Analysis

Why COOs and CFOs of Wealth Managers, Multi-Family Offices, and OCIOs Should Consider Outsourced Fund Administration

Rising operational complexity, lean teams, and expanding investment mandates are driving wealth managers and family offices to consider outsourced fund administration.

Why consider outsourced fund administration

As a COO or CFO of a wealth manager, multi-family office, or OCIO, you carry a responsibility that extends well beyond numbers. You’re not just managing books—you’re safeguarding a family’s legacy, ensuring operational resilience, and giving principals the confidence that their capital is stewarded with precision. That mandate has only grown more complex.

Expanding into direct deals, private credit, real estate, and cross-border structures means you’re expected to deliver institutional-grade reporting, governance, and controls—often with lean teams and finite resources. It’s a balancing act: meeting rising operational demands while protecting the office’s agility and focus. This is exactly where an outsourced fund administration model becomes invaluable.

Why outsourced fund administration fits the wealth manager, multi-family, and OCIO office model

Outsourcing isn’t about relinquishing control—it’s about fortifying your operational backbone so that you can focus on higher-value work. A trusted fund administrator brings:

- Accuracy and independence – Third-party validation of NAVs, cash flows, and performance ensures credibility with stakeholders.

- Scalability – As the family invests in new strategies or regions, outsourced infrastructure flexes with you.

- Technology advantage – Purpose-built platforms for data management, accounting, reporting, and investor visibility—without the heavy lift of implementation or maintenance.

- Efficiency – Offloading data feeds, document management, reconciliations, financial preparation, audit management, and compliance tasks frees your time for strategic planning and governance.

- Credibility – Enhances your standing with advisory clients, auditors, partners, and institutional co-investors by demonstrating best-practice operations.

What sets Alter Domus apart as an outsourced or co-sourced solution

For COOs and CFOs of wealth managers and multi-family offices, partnering with Alter Domus means strengthening your operational backbone without losing control. Our model is built to meet the rising demands of complex investment offices while safeguarding the agility and stewardship your principals expect.

- Knowledgeable staff – Our teams bring deep experience in IBOR and ABOR reporting, as well as NAV calculation, cash flow management, and investor reporting. Whether working within our licensed systems or those licensed by your firm, we ensure that operations run smoothly and in full compliance.

- Service level agreements: We commit to aggressive SLAs that ensure timely, accurate posting of data across portfolios, enabling you to meet reporting deadlines with confidence. That reliability frees your office to focus on value-add initiatives like strategic allocations, family governance, or new market entry.

- Thought leadership: We don’t just administer funds; we help shape back-office strategy. Our specialists assess your operational set-up and advise on process redesign, technology choices, and efficiency measures – helping you protect long-term advisory fees and build resilience as your family office grows in complexity.

- Built for alternatives: Alter Domus was created to serve private capital. From private equity and venture to private debt, infrastructure, and real estate, we understand the nuances of alternative assets and how to integrate them into family portfolios. That expertise ensures your reporting, governance, and investor communications reflect institutional-grade standards.

- Global scale with local relevance: With more than 6,000 professionals across 23+ jurisdictions, Alter Domus delivers the reach and regulatory expertise of a global leader. Crucially, we know how to apply that scale to the needs of smaller wealth managers and multi-family offices—bringing institutional-grade processes, controls, and insights to leaner teams without overburdening them.

- Technology advantage: Our purpose-built platforms reduce manual processing, harmonize data feeds, and deliver investor-ready reporting. For offices running lean teams, this alleviates the burden of system implementation and ongoing maintenance, while ensuring transparency and auditability.

- Operational assurance: From capital calls and waterfall allocations to audit coordination and compliance checks, we provide institutional-grade rigor. That strengthens your credibility with auditors, trustees, and co-investors—key for offices balancing family dynamics with professional governance.

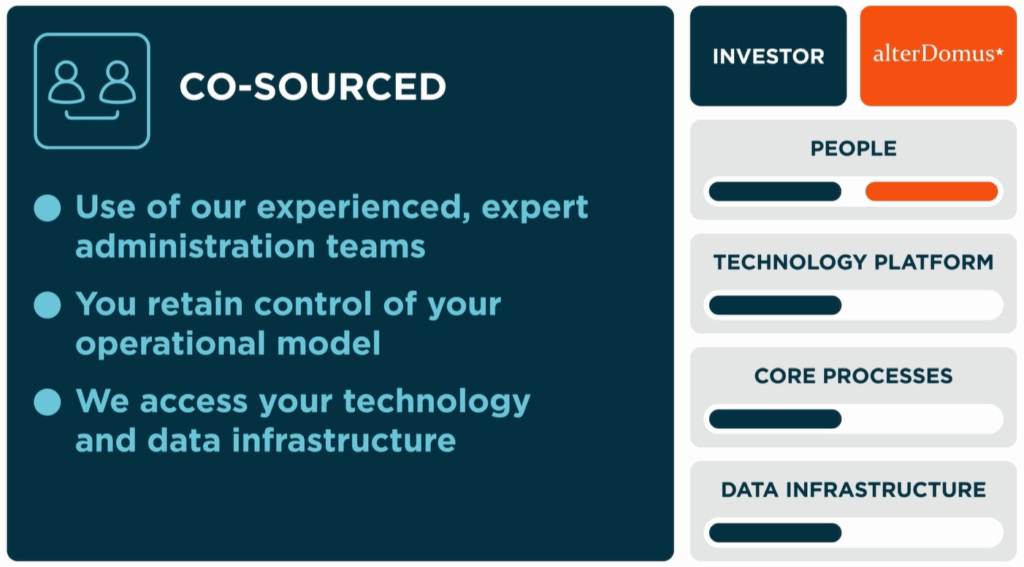

- Flexible engagement models: Whether you want a traditional outsourced solution, a co-sourced arrangement where you retain data ownership, or even a lift-out of existing in-house teams, Alter Domus tailors its approach to preserve continuity while enabling scale.

What this means for COOs and CFOs

As a COO or CFO, you sit at the heart of your company’s success. You’re tasked with ensuring both operational excellence and strategic foresight. We see what your peers are doing and understand which processes work.

In today’s complex landscape, outsourcing fund administration services is not about giving up responsibility—it’s about giving yourself the tools, expertise, and confidence to meet the family’s needs today and for generations to come.

Analysis

The Tax Challenge in Private Capital: How to Scale without Risk

Tax compliance in private capital has become a board-level issue. Rising regulatory demands, growing fund structures, and leaner teams leave managers with little room for error. The firms that adopt now will safeguard investor confidence and avoid costly setbacks.

Tax compliance in private capital has shifted from a back-office task to a board-level priority. Federal and state filings, 1065 partnership returns, K-1s, FATCA/CRS, and 1099 reporting all converge under strict deadlines — and investor confidence depends on getting them right. For many firms, the question is no longer if they can keep up, but how to do so without overburdening already stretched teams.

The Weight of Rising Tax Demands

As private capital funds grow, so do their filing obligations. Teams face an unrelenting tax cycle that requires accuracy, speed, and continuity. Yet many managers struggle with:

- Rising complexity: Multiple fund structures, investor demands, and cross-jurisdictional reporting.

- Limited capacity: Lean teams balancing tax alongside other operational responsibilities.

- Turnover risk: The loss of a single experienced professional can erase institutional knowledge overnight.

These pressures are magnified by shifting expectations. Regulators continue to expand cross-border requirements, while investors demand greater transparency and faster turnaround. What was once treated as a compliance function has become a visible measure of operational maturity — and firms that fall behind risk eroding investor trust.

Experience that Scales

Meeting these challenges requires a model that can handle scale without sacrificing quality. Alter Domus supports:

- 1,466 funds supported with tax services annually

- 1,200 Federal and State tax returns reviewed annually

- 435 funds supported with dedicated tax return reviews

- 300 funds served with FATCA/CRS filings

These numbers highlight more than just scale — they reflect the way managers are choosing to structure their tax function. Many continue to use a Big 4 firm for preparation, while relying on Alter Domus for reviews, coordination, and data management. This model reduces back-and-forth, ensures continuity year after year, and allows firms to expand without adding internal headcount.

A Smarter Model for Tax Support

The most effective models extend beyond outsourcing. They integrate seamlessly with existing tax preparers and in-house processes, acting as an extension of the manager’s team.

For many firms, the challenge isn’t who prepares the return — it’s the review and coordination around it. Some want to keep a Big 4 firm on preparation but lack the bandwidth or expertise to manage the process. Others have lost in-house tax staff and the knowledge that left with them.

Alter Domus’ tax review and data coordination services were built to fill this gap — offering fractional expertise that reduces back-and-forth with preparers, ensures continuity, and avoids the overhead of hiring full-time staff.

Priorities for Managers

Chief Financial Officers (CFOs) and Chief Operating Officers (COOs) in private capital face three key imperatives:

- Accuracy: Every return and report is thoroughly reviewed to the highest standard.

- Efficiency: Faster turnaround times through streamlined coordination with preparers.

- Compliance: Reliable 1065, FATCA/CRS, and 1099 reporting across jurisdictions.

Meeting these expectations requires more than capacity — it requires the right partnership.

A Partner for What Comes Next

Alter Domus combines deep private capital expertise with the scale and continuity today’s tax environment demands. Our teams don’t replace your preparers — we work alongside them, ensuring reviews are rigorous, data is coordinated, and deadlines are met without disruption.

By reducing the back-and-forth between administrators, preparers, and internal teams, we free managers to focus on growth while knowing investor expectations will be met. And as reporting requirements continue to tighten, we provide the stability to keep pace without adding internal headcount.

For private capital managers, tax isn’t slowing down. With Alter Domus, you don’t have to choose between accuracy, efficiency, and scale — you get them all.

Analysis

CFO Structures Explained: Bringing Transparency to a Complex Capital-Raising Tool

Learn how Collateralized Fund Obligations (CFOs) provide NAV liquidity and capital efficiency in private markets, and how Alter Domus enables execution.

Collateralized Fund Obligations (CFOs) have re-emerged as sophisticated capital-raising instruments at the intersection of private markets and structured finance. This resurgence reflects both private market managers’ search for liquidity solutions and institutional investors’ appetite for rated exposure to alternative assets.

CFOs serve as critical bridges between private equity fund managers seeking flexible capital and institutional investors requiring rated securities. As traditional financing avenues face pressure from sustained elevated interest rates, these structures have evolved from niche instruments to mainstream financing tools for sophisticated asset managers.

What are CFOs?

Collateralized Fund Obligations represent securitized portfolios of private fund interests, typically packaged into special purpose vehicles (SPVs) that issue tranched debt and equity securities. At their core, CFOs transform relatively illiquid limited partnership interests into structured products with varying risk-return profiles.

The fundamental architecture involves:

- Asset Pool: A diversified collection of fund interests spanning private equity, private debt, or other alternative assets.

- Tranched Capital Structure: Typically featuring senior notes (AAA/AA/A), mezzanine tranches (BBB/BB), and equity components.

- Cash Flow Waterfall: Predetermined distribution hierarchy prioritizing senior tranches.

- Rating Agency Oversight: Independent risk assessment from agencies like KBRA, Moody’s, and S&P.

The tranched structure creates investment options suitable for different risk appetites. Investment-grade senior notes appeal to insurance companies and pension funds, while subordinated tranches attract yield-focused investors comfortable with higher risk.

The equity piece typically remains with the sponsor or dedicated alternative investors seeking enhanced returns.

Why Sponsors Use CFOs to Unlock Capital

For private market managers, CFO structures provide multiple strategic advantages in today’s capital-constrained environment. One of the most significant benefits lies in their NAV financing capabilities.

According to Preqin’s Global Private Equity Report, private equity assets under management are projected to double from $5.8 trillion at the end of 2023 to approximately $12 trillion by 2029, reflecting sustained institutional confidence in alternative investments despite moderating growth rates.

Another advantage is capital recycling efficiency. By securitizing mature fund positions, managers can accelerate the return of capital to limited partners while still preserving potential upside.

CFO structures also expand investor access. By transforming alternative investments into rated securities, they make these products accessible to a wider base of regulated institutional investors.

Key Mechanics: How CFO Structures Work

Executing these mechanisms efficiently often requires fund administration services and fund regulatory reporting services to manage accounting, compliance, and investor reporting across underlying fund interests.

Similarly, tailored private equity fund solutions and private debt fund solutions help optimize structuring, NAV management, and investor communications.

- SPV Structure: The securitization process begins with establishing a special purpose vehicle that acquires the fund interests. This legal separation creates bankruptcy remoteness and enables the issuance of rated securities backed by the underlying portfolio.

- Tranching Process: The capital structure typically includes:

- Senior Secured Notes (60-75% of capital structure)

- Mezzanine Notes (10-20% of capital structure)

- Subordinated Notes/Equity (15-25% of capital structure)

- Waterfall Distributions: Cash flows cascade down the tranches in a predetermined order, with senior noteholders getting principal and interest first. This is what gives senior securities investment-grade ratings.

- Coverage Tests: Ongoing monitoring includes overcollateralization and interest coverage tests. These mathematical fences protect senior investors by siphoning off cash from junior tranches if the portfolio’s performance falls below certain thresholds.

- Reinvestment Period: Most structures have a 2-4 year reinvestment period during which the manager can recycle capital from realizations into new fund commitments, subject to eligibility criteria and portfolio constraints.

- Liquidity Facilities: To manage timing mismatches between fund cash flows and payment obligations, CFOs often include revolving credit facilities that provide short-term liquidity between distribution periods.

Challenges: Transparency, Ratings, and Reporting

Despite the benefits, CFOs present operational complexities that require special expertise to navigate.

Private markets are opaque. Private fund interests have irregular valuation periods, non-standard performance metrics, and limited secondary market price discovery. This opacity is a challenge for rating agencies, which have to assess credit quality with less frequent and standardized data than in traditional structured finance.

Disclosure restrictions add to the challenge. Limited partnership agreements often have confidentiality clauses that restrict position-level disclosure. Structuring teams have to create information frameworks that meet rating agency requirements while respecting contractual constraints.

Regulatory frameworks add another layer of complexity, with transatlantic divergence creating particular challenges for global managers. EU regulations (Securitisation Regulation and AIFMD) have different risk retention and disclosure requirements than US frameworks (Regulation AB and Dodd-Frank).

Unlike corporate bonds or mortgages, private equity distributions follow non-linear patterns driven by exit timing, recapitalisation, and manager discretion. Modelling these cash flows requires advanced forecasting capabilities that combine quantitative analysis with qualitative judgement.

How Alter Domus Delivers CFO Success

The operational infrastructure required to support the CFO goes beyond traditional fund administration. As CFOs have become more complex, savvy managers recognize that execution excellence requires a partner with private markets knowledge and structured finance expertise.

Alter Domus has become a market leader in this space, having closed over 35 CFOs across North America and Europe. This track record reflects the firm’s integrated approach to managing these complex instruments throughout their lifecycle.

At the foundation is a fund-of-funds accounting expertise. Unlike traditional funds, CFOs require multi-layered accounting frameworks that track cash flows from underlying investments through the SPV and ultimately to security holders. This means specialized systems that can handle the accounting nuances at each level—from recognizing distributions and valuing fund positions to calculating payment obligations across the tranched securities.

The waterfall calculation engine is perhaps the most critical component. These algorithms manage the priority of payments with institutional-grade precision, so cash is distributed exactly as per indenture. The complexity of these waterfalls increases exponentially when you add features like PIK (payment-in-kind) interest, coverage test remediation and reinvestment criteria.

We offer fund administration services, fund regulatory reporting services, and specialized private equity and private debt fund solutions, ensuring that complex NAV calculations, cash flow waterfalls, and reporting obligations are managed accurately and efficiently.

If you’re considering a CFO structure, this operational foundation doesn’t just support execution—it gives you an edge. By outsourcing the complexity to a partner with private markets knowledge and structured finance expertise, you can focus on portfolio and investor relationships.

Conclusion

Collateralized fund obligations are powerful but complicated capital-raising tools for private market managers. When done right, they create win-win outcomes for sponsors looking for flexible liquidity, investors looking for rated exposure to alternatives, and limited partners looking for accelerated recycling.

The market is accelerating, with innovation in underlying assets, structure, and investor engagement models. CFOs will become more common in alternative investments as private market NAV keeps going up through 2025 and beyond.

But they are complicated. The operational intricacies of fund securitization require partners with in-depth experience in private markets, structured finance, and regulatory frameworks. With the right guidance, these instruments can go from complicated to a strategic advantage for sophisticated players.

Disclaimer: THIS MATERIAL IS PROVIDED FOR GENERAL INFORMATION ONLY, DOES NOT CONSTITUTE INVESTMENT ADVICE, AND PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

Insights

Analysis

The Credit Middle Office: Navigating Complexity in a Competitive Market

Escalating regulatory demands, accelerated settlement cycles, and increasingly intricate deal structures are compelling credit managers to strengthen their middle office infrastructure as a strategic priority.

Credit markets have entered a phase of rising complexity. Competitive pressure, evolving regulatory requirements, and increasing operational demands now make an efficient, robust middle office infrastructure a strategic imperative for private markets managers.

Since the height of post-crisis bank retrenchment, private credit and broadly syndicated loan (BSL) markets have filled much of the gap. Managers today are working with increasingly intricate structures—unitranche, hybrid financings, NAV loans, leveraged loans with complex covenant packages—each of which places heavier demands on operations. At the same time, investor expectations around speed, transparency, and data consistency are higher than ever.

Drivers of complexity

- Shorter settlement cycles and tighter turnarounds. U.S. markets have already transitioned to T+1 settlement, compressing reconciliation, trade capture, and cash settlement timelines. Delays or errors are far less forgivable in this environment.

- Regulatory and disclosure pressures. ESG reporting, borrower-reporting requirements, increased focus on transparency, and heightened regulatory oversight are placing new burdens on middle offices.

- Volume and diversity of instruments. Managers are handling more deals per year, across more jurisdictions, with different structures—unitranche, participation interests, hybrid debt, multiple servicer arrangements—each introducing unique reconciliation and risk-management challenges.

- Fragmented systems and manual workflows. Silos across front, middle, and back offices, inconsistent data feeds, and lack of real-time visibility multiply operational risk. Duplicate work, delayed reporting, and mismatched data remain common pain points.

What effective middle office support looks like

To manage this complexity without ballooning costs or risk, many firms are partnering with specialist providers offering scalable, tech-enabled middle office services. Effective support often includes:

- Loan and Agency Services — Full loan accounting, agency or sub-agency responsibilities, servicing of covenant and structural tests, notices, interest and principal payments.

- Monitoring and Reporting — Harmonizing borrower data, standardized and bespoke reporting (financial, ESG, compliance), custom dashboards, regulatory disclosures.

- Trade Capture and Settlement — Ensuring trades are captured accurately, settled on time, correct counterparties engaged, complex or distressed trades handled properly.

- Technology Integration and Automation — Proprietary platforms and data pipelines that reduce manual touchpoints, maintain an auditable “golden copy” of loan data, and support cross-jurisdiction operations.

- Process Design and Risk Management — Workflow standardization, reconciliation procedures, audit controls, error mitigation practices, and alignment of operating models with regulatory expectations.

Why it matters strategically

In 2025, the middle office is no longer just about cost efficiency—it is about operational resilience, competitive differentiation, and investor trust. Firms unable to keep pace with settlement, reporting, or regulatory expectations risk lost deals, higher costs, reputational damage, or worse.

A strong middle office backbone allows credit managers to focus on what they do best: sourcing, underwriting, and structuring. Meanwhile, operations can be confident that deals are administered, data is reliable, and risks are identified early.

Alter Domus: a proven operational backbone

Alter Domus combines scale, expertise, and technology to help managers meet these challenges head-on. With a global team of 6,000 professionals across 23 jurisdictions, we bring consistency across time zones and markets. Our role administering more than $3.5 trillion in assets reflects both the trust placed in us by leading credit managers and our ability to deliver at scale. Beyond the numbers, what truly sets Alter Domus apart is the strength of our integrated platform: proprietary technology, deep market knowledge, and a service model designed to simplify complexity and give managers confidence in their operations.

Insights

Analysis

What is a company secretary? Navigating Jurisdictional differences across Europe

The role of the company secretary is central to ensuring compliance, governance, and smooth corporate operations, yet its definition and legal standing vary widely across Europe. This article explores the jurisdictional differences between common law and civil law countries, and why clarity on governance responsibilites is vital for multinational organizations.

Have you ever wondered who ensures a company maintains its good standing while navigating the complex landscape of corporate governance? That’s where a company secretary comes in—a strategic position responsible for ensuring that a company complies with various statutory and regulatory requirements while playing a central role in the smooth administration of a company entity.

The company secretary is an organization’s governance pillar, a role that is frequently misunderstood as solely administrative but actually includes significant strategic responsibilities. With the increasing focus on corporate governance, the company secretary is considered the guardian of the company’s compliance with both good governance practices and the law.

Think of the company secretary as the invisible force that keeps the corporate machine running smoothly, ensuring board meetings happen on schedule, statutory filings are submitted on time, and shareholders stay informed about company affairs.

The Three Pillars of Company Secretarial Responsibilities

The role of a company secretary can encompass all areas of a company’s activities, depending on the size and nature of the organization. These activities typically fall into three principal categories:

1. The Board

The company secretary ensures proper board procedures are established and followed, prepares and circulates board materials, and provides practical guidance to directors. They serve as a crucial advisor on governance matters, keeping the board informed of relevant legislative and regulatory changes.

2. The Company

A fundamental aspect of the role of company secretary involves maintaining statutory registers, organizing board and shareholder meetings, preparing minutes, and ensuring the company complies with all applicable legal and regulatory requirements. This includes managing annual returns, coordinating statutory filings, and overseeing changes to company structures.

3. The Members (Shareholders)

The company secretary often serves as the primary point of contact between the company and its shareholders, ensuring effective information flow and communication. They facilitate dialogue between the board, shareholders, and other stakeholders, promoting transparency and accountability.

Jurisdictional Differences: Common Law vs. Civil Law Approaches

Did you know that the role and legal requirements of a company secretary vary significantly across European jurisdictions? This variation primarily stems from differences between common law and civil law systems.

Common Law Jurisdictions (UK, Ireland)

In common law jurisdictions like the United Kingdom and Ireland, the company secretary role is integrated into company law and treated as a formal function. This officer, usually appointed by the Board, has extensive duties and responsibilities including statutory filings, compliance, board governance, shareholder communication, and transactional support.

In the United Kingdom, public companies must appoint a company secretary, while private companies may choose to do so. The position can be filled by either an individual or a corporate body. UK company secretaries are responsible for statutory filings with Companies House, board governance, and shareholder communication.

Similarly, in Ireland, all companies must have a company secretary. The role focuses on statutory compliance, transaction management, and filing obligations with the Companies Registration Office (CRO).

Common Law Jurisdictions (Luxembourg, France, Germany)

In contrast, civil law jurisdictions like Luxembourg, France, and Germany rarely reference the company secretary role directly in company law. These responsibilities are typically handled by a law firm or an in-house legal/paralegal expert (sometimes called a “jurist”).

Luxembourg presents an interesting case study in the evolution of the company secretary role. While no formal legal requirement exists for a company secretary, the function has gained recognition through the efforts of organizations like the Luxembourg Institute of Governance (ILA). The role typically focuses on board administration, maintaining legal records, and liaising with the Registre de Commerce et des Sociétés (RCS) when applicable.

France and Germany similarly have no specific statutory position of company secretary in their corporate law. Governance and compliance duties are often divided among legal counsel, managing directors, and external advisors.

However, the landscape is evolving. With global investors increasingly concerned about Environmental, Social, and Governance (ESG) practices, we’ve seen movements in some civil law jurisdictions toward creating formal governance professional roles. For example, the Luxembourg Institute of Directors has created the “Corporate Governance Officer” certification for professionals in governance functions.

Why being clear on who holds the corporate governance responsibilities matters

For companies operating across multiple jurisdictions, being clear on who is responsible for the corporate governance responsibilities and understanding the jurisdictional differences isn’t just an academic exercise—it’s a business necessity. Failing to meet local corporate compliance requirements can lead to:

- Regulatory finds and penalties

- Delayed transactions

- Loss of good standing or legal personality

- Significant reputational risk

The Strategic Value of Corporate Secretarial Service Providers

The fragmented regulatory landscape across Europe creates significant governance challenges for multinational organizations. As regulatory scrutiny intensifies and corporate structures grow more complex, businesses increasingly recognize that maintaining in-house expertise across multiple jurisdictions is both inefficient and risky and look for third-party providers support.

These providers offer several key advantages:

- Jurisdictional Expertise: They possess in-depth knowledge of local requirements across different European countries. This expertise extends to intricate regulatory nuances that vary significantly between jurisdictions and enables multinational organizations to navigate complex compliance landscapes with confidence.

- Consistency: They can maintain uniform governance standards across multinational corporate structures. This standardization creates operational efficiency while still allowing for necessary jurisdictional adaptations to local regulations.

- Risk Mitigation: Their expertise helps prevent compliance failures and governance lapses. By implementing proactive monitoring systems and conducting regular governance audits, they identify potential issues before they escalate into serious problems.

- Resource Efficiency: Outsourcing reduces the administrative burden on internal teams. This allows corporate staff to focus on strategic initiatives rather than routine compliance tasks that require specialized knowledge.

- Access to Specialized Knowledge: They employ qualified professionals with extensive experience in governance matters. These specialists bring cross-industry insights and best practices that enhance corporate governance beyond mere compliance.

As corporate governance continues to evolve across Europe, the company secretary role is gaining further prominence, even in jurisdictions where it currently lacks formal recognition.

Conclusion: The universal importance of governance

While not every jurisdiction mandates a designated company secretary, the fundamental responsibilities of regulatory adherence, administrative coordination, and governance oversight remain critical operational necessities.

Whether you hire someone in-house or outsource, ensuring robust company secretarial support is key to operating legally, efficiently, and with good governance across Europe.

Secure your organization’s future with governance expertise that transforms compliance from a challenge into a competitive advantage. The time to enhance your corporate governance framework is now, your stakeholders and bottom line will thank you.

References

1 Companies Act 2006, c. 46, § 271-273. (2006). UK Public General Acts. https://www.legislation.gov.uk/ukpga/2006/46/part/12/chapter/1

2 Companies Act 2014, § 129. (2014). Irish Statute Book. http://www.irishstatutebook.ie/eli/2014/act/38/enacted/en/html

3 Luxembourg Institute of Gvernance. (2023). Corporate Governance Officer certification. https://www.ila.lu/education/certified-programs/certified-programs-description/corporate-governance-officer

Insights

Analysis

Audit Season Stress: Why High-Touch Fund Administration Matters

The vital role of attentive fund administration services in minimizing stress, addressing auditor inquiries, and safeguarding operational efficiency during audit season.

For asset managers, audit season is more than a routine compliance exercise—it is a critical period where operational precision, regulatory adherence, and investor transparency are all under the microscope. Even well-run funds can feel pressure during this time: schedules tighten, audit teams request detailed reconciliations, and reporting must be flawless across multiple fund structures and geographies.

For managers working with fund administrators who take a tech-first, low-touch approach, these challenges are magnified. While technology can streamline reporting and data aggregation, it cannot on its own replace proactive, hands-on guidance. Additionally, administrators with low or varying service quality may struggle to scale up or adapt to clients’ changing needs, further complicating the audit process.

The most common stress points exacerbated by a lack of high-touch support include:

- Delayed responses to audit inquiries: Solely tech-driven platforms often prioritize automated workflows over real-time human support. When auditors raise questions—whether about NAV adjustments, intercompany transactions, or fee calculations—delays in response can cascade into last-minute escalations.

- Limited visibility into complex structures: Private funds often have multi-class shares, co-invest vehicles, or feeder funds spanning multiple jurisdictions. Without a dedicated team that understands these nuances, managers risk receiving incomplete or confusing reports, increasing the potential for audit findings or rework.

- Incomplete reconciliations: Automated reporting can handle standard positions and cash flows, but unusual transactions—such as NAV loans, secondary trades, or FX adjustments—require expert judgment. Low-touch models can miss these, leaving managers responsible for manual corrections under tight deadlines.

- Reactive problem-solving: Tech-first providers often wait for issues to surface before addressing them. In contrast, high-touch administrators anticipate anomalies—spotting missing documents, reconciling prior period adjustments, and preparing schedules proactively to minimize disruption.

- Pressure on internal teams: When administrators are unavailable or lack deep operational knowledge, fund teams must shoulder the burden—preparing reconciliations, chasing auditors, and addressing exceptions—diverting time from strategy and investor engagement.

Managing risk

A high-touch fund administration model mitigates these risks. Dedicated teams with deep operational knowledge and experience across fund structures:

- Serve as a single point of contact for audit and regulatory queries, ensuring timely, accurate responses.

- Prepare detailed pre-audit schedules, including cash reconciliations, capital call and distribution statements, and third-party confirmations, as an integral part of our service delivery—without additional costs or requests. This high-touch service is embedded directly into our offering, ensuring that clients receive the support they need without added stress.

- Coordinate across custodians, prime brokers, and portfolio managers to reconcile positions and verify valuations.

- Anticipate unusual or complex items, such as subscription line loans, multi-jurisdictional tax considerations, or NAV adjustments for illiquid assets, reducing last-minute surprises.

- Provide transparent, customizable reporting tailored to the needs of auditors, investors, and internal management.

Ultimately, the difference between a stressful audit and a smoothly managed one comes down to the support model. Technology is essential, but human expertise, proactive guidance, and a relationship-driven approach ensure accuracy, efficiency, and peace of mind.

At Alter Domus, we combine leading-edge operational platforms with white-glove service. By integrating technology with hands-on support, we help asset managers navigate audit season confidently reducing risk, freeing internal resources, and delivering the reliability that investors and auditors demand.

Insights

Analysis

Tech’s Impact on Fund Admin Services

Explore how tech is reshaping fund administration through automation, APIs, and smart ops. Discover what GPs and COOs should prioritize in 2025.

The investment landscape has shifted dramatically, with fund administrators facing rising investor expectations, regulatory complexity, and market volatility. Traditional approaches no longer suffice.

Investors now demand greater transparency, faster reporting, stronger security, and lower fees—making technology the key differentiator between administrators that thrive and those that fall behind.

Most wealth managers already rely on digital platforms—94% of firms with $500M+ in assets and 61% of smaller firms use fintech to improve client engagement and efficiency.1 The question is no longer whether to adopt new technology, but how quickly and effectively it can be deployed to transform operations.

How Technology Is Transforming Fund Administration

From spreadsheets to smart systems

The journey from manual processes to intelligent automation represents perhaps the most significant shift in fund administration technology. Historically, fund administrators relied heavily on spreadsheets and manual data entry—approaches that were not only time-consuming but prone to human error.

Modern fund administration technology has evolved to replace these outdated methods with integrated systems that automate routine tasks. Advanced platforms now handle everything from NAV calculations to investor communications with minimal human intervention. This transition eliminates the bottlenecks associated with manual processing while dramatically reducing error rates and improving overall efficiency.

Digitization of workflows and document handling

Document management has traditionally been one of the most labor-intensive aspects of fund administration. The digitization of workflows and document handling represents a quantum leap forward, enabling administrators to process, store, and retrieve critical information with unprecedented speed and accuracy.

The benefits extend beyond mere efficiency. Digital workflows create audit trails that enhance compliance and security while reducing the risk of document loss or unauthorized access. For fund managers and investors alike, this translates to greater confidence in the integrity of administrative processes.

Role of APIs in real-time data sharing

Application Programming Interfaces (APIs) have revolutionized how fund administration systems interact with each other and with external platforms. By enabling seamless data exchange between previously siloed systems, APIs create a connected ecosystem that supports real-time information sharing and processing.

This connectivity allows fund administrators to integrate with banking platforms, trading systems, and investor portals, creating a unified experience for all stakeholders. Rather than waiting for batch processing or manual reconciliations, information flows continuously between systems, enabling near-instantaneous updates and reporting.

Benefits for GPs and Operations Teams

The power of RNFs becomes clear when comparing SCR requirements. Consider two scenarios:

Faster, more accurate investor reporting

Perhaps the most tangible benefit of fund administration technology is the transformation of investor reporting. Traditional reporting cycles often stretched over weeks, with manual data collection and verification creating significant delays. Today’s technology-enabled administrators can compress these timelines dramatically, delivering accurate reports in days or even hours. 81% of clients using fintech platforms in 2025 report higher satisfaction from greater transparency and easier access to investment data.1

This acceleration doesn’t come at the expense of quality. In fact, automated data processing and validation actually enhance accuracy by eliminating human errors and ensuring consistent application of accounting principles. Whether you’re a venture capital fund administration or managing traditional vehicles, digital tools compress reporting cycles from weeks to hours.

Improved scalability for fund growth

Traditional fund administration models faced inherent limitations when it came to scaling operations. Adding new funds or investors typically requires proportional increases in staffing and resources, creating operational challenges and cost pressures during periods of growth.

Modern fund administration technology breaks this linear relationship between growth and resource requirements. Cloud-based fund administration services can scale elastically as you grow—from managing a single fund in-house to migrating fund admin activities to a third-party platform. This enables administrators to support fund managers through growth phases without service disruptions or quality compromises.

Better risk management and compliance readiness

The regulatory landscape for investment funds continues to grow more complex, with new requirements emerging across jurisdictions. Fund administration technology has evolved to address this challenge through automated compliance monitoring and regulatory reporting capabilities.

Advanced systems now use regulatory rules engines to continuously monitor transactions and positions, flagging potential compliance issues early for proactive remediation. This reduces risk and workload for operations teams, replacing manual tracking and sampling with automated, comprehensive monitoring.

Comparing Traditional vs. Tech-Enabled Models

Manual bottlenecks vs. automated efficiency

The contrast between traditional and technology-enabled fund administration is clearest in operational bottlenecks. In conventional models, tasks like month-end reconciliations, NAV calculations, and investor distributions often create backlogs demanding all-hands-on-deck efforts.

Tech-enabled administrators remove these bottlenecks through automation. Reconciliations that once took days now finish in hours or minutes, with only exceptions flagged for review. NAV runs on set schedules with little manual input, and distributions flow through straight-through processes.

This shift goes beyond speed—it reshapes fund administration. Instead of routine data processing, teams now focus on exception handling, client relationships, and value-added analysis.

Fragmented systems vs. integrated platforms

Traditional fund administration relied on separate systems for accounting, investor services, compliance, and reporting, leading to integration issues, data inconsistencies, and poor user experiences.

Modern platforms take an integrated approach, spanning all functions to ensure data consistency, streamline workflows, and deliver a cohesive experience. With all data stored in a single ecosystem, administrators can produce comprehensive reports and analytics without the transformation challenges of fragmented systems.

What to Look for in a Technology-Forward Partner

Infrastructure maturity, flexibility, and security

When selecting a fund administrator, prioritize technology infrastructure. Leading partners invest in enterprise-grade platforms that combine reliability, flexibility, and strong security.

Mature infrastructure ensures uptime, processing power, disaster recovery, and robust change management to prevent disruptions. Flexible platforms support diverse fund types, complex structures, and a wide range of asset classes, including alternatives.

Security is critical amid rising cyber threats. Top administrators deploy encryption, multi-factor authentication, access controls, and continuous monitoring, while maintaining SOC 2 and ISO 27001 compliance.

Ability to scale with complex fund structures

As investment strategies grow more sophisticated, fund structures have become increasingly complex. When considering In-house vs third-party fund administration, look for providers whose platforms already support complex structures like master-feeder and venture capital fund administration.

These systems also scale to diverse investor needs, managing varied fee arrangements, tax treatments, reporting requirements, and side letters, ensuring all investor-specific provisions are accurately implemented and documented.

Conclusion

The technological revolution in fund administration represents both a challenge and an opportunity for investment managers. Those who partner with technology-forward administrators gain significant advantages in operational efficiency, investor satisfaction, and regulatory compliance.

As we look toward the future, tech like AI and machine learning will continue to enhance automation capabilities, while blockchain[1] and distributed ledger technologies may fundamentally transform transaction processing and verification. Data analytics will grow more sophisticated, providing deeper insights into portfolio performance and investor behavior.

For fund managers navigating this evolving landscape, the choice of a fund administration service provider has never been more consequential. By selecting providers with robust, flexible technology platforms and demonstrated commitment to innovation, they can ensure that their administrative capabilities remain aligned with their strategic ambitions—today and into the future.

Disclaimer: THIS MATERIAL IS PROVIDED FOR GENERAL INFORMATION ONLY, DOES NOT CONSTITUTE INVESTMENT ADVICE, AND PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

Insights

Analysis

Evolving Operations: The Rise of Co-Sourcing in Private Markets

Co-sourcing is increasingly being seen as a viable operational model by asset managers. In this article, we break down the fundamentals of co-sourcing, and outline the factors driving its adoption.

Staying in Control

How do private markets firms scale operations while maintaining control? It’s a challenge facing CFOs, COOs, and fund controllers as the industry grows in scale and sophistication.

Over the past decade, private capital has become a mainstream asset class, with managers handling larger, more complex portfolios across diverse jurisdictions. The introduction of new fund structures—like continuation vehicles and co-investments—has expanded the toolkit for general partners (GPs) but also intensified operational demands amid rising regulatory pressures and limited partner (LP) expectations.

Eight Drivers of Co-Sourcing In Private Markets

A 2024 Private Markets Insight Report by Allvue Systems reveals that 84% of private capital firms plan to re-evaluate their operating models within the next 12–18 months, with modular co-sourcing as a key focus. Similarly, 88% of managers at the Fund Operator Summit Europe are exploring outsourcing or co-sourcing in operational areas, particularly in reporting and support functions. Here, we explore the driving forces behind the growing adoption of co-sourcing.

1. Complexity outpaces legacy models

Firms manage more funds, across more jurisdictions, for increasingly diverse investors. Co-sourcing provides the flexibility and transparency needed to navigate this complexity.

2. Control without Overhead

Managers want to own their data, systems, and client relationships—without carrying the full operational load. Co-sourcing allows firms to retain oversight while shifting execution to trusted partners.

3. Scalable without compromise

As strategies multiply and reporting timelines tighten, operational needs fluctuate. Co-sourcing provides institutional-grade support that flexes with demand, without overcommitting to permanent hires.

4. Enhanced governance and risk management

Regulators demand clear accountability on vendor oversight and operational continuity. Co-sourcing provides transparency into workflows, responsibilities, and data flows, strengthening governance.

5. Rising regulatory burden

SEC Form PF updates, AIFMD filings, ESG disclosures, and tax transparency rules require greater frequency and granularity in reporting. Co-sourcing ensures consistency and accuracy across jurisdictions.

6. Growing LP expectations

Investors want richer insights into performance, fees, and portfolio exposures—delivered faster. Co-sourcing gives managers the back-office strength to meet these expectations while retaining control of the client narrative.

7. Data and platform ownership

Unlike traditional outsourcing, co-sourcing ensures managers keep ownership of their platforms and data, while partners integrate into existing systems to maintain continuity and reduce transition risks.

8. Talent scarcity

Specialist skills in fund operations—such as waterfall calculations or jurisdiction-specific compliance—remain hard to source. Between 2020 and 2022, the U.S. lost more than 300,000 accounting professionals. Co-sourcing provides immediate access to expertise without lengthy recruitment cycles.

Co-Sourcing Overview

To address these challenges, many fund managers are shifting towards a hybrid co-sourcing approach, allowing them to retain control over their systems and client experience while leveraging specialist partners for precise execution.

Ready to transform your operating model?

Co-sourcing with Alter Domus offers General Partners a tailored approach that combines internal oversight with the executional strength of a specialist partner.

Our consultative model allows you to define the scope of support that best fits your unique operational needs, whether it’s fund accounting, capital activity, or regulatory reporting.

By maintaining system continuity and establishing strong governance, we empower your internal teams to focus on strategy while we handle execution efficiently.

Experience the benefits of enhanced operational resilience, regulatory readiness, and access to deep industry expertise.

Contact us today to explore how co-sourcing can elevate your business.

"*" indicates required fields

Insights

Analysis

Co-Sourcing with Alter Domus: A Custom Approach for General Partners

Alter Domus understands that every General Partner has unique operational needs, which is why we offer tailored co-sourcing strategies to enhance efficiency and maintain control. Our expertise allows clients to focus on strategic growth while we manage execution and ensure regulatory compliance.

In the dynamic landscape of private markets, every General Partner (GP) has unique operational needs and preferences. At Alter Domus, we understand that a one-size-fits-all model simply doesn’t work. Instead, we adopt a consultative approach, collaborating with each client to define a co-sourcing strategy that aligns with their specific requirements.

Whether it’s supporting a single process like Form PF reporting or managing full fund accounting cycles within the client’s infrastructure, our flexibility ensures that we meet diverse operational contexts.

Here are some examples of how we empower GPs through customized services and expertise:

Typical Capabilities Include:

- Fund Accounting: We prepare books and records using the client’s technology platform, with workflows designed for dual review and sign-off.

- Capital Activity: We calculate and format capital calls, distributions, and notices, while clients retain approval rights and manage LP communications.

- Regulatory Reporting: Our teams collect, map, and format data to comply with evolving requirements.

By partnering with us, internal GP teams can concentrate on oversight and strategy, while our dedicated professionals manage execution within a clearly defined control framework.

Making the Shift: Practical Considerations:

Transitioning to a co-sourcing model doesn’t mean overhauling existing systems or starting from scratch. With years of implementation experience, we guide clients through a structured transition focused on clarity, integration, and flexibility.

Through our extensive work with clients, we’ve identified three key building blocks essential for unlocking the full potential of a co-sourced operating model:

1. Define the right scope: We pinpoint operational areas under pressure, such as:

- Fund closings and reconciliations

- Capital statements and investor notices

- Data preparation for regulatory reporting

- Waterfall modeling and fee calculations

2. Maintain System Continuity: Clients keep their platforms while we securely integrate into their ecosystem, ensuring a single source of truth and avoiding fragmentation.

3. Establish Strong Governance: We align with each client’s compliance and oversight model, ensuring clear roles, documentation, and audit trails. Managers retain ultimate responsibility, while our teams execute defined workflows according to agreed service-level agreements (SLAs).

Figure 1 – The Benefits of Co-Sourcing with Alter Domus

| Benefit | How it Helps |

|---|---|

| Internal Oversight | Control over systems, data, policies, and approval processes remains in-house |

| External Execution | Alter Domus executes defined tasks at scale, with speed, accuracy, and rigor |

| Data Ownership | Clients maintain full ownership of their infrastructure and data environment |

| Regulatory Readiness | Respond to changing rules with agile support and specialist knowledge. |

| Investor Responsiveness | Meet LP reporting demands faster and more consistently. |

| Operational Scalability | Expand or contract support without internal hiring constraints. |

| Access to Talent | Tap into deep experience across private equity, private credit, and real assets |

Co-Sourcing: A Model for Long-Term Resilience

For private markets managers, operational resilience transcends mere business continuity; it’s about forging systems and partnerships that can adapt and thrive in an increasingly complex environment. Co-sourcing provides the perfect balance: the stability of internal oversight combined with the executional strength of a specialist partner.

At Alter Domus, we view co-sourcing as a strategic decision rather than just a service model. It empowers asset managers to focus on what truly matters: creating value for investors, meeting regulatory expectations, and growing with confidence.

If you’re reevaluating your operating model or exploring how co-sourcing could enhance your structure, we’re here to assist. Alter Domus has extensive experience supporting transitions of all sizes and complexities—whether you’re managing a single strategy or adding new strategies.

Ready to transform your operating model?

Our consultative model allows you to define the scope of support that best fits your unique operational needs, whether it’s fund accounting, capital activity, or regulatory reporting.

By maintaining system continuity and establishing strong governance, we empower your internal teams to focus on strategy while we handle execution efficiently.

Experience the benefits of enhanced operational resilience, regulatory readiness, and access to deep industry expertise.

Contact us today to explore how co-sourcing can elevate your business.

"*" indicates required fields

Insights

Analysis

Looking to incorporate a Securitisation Vehicle? Here’s what you need to know

Securitisation vehicles are powerful tools that enhance liquidity, optimize risk management, and streamline capital structures. We explore how understanding their complexities can equip you to unlock financial opportunities and stay ahead in today’s evolving markets.

Securitisation has become an indispensable tool for institutions, asset managers, and asset owners. This sophisticated financial instrument offers a powerful trifecta: effective risk management, enhanced liquidity, and streamlined capital structures.

For those contemplating the incorporation of a securitisation vehicle, a comprehensive grasp of this intricate yet potentially lucrative process is crucial. By mastering its complexities, you’ll gain the confidence to navigate challenges adeptly and fully harness the myriad benefits securitisation offers, positioning yourself at the forefront of modern financial strategy.

What is Securitisation and why is important?

Securitisation is the process of pooling various types of financial assets, such as loans, mortgages, or receivables, and converting them into marketable securities. These securities are then sold to investors, allowing the originators to free up capital and manage risk more effectively. The cash flows generated from the underlying assets are used to pay interest and principal to the investors.

During 2017 and 2018, the European Union set up rules for securitisations. The goal was to bring the EU securitisation market back to life while also addressing worries about risky practices that had threatened stability after the global financial crisis of 2008. Since it entered into force in 2019-2020, the framework has strengthened investor protection, transparency, and financial stability.1

The European Commission has recently taken steps to revitalize the EU’s securitisation framework to make it simpler, more effective, and supportive of economic growth. These initiatives are part of the savings and investments union strategy, which focuses on improving the way the EU financial system works to boost investment and economic growth across Europe.

Benefits of Securitisation

Enhanced Liquidity

By converting illiquid assets into tradable securities, institutions and originators can access capital markets and improve their liquidity position. This transformation allows entities to free up resources that can be used for further lending to EU citizens and enterprises.

Risk Management

Securitisation allows for the transfer of risk from the originator to investors, which can help in managing credit risk and regulatory capital requirements. The main goal is to enable banks and other financial institutions to use the loans and debts they grant or hold, pool them together, and turn them into different types of securities that investors can purchase.

Cost Efficiency

Securitisation can lead to lower funding costs compared to traditional financing methods, as it often allows for better pricing based on the risk profile of the underlying assets. Recent EU reforms aim to simplify unnecessarily burdensome requirements and reduce costs to encourage more securitisation activity.

Diversification of Funding Sources

By tapping into the capital markets, institutions can diversify their funding sources and reduce reliance on bank financing. This diversification is particularly important in today’s volatile economic environment.

Regulatory Benefits

In some jurisdictions, securitisation can provide regulatory capital relief, allowing institutions to optimize their balance sheets. The European Commission’s recent proposals have estimated a reduction in capital requirements by one-third for senior securitisation tranches, which should encourage new issuances in member states where activity has been limited.

Key Considerations before incorporating a Securitisation Vehicle

The European securitisation market operates under the EU Securitisation Regulation (EUSR), introduced in January 2019 as part of a comprehensive regulatory response to the Global Financial Crisis.

The Securitisation Regulation amendments aim to reduce operational burdens by simplifying transparency requirements, with plans to cut reporting fields by at least 35%. The revisions introduce more proportionate, principle-based due diligence processes, eliminating redundant verification steps when the selling party is EU-based and supervised.

Notably, the requirement for Simple, Transparent and Standardised (STS) securitisations has been modified to consider pools containing 70% SME loans as homogeneous, facilitating cross-border transactions and enhancing SME financing opportunities.2

Choosing the right jurisdiction

Selecting the appropriate jurisdiction for your securitisation vehicle is a critical strategic decision that impacts regulatory compliance, tax efficiency, and operational flexibility. Several European jurisdictions offer competitive frameworks for securitisation vehicles, each with distinct advantages depending on your specific transaction objectives.

The optimal jurisdiction ultimately depends on multiple factors: the location and type of underlying assets, your investor base, anticipated transaction complexity, and specific business objectives. Regulatory changes, such as the EU Securitisation Regulation, have created a more harmonized framework across Europe, though important jurisdictional nuances remain that can significantly impact transaction efficiency.

Structuring the vehicle

Decide on the structure of the securitisation vehicle. Common structures includes:

- Securitisation Undertaking: A corporate entity specifically designed for securitisation transactions

- Securitisation Fund: Similar to an investment fund, but specifically for securitisation assets

- Fiduciary Structures: Where assets are held by a fiduciary for the benefit of investors

These structures are designed to isolate financial risk and facilitate the issuance of securities. You can choose a bankruptcy-remote structure with a Dutch Stichting or a Jersey Trust, which are most commonly used, or incorporate a vehicle using an entity in your group.

Legal & Tax Implications

You’ve made the strategic decision to incorporate a securitisation vehicle—now it’s time to navigate the complex legal and tax landscape that comes with it. Have you considered how different jurisdictional choices might impact your bottom line?

Legal and tax considerations aren’t just compliance checkboxes. They’re powerful levers that can dramatically enhance your securitisation structure’s efficiency. Engaging specialized advisors early in your planning process to avoid costly restructuring later.

By strategically selecting your jurisdiction and structure based on your specific assets and investor profile, you can create a tax-efficient vehicle that maximizes returns while maintaining full compliance.

Servicing and Management

Establish a reliable servicing and management framework for the transaction. Effective management and administration of the vehicle by an experienced partner is critical to ensure the correct execution of the transaction.

As the legislative changes removed restrictions on leverage and the nature of the securities permitted as collateral, the SV can now enter into a facility with a credit institution. This is required to acquire the full amount of the contemplated investments, providing greater certainty to the market.

Conclusion

Incorporating a securitisation vehicle represents a strategic opportunity for financial institutions and asset managers seeking to optimize their capital structures, enhance liquidity, and manage risk effectively. The European securitisation market, with its evolving regulatory framework, offers sophisticated mechanisms to achieve these objectives when properly structured.

Partnering with an experienced service provider gives you access to specialized knowledge from structuring and incorporation to efficient implementation and execution to vehicle liquidation.

This collaboration enables you to navigate jurisdictional complexities with confidence, ensure regulatory compliance across borders, and optimize your structure for maximum efficiency and investor appeal. Such expertise has become not merely beneficial but essential for institutions seeking to leverage the full potential of securitisation.

Securitisation is complex and you shouldn’t have to manage it alone. At Alter Domus, we simplify the process with end-to-end expertise, from transaction closing through administration and up to liquidation. With us as your partner, you can focus on strategy and investors while we take care of execution.

Contact us today to learn about how you can unlock of the full potential of securitisation with Alter Domus.