Infrastructure

Venture Capital

Real Assets

Private Equity

Private Debt

Private Debt Fund Solutions

Front-to back-office support for managers of direct lending, CLOs, and broadly syndicated loans-powered by integrated services, purpose-built platforms, and a single source of loan data.

Trusted by the world’s leading private debt managers

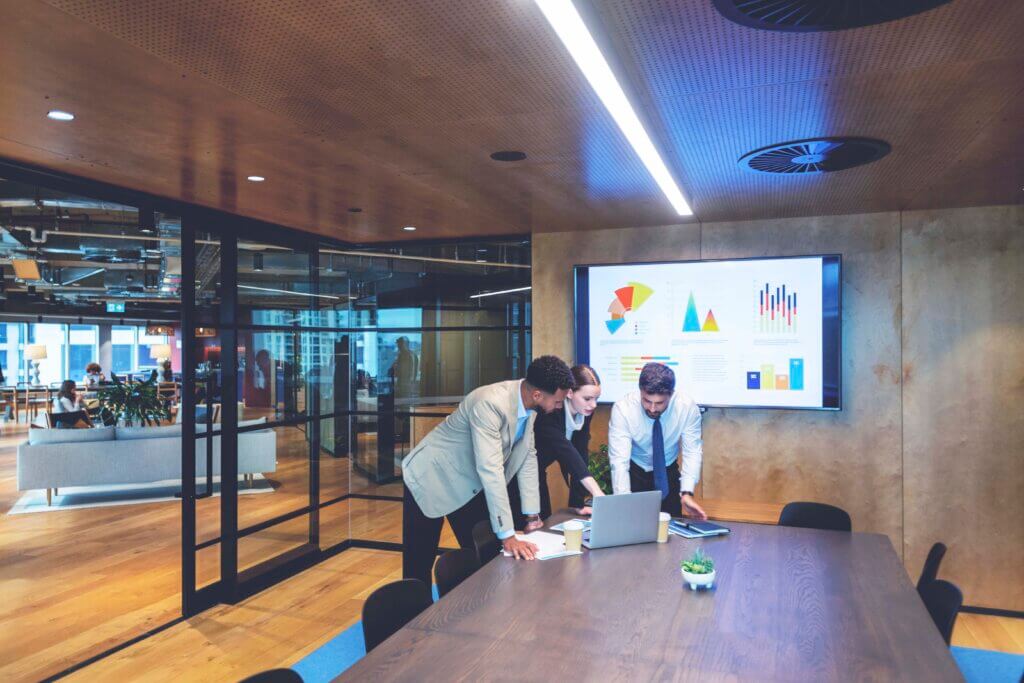

From CLO managers to direct lenders, we support leading firms with scalable, integrated operations that cut settlement times, reduce reconciliation errors, and meet evolving regulatory demands.

Giving you the edge with a holistic private debt fund service offering

As the private debt market has grown, so has the need to perfect your loan operations, from the front office through to the back office. Our full service private debt solutions offering allows your team to select the elements needed most to help your fund operations run smoothly, enabling better collaboration and superior returns.

95%

of the largest private debt managers serviced

3,000

Private debt funds under administration

$1.8tn

in debt capital market assets administered

$535bn+

Private debt fund assets under administration

Why Alter Domus for private debt solutions?

With decades of expertise and operations in 23 jurisdictions, our SOC 1 & 2 certified processes and AIFMD-compliant services ensure global consistency and investor confidence.

Services

Our private debt specialists act as an extension of your in-house teams, delivering fund administration, CLO management, loan settlement, and agency support. With global asset class expertise and multi-jurisdictional regulatory knowledge, we help you scale operations, reduce risk, and stay compliant across markets.

Technology

Our private debt solutions are supported by a suite of purpose-built technologies, from advanced automation to machine learning, maintained by our in-house teams. These tools simplify loan operations, reduce manual processing, and give your investment and operations teams a competitive edge across the entire credit portfolio lifecycle.

Data integration

We maintain a golden copy of loan and fund data across the lifecycle, ensuring accuracy for reconciliations, reporting, and investor communications. At the same time, our solutions integrate seamlessly with the systems already embedded in your operations, so you are never locked into a single provider.

Key contacts for private debt services

Greg Myers

United States

Global Sector Head, Debt Capital Markets

Ready to learn more about Alter Domus’ Private Debt Solutions?

Join the world’s leading private debt managers who already rely on Alter Domus. Get in touch with us today.

"*" indicates required fields

Lorem Ipsum

Lorem Ipsum

Heading lorem ipsum dolor sit amet elit consectetur adipiscing

85%

Statistic

30,000

Statistic

$2tn

Statistic

4,500

Statistic

Lorem ipsum

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nullam sed nisi ut sapien rhoncus. Ut consectetur faucibus sem dictum sodales. Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nullam sed nisi ut sapien rhoncus. Ut consectetur faucibus sem dictum sodales. Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Lorem Ipsum

Lorem Ipsum dolor

Text Image

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nullam sed nisi ut sapien rhoncus. Ut consectetur faucibus sem dictum sodales. Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Key contacts

Example Contact

Region…

Job Title…

Example Contact

Region…

Job Title…

Example Contact

Region…

Job Title…

Example Contact

Region…

Job Title…

Contact form

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nullam sed nisi ut sapien rhoncus. Ut consectetur faucibus sem dictum sodales. Lorem ipsum dolor sit amet, consectetur adipiscing elit.

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor

- Lorem ipsum

"*" indicates required fields

Broadly Syndicated Debt

Proven expertise to guide you through complexity

Broadly syndicated debt: An established asset class with growing challenges

The broadly syndicated debt (or “leveraged loan”) market has grown exponentially and is now worth over $1.5 trillion globally. Vehicles ranging from CLOs and private funds to mutual funds and ETFs are traded at high volumes daily, providing participants with much needed liquidity.

But market growth has brought increased complexity. The sheer volume of stakeholders, disconnected data sources, and non-centralized communications can impede deal management and operational efficiencies. What’s more, deals are larger and more complex in structure, with larger numbers of participants and non-standardized trade settlement times.

By partnering with Alter Domus, you’ll have the guidance of an organization that really understands the landscape, intricacies, and challenges of the broadly syndicated debt market, helping you take advantage of opportunities at speed.

Private Debt Solutions

Connecting back, middle and front office operations to drive efficiency and reduce risk across your portfolio.

Key contacts

Greg Myers

United States

Global Sector Head, Debt Capital Markets

Get in touch with our private debt team

Contact us today to learn more about our services.

"*" indicates required fields

Private Credit

Powering financial growth through world-class expertise and technology

Accurate data in private credit: A direct impact on direct lending

The private credit market has experienced phenomenal growth over the last decade, becoming an essential mainstream investment strategy. As a result, holding structures and jurisdictional considerations are more complex — and investors are demanding more data and reporting to make sense of it all.

To grow your business, you need an experienced partner who can bring those demands down to size and help you deliver on direct lending strategies.

Our industry-leading technologies, support models, and risk management framework enable you to measure asset and fund performance, creating insight for better performance. With services spanning the back, middle, and front office, we support private credit managers of all types and sizes. Regardless of the debt instruments you originate or trade — senior secured, second lien, or mezzanine loans — we’ll help you effectively monitor and operate your private credit portfolio.

Services

Private Debt Solutions

Connecting back, middle and front office operations to drive efficiency and reduce risk across your portfolio.

Insights

Private debt:

outlook for 2025

Private debt is poised for a strong 2025 as M&A activity rebounds, despite slight return pressures from rate cuts.

Key contacts

Greg Myers

United States

Global Sector Head, Debt Capital Markets

Get in touch with our private debt team

Contact us today to learn more about our services.

"*" indicates required fields

Infrastructure Solutions

Discover our deep infrastructure asset management expertise, and our full lifecycle offering of global infrastructure solutions.

80%

of the world’s largest real estate and infrastructure firms served

$140bn+

infrastructure assets under administration

#1

most-used administrator for infrastructure managers in the last four years

We’re the best positioned partner to deliver the niche infrastructure solution your firm seeks

The infrastructure asset management space is a complex one. Intensely unique needs exist between individual subsectors, private versus public projects, and differing global jurisdictions. And as the space grows, we see infrastructure asset managers stuck between intensifying subsector and fund complexity alongside the challenges for seeking fundraising, deals, and returns.

At Alter Domus, our Infrastructure solutions are built to ease your back-office burden amidst these growing challenges. Trust in our deep sector expertise and thoughtful technology and operating model design to free up your teams to focus on capturing deals and generating returns.

Why Alter Domus for infrastructure solutions?

Deep expertise

Our team of infrastructure specialists understands the nuances of asset servicing, from private-public partnerships to sector-specific regulatory requirements.

Holistic offering

We offer a full suite of services, from fund administration to compliance and reporting, ensuring a comprehensive approach to asset servicing.

Global geographic reach

With 39 offices in 32 jurisdictions, our team has deep expertise in regional regulations and market-specific practices, ensuring compliance and operational efficiency worldwide.

Operational efficiency

Our services align with your strategic objectives, supporting operational efficiency and allowing your team to focus on growth and returns.

Our infrastructure solutions technology

Yardi

We utilize Yardi, the real assets accounting and investment management software platform, as an end-to-end accounting engine to facilitate property & loan accounting, servicing, entity consolidation, investment & fund entity accounting, investor allocation and reporting.

eFront

Alter Domus teams also use eFront, a plaform serving the alternatives investment lifecycle, from due diligence and portfolio planning, to performance and risk analysis, across a range of alternative asset classes including private equity, real estate investment, banking, and insurance sectors.

CorPro

CorPro is Alter Domus’ proprietary fund manager and investor portal, offering a secure digital space for GPs and LPs to access reporting and documents. CorPro seamlessly integrates with our core accounting systems, fostering greater transparency between the service provider, GP, and LP.

Our infrastructure solutions servicing models

At Alter Domus, we offer a full spectrum of operational model delivery. Sign on for one-off outsourced services or invite us in to shape a custom operational model – or anywhere in between. Here are some examples of how infrastructure asset managers bring us into their fold.

Outsourcing

Your firm cedes the day-to-day fund operational duties – such as financial statements and investor reporting – to our teams and technology, while we report progress and updates to your key back-office contacts.

Co-Sourcing

Existing at the intersection of insourcing and outsourcing, the administrator handles the day-to-day operational activities while the fund manager retains ownership of their in-house technology.

Lift Out

We work with asset managers to lift out their operational teams, making them our own employees. Staff would fall under our overhead but remain completely dedicated to the fund and its activities.

Our infrastructure content

Mind the gap: meeting the infrastructure funding gap

Solid foundations: the infrastructure opportunity

Infrastructure outlook 2025

Key infrastructure contacts

Anita Lyse

Luxembourg

Global Sector Head, Real Assets

Get in touch with our infrastructure specialists

Contact us today to learn more about our solutions, including:

- Real Asset Servicing

- Fund Administration

- AIFM Services

- Depositary Services

- Corporate Services

- Capital Administration

"*" indicates required fields