper year of deal flow in 2025 as M&A activity rebounds.

Exploring private debt trends in 2025

- Private debt is in line for a bumper year of deal flow in 2025 as M&A activity rebounds

- Interest rate cuts will squeeze returns a little, but the asset class will continue to present compelling risk-adjusted investment opportunities

- Private credit defaults are likely to track higher, but within manageable levels for managers equipped to troubleshoot

- Competition for deals will intensify as broadly syndicated loan (BSL) markets continue to rally. Securities offered in this space are also predicted to evolve with trends, further enhancing attractiveness to investors. Debt funds must adapt pricing while leveraging securities to maintain competitiveness in core sectors.

Private debt’s so called “golden age” will still have room to run in 2025, even as interest rates come down and broadly syndicated loan (BSL) markets reopen. The financial landscape is evolving, bringing new views and strategies into private debt.

The asset class has proven resilience through rising inflation, benefiting from market shifts and proving reliable returns. With its floating rate structures benefitting from rising base rates at the same time as risk-averse BSL markets pulled up the shutters, opening the way for private debt managers to gain market share and take their pick from the best credits on offer.

These favorable dynamics have shifted in 2024, with central banks cutting rates as inflation subsided and BSL markets bouncing back to record double-digit gains in year-on-year issuance. Lenders will continue to provide diversified financing solutions to support various sectors.

Private debt managers will face increasing competition from global banking institutions and investors in 2025, impacting future financing. BSL markets in 2025 as a result, with BSL arrangers and investors showing strong appetite to lean back into M&A and leveraged buyout financings after a stepping back through the period of interest rate dislocation.

The last year has already seen BSL markets claim back market share, offering lower pricing to win back credits that were financed with private debt-backed unitranche loans.

Data from Bank of America and information from Bloomberg show that at least US$30 billion worth of private debt deals in the US were refinanced in the BSL market in 2024 at lower rates. BSL market participants will remain competitive, not solely based on pricing, but through strategic asset management. Arrangers, noting the speed of execution and certainty offered by private debt providers, have worked hard to get BSL pricing spot on to avoid flex and mitigate syndication risk.

For deep dives into key trends driving the 2025 private debt outlook, read on. Insights into how institutional investors view private debt’s role will be shared.

Pricing pressure for private debt investment targets

Banks and other financial institutions are reshaping their service profiles to adapt to these changes. Increased competition will keep private debt managers on their toes, but the asset class is still well placed for a strong year of activity and opportunity in 2025.

Managers will have to acknowledge the need to reduce margins to stay within a reasonable range of the pricing banks and BSL markets can offer in the year ahead. Many have already done so.

But while margins may have to come down, and interest rates are lower, private debt managers will still be able to deliver consistent, high single digit returns, as base rates remain well above levels from 24 months ago. On a risk-adjusted basis, private debt will continue to appeal to investors, even if returns are slightly lower than those delivered in 2024. Significant asset growth is anticipated across the private credit sector. Global trends indicate increased private market activities, including corporate financing.

Lower returns, however, will be more than made up for if a much-anticipated uptick in M&A activity is realized in 2025. Interest rate stability and the urgent requirement for private equity dealmakers to make distributions to LPs promises to deliver a meaningful uptick in deal volume and demand for private debt financing. With emerging corporate partnerships, private debt providers are poised to capitalize on substantial investment opportunities, also supported by significant asset allocations.

Private debt players have demonstrated the capability to finance significant credits during the period of interest rate rises. BSL markets may be open again, but private debt managers now have a track record of clubbing together to deliver financing for massive credits that not too long ago would have been the exclusive preserve of BSL markets. This showcases the increasing access to diverse private credit options that accommodate less traditional financing preferences.

Recently, for example, a club private credit managers teamed up to provide a £1.7 billion loan to help finance the take private of UK investment platform Hargreaves Lansdown. Private equity firms are exploring additional private market ventures, including direct lending strategies to leverage growth. While BSL markets will appeal to borrowers with lower pricing in 2025, but large credits will no longer default to BSL markets, as private debt managers show that they have the scale and appetite to offer flexibility and certainty of execution on big credits.

Dealing with private debt defaults

Strategic partnerships will be vital for managing private debt portfolios effectively, including asset risk considerations. A rise in deal financings, however, will not be the only thing taking up private debt manager time in 2025. Portfolio management will remain a key priority, as managers move to protect value and limit losses.

Private debt portfolios have proven resilient through a period of rising rates, and while defaults are expected to increase in 2025 as the impact of rising rates trickles down to borrower balance sheets, overall default levels should, all being well, remain within manageable thresholds.

Asset management strategies will need to adjust to address defaults. An uptick in defaults, however, will see a bifurcation in the market between managers with the capability and resources to steward credits through periods of stress and distress, and those that have strong transactional capabilities but haven’t made the investment in restructuring capability. This will become especially apparent in a market where defaults track higher at the same time as new financing deal volumes start to rally. Managers with lean teams will find it increasingly difficult to keep on top of new opportunities and keep troubled credits on track.

Regulatory changes influencing private debt

The evolving regulatory environment in 2025 is reshaping how companies value private debt. Emphasis on transparency ensures valuations precisely reflect the market conditions. This heightened scrutiny requires comprehensive and meticulous financial reporting.

Independent evaluations and transparent financial information will ensure asset values align with actual market conditions. Private credit managers must comprehend and strategize around regulatory shifts to manage obstacles. Emphasizing regulation can foster improved business practices among private credit managers, thereby offering clients more secure and stable investment options in a dynamic market landscape that features stringent regulatory standards from both global and regional authorities.

Leveraging global trends to expand in private credit

Banks are also participating more actively, providing complementary services to bolster private credit growth. Private credit is increasingly global, with heightened investor access to cross-border investment opportunities. The allure of high yields and diversification benefits is attracting global investors, making private credit a key strategy for asset managers aiming to harness international opportunities while managing financial risks. As global demand for securities evolves, embracing trends will be vital to stay competitive.

A good time to be in private debt

The next year might not be quite as good for private credit debt as 2023 and 2024, but the asset class is still set for a good 2025.

Winning deals will take more work as competition increases, and margins and returns will have to be adjusted accordingly for private debt to remain competitive in a market where other financing channels are beginning to function normally once again.

There will, however, be more deals to go for if M&A activity rebounds as expected, which should balance out the challenges posed by rising competition and tighter margins and returns.

The private debt “golden era” may have run its course, but private debt is an asset class that looks likely to retain is luster for some time yet.

The full scope of private capital outlooks

To read about the trends driving all private capital asset classes through 2025, check out the other articles in our Outlooks series.

Private equity outlook 2025

Real estate outlook 2025

Infrastructure outlook 2025

Key contacts

Greg Myers

United States

Global Sector Head, Debt Capital Markets